Pandora A/S Just Beat EPS By 12%: Here's What Analysts Think Will Happen Next

A week ago, Pandora A/S (CPH:PNDORA) came out with a strong set of quarterly numbers that could potentially lead to a re-rate of the stock. It was overall a positive result, with revenues beating expectations by 3.4% to hit kr.6.8b. Pandora reported statutory earnings per share (EPS) kr.11.80, which was a notable 12% above what the analysts had forecast. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Pandora

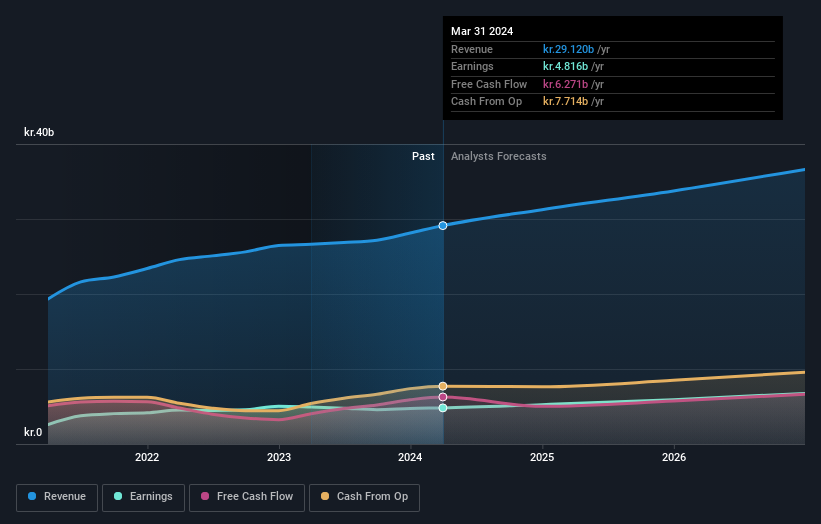

After the latest results, the 16 analysts covering Pandora are now predicting revenues of kr.31.2b in 2024. If met, this would reflect a credible 7.3% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to accumulate 8.8% to kr.64.54. Before this earnings report, the analysts had been forecasting revenues of kr.30.9b and earnings per share (EPS) of kr.63.15 in 2024. So the consensus seems to have become somewhat more optimistic on Pandora's earnings potential following these results.

The consensus price target was unchanged at kr.1,184, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Pandora at kr.1,400 per share, while the most bearish prices it at kr.900. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Pandora shareholders.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Pandora's growth to accelerate, with the forecast 9.8% annualised growth to the end of 2024 ranking favourably alongside historical growth of 7.1% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.4% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Pandora is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Pandora following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at kr.1,184, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Pandora. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Pandora going out to 2026, and you can see them free on our platform here..

However, before you get too enthused, we've discovered 2 warning signs for Pandora that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:PNDORA

Pandora

Engages in the designing, manufacturing, and marketing of jewelry products.

Undervalued average dividend payer.

Market Insights

Community Narratives