- Denmark

- /

- Medical Equipment

- /

- CPSE:COLO B

Coloplast A/S Just Missed EPS By 16%: Here's What Analysts Think Will Happen Next

It's been a good week for Coloplast A/S (CPH:COLO B) shareholders, because the company has just released its latest third-quarter results, and the shares gained 3.4% to kr.619. It was not a great result overall. While revenues of kr.7.0b were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 16% to hit kr.3.57 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Coloplast after the latest results.

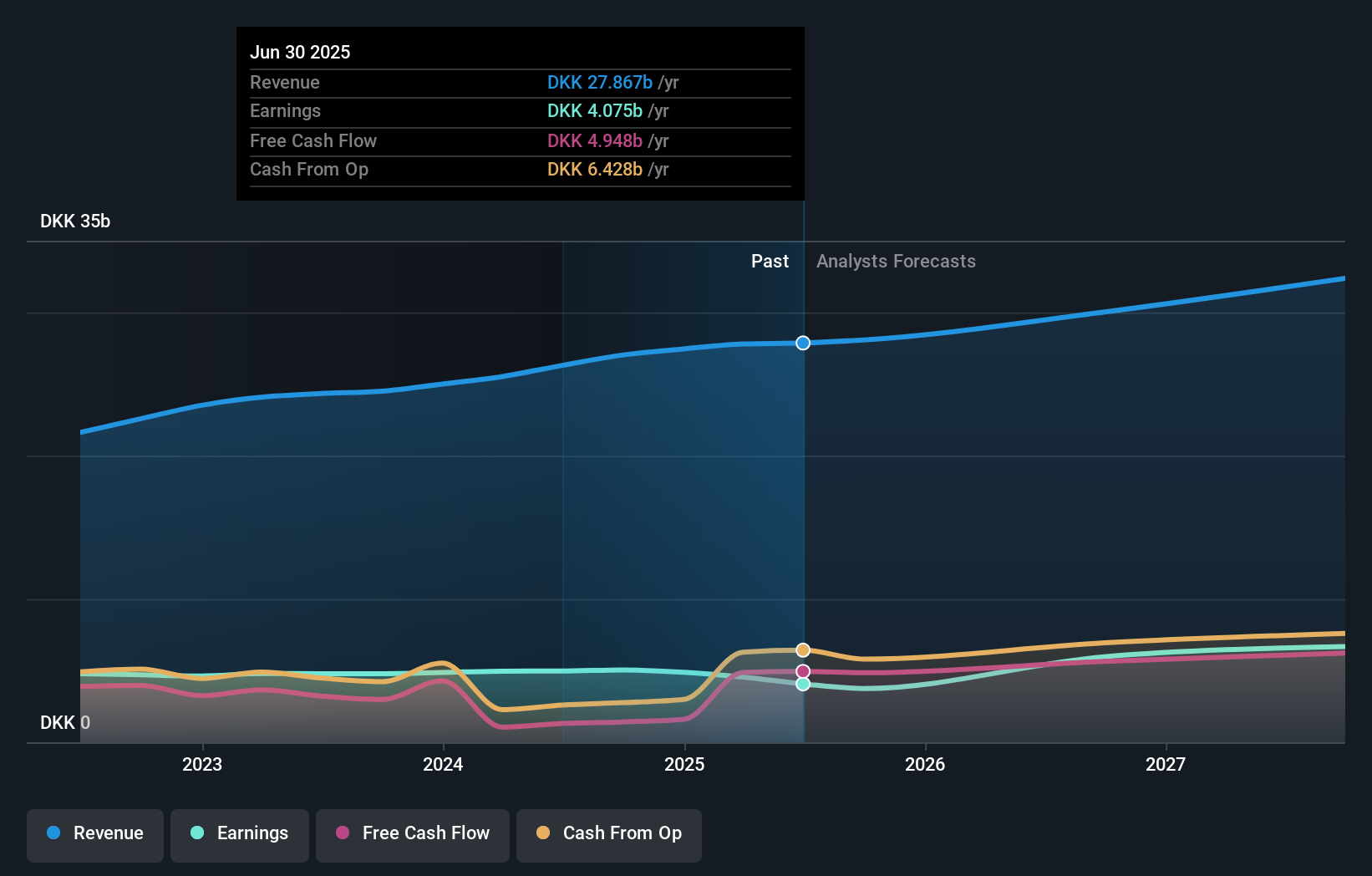

Taking into account the latest results, the consensus forecast from Coloplast's 18 analysts is for revenues of kr.30.0b in 2026. This reflects a credible 7.8% improvement in revenue compared to the last 12 months. Per-share earnings are expected to bounce 47% to kr.26.68. Before this earnings report, the analysts had been forecasting revenues of kr.30.1b and earnings per share (EPS) of kr.26.82 in 2026. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

See our latest analysis for Coloplast

The analysts reconfirmed their price target of kr.725, showing that the business is executing well and in line with expectations. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Coloplast, with the most bullish analyst valuing it at kr.962 and the most bearish at kr.585 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Coloplast's revenue growth is expected to slow, with the forecast 6.2% annualised growth rate until the end of 2026 being well below the historical 9.6% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 7.1% annually. So it's pretty clear that, while Coloplast's revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Coloplast going out to 2027, and you can see them free on our platform here..

You should always think about risks though. Case in point, we've spotted 2 warning signs for Coloplast you should be aware of, and 1 of them doesn't sit too well with us.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026