- Poland

- /

- Aerospace & Defense

- /

- WSE:LBW

Føroya Banki And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As the European market navigates a complex landscape of mixed inflation data and economic contractions in key economies like Germany and France, the pan-European STOXX Europe 600 Index has managed to post its longest streak of weekly gains since August 2012. This resilience, buoyed by encouraging company results and sector-specific gains, highlights the potential for discovering lesser-known stocks that may offer unique opportunities amidst broader market uncertainties. In this context, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can thrive even when larger economic indicators present challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Bahnhof | NA | 8.39% | 14.20% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Føroya Banki (CPSE:FOBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Føroya Banki, with a market cap of DKK1.86 billion, offers personal and corporate banking services across the Faroe Islands, Denmark, and Greenland through its subsidiaries.

Operations: Føroya Banki generates revenue primarily from its personal banking segment, contributing DKK293.77 million, followed by corporate banking at DKK129.13 million. The bank also earns from other banking services and non-life insurance in the Faroe Islands, adding DKK201.31 million and DKK29.41 million respectively to its income streams.

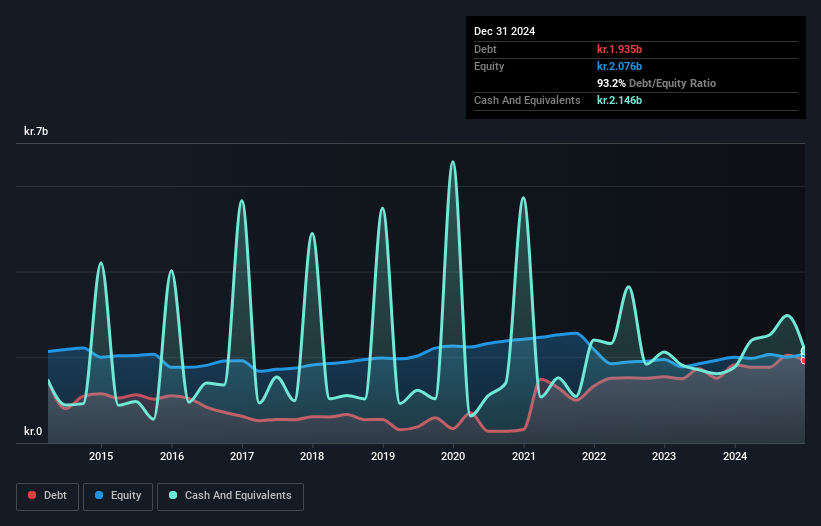

Føroya Banki, with total assets of DKK14.1 billion and equity of DKK2 billion, is trading at a significant discount to its estimated fair value. The bank's earnings grew by 19.7% over the past year, outpacing the industry average of -3.2%. Despite having a high level of bad loans at 5.2%, it maintains a low allowance for these loans at 38%. With deposits totaling DKK9.4 billion and loans at DKK9.1 billion, it relies on low-risk funding sources for 78% of its liabilities. Looking ahead, net profit for 2025 is expected between DKK210 million and DKK240 million.

- Get an in-depth perspective on Føroya Banki's performance by reading our health report here.

Explore historical data to track Føroya Banki's performance over time in our Past section.

EVS Broadcast Equipment (ENXTBR:EVS)

Simply Wall St Value Rating: ★★★★★★

Overview: EVS Broadcast Equipment SA specializes in delivering live video technology solutions for broadcast and media productions on a global scale, with a market capitalization of €493.64 million.

Operations: The company generates revenue primarily from its solutions based on tapeless workflows, amounting to €197.99 million. The market capitalization stands at €493.64 million.

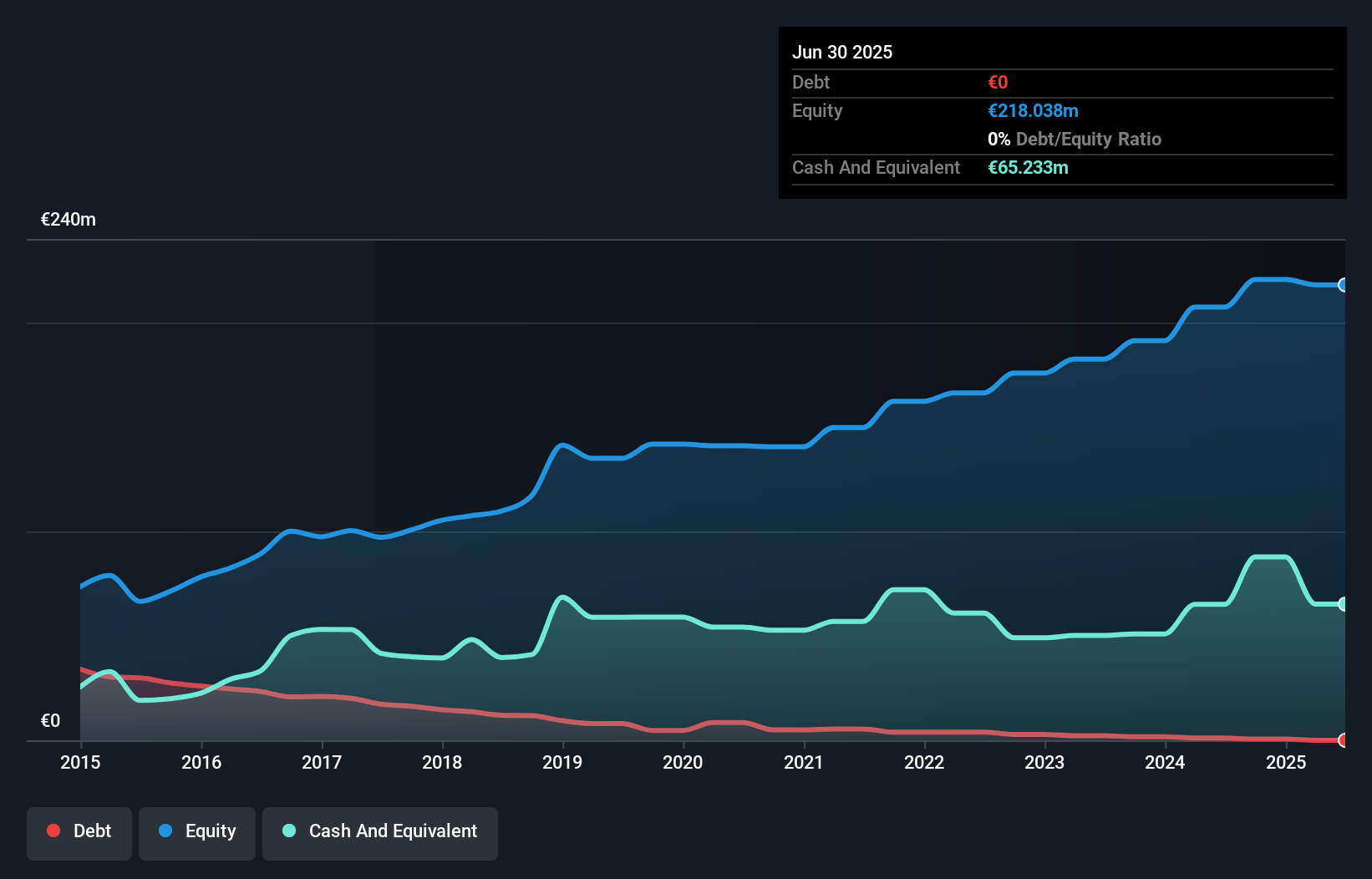

EVS Broadcast Equipment, a dynamic player in the broadcast technology space, has demonstrated robust financial health with net income rising to €42.88 million from €36.95 million last year. Despite earnings growth of 16.1%, analysts anticipate a profit margin contraction from 21.7% to 17.1%. The company is strategically expanding in North America and investing in AI technologies, aiming for revenue between €195 million and €210 million for 2025, while maintaining strong debt management with a reduced debt-to-equity ratio of 0.3%. These moves could enhance its competitive edge despite challenges like geopolitical tensions and cost pressures.

Lubawa (WSE:LBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Lubawa S.A. is a company that manufactures and sells products for army, police, municipal police, border patrol, fire brigade, and special forces both in Poland and internationally, with a market capitalization of PLN1.11 billion.

Operations: The company's primary revenue streams include Specialist Equipment - Retail, contributing PLN264.99 million, and Fabrics, adding PLN180.45 million. Advertising Materials also play a significant role with PLN142.56 million in revenue.

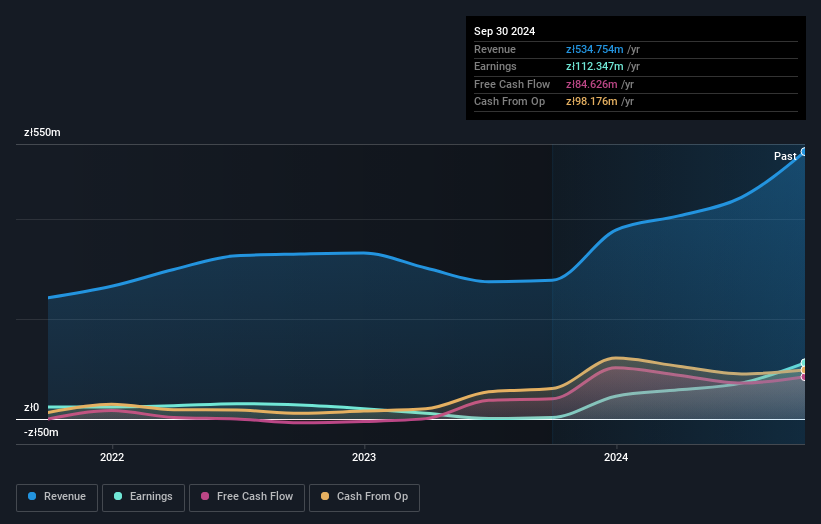

In the dynamic Aerospace & Defense sector, Lubawa stands out with impressive earnings growth of 3846% over the past year, far surpassing the industry average of 36%. The company’s financial health appears robust as it is debt-free now compared to a debt-to-equity ratio of 37.8% five years ago. Additionally, Lubawa's shares are trading at a substantial discount, around 63% below estimated fair value. Despite recent share price volatility, its profitability and positive free cash flow suggest resilience and potential for future stability in this competitive market.

- Click here to discover the nuances of Lubawa with our detailed analytical health report.

Assess Lubawa's past performance with our detailed historical performance reports.

Taking Advantage

- Navigate through the entire inventory of 359 European Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:LBW

Lubawa

Manufactures and sells army, police, municipal police, border patrol, fire brigade, and special force products in Poland and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives