As global markets navigate the complexities of policy shifts under the incoming Trump administration, investors are witnessing significant fluctuations across various sectors. With financial and energy stocks benefiting from deregulation hopes and healthcare shares facing challenges, identifying reliable dividend stocks becomes crucial for those seeking stability amidst market volatility. In this environment, a good dividend stock is characterized by its ability to provide consistent income and maintain resilience despite economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.80% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

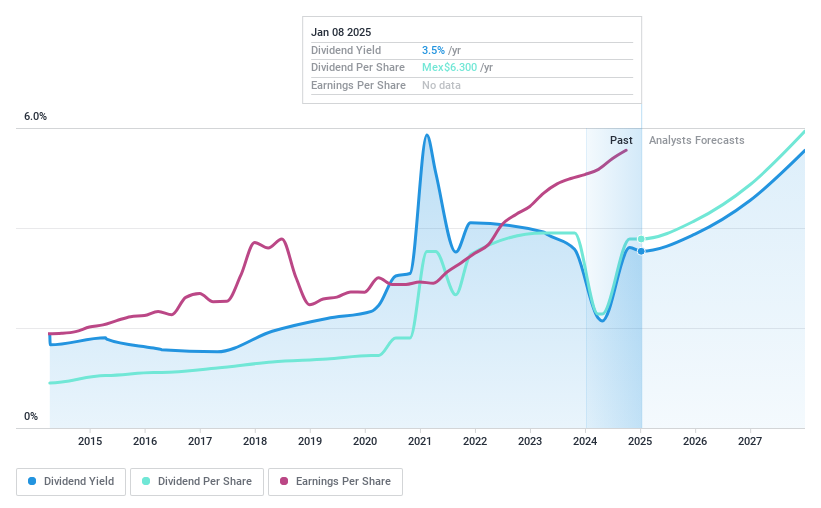

Arca Continental. de (BMV:AC *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arca Continental, S.A.B. de C.V. operates in the beverage industry by producing, distributing, and selling soft drinks across Mexico, Peru, the United States, Argentina, and Ecuador with a market cap of MX$295.91 billion.

Operations: Arca Continental's revenue segments include the production, distribution, and sale of soft drinks across its key markets.

Dividend Yield: 3.6%

Arca Continental's dividend payments are well-covered by earnings and cash flows, with payout ratios of 34.2% and 48.8%, respectively. Despite this coverage, the company has an unstable dividend track record with volatile payments over the past decade. The recent earnings report shows growth, with Q3 sales at MX$62.61 billion and net income at MX$5.13 billion, reflecting an increase from last year, which may support future dividend sustainability despite its current low yield of 3.61%.

- Click here to discover the nuances of Arca Continental. de with our detailed analytical dividend report.

- Our valuation report unveils the possibility Arca Continental. de's shares may be trading at a discount.

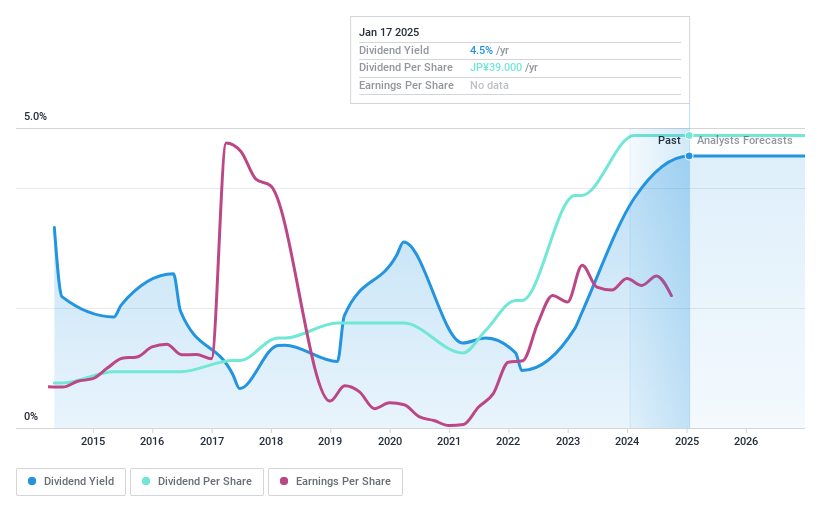

Ultrafabrics HoldingsLtd (TSE:4235)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ultrafabrics Holdings Co., Ltd. is a company that manufactures and sells synthetic leather both in Japan and internationally, with a market cap of ¥15.98 billion.

Operations: Ultrafabrics Holdings Co., Ltd. generates revenue primarily from its manufacturing and selling of polyurethane leather products, amounting to ¥20.89 billion.

Dividend Yield: 3.8%

Ultrafabrics Holdings Ltd. offers a mixed dividend profile with payments covered by earnings (29.6% payout ratio) and cash flows (72.6% cash payout ratio), yet its dividends have been volatile over the past decade, showing instability despite recent growth in payments. The stock trades at a significant discount to estimated fair value, suggesting potential upside if stability improves. However, high debt levels and share price volatility may pose risks for dividend sustainability moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of Ultrafabrics HoldingsLtd.

- The analysis detailed in our Ultrafabrics HoldingsLtd valuation report hints at an deflated share price compared to its estimated value.

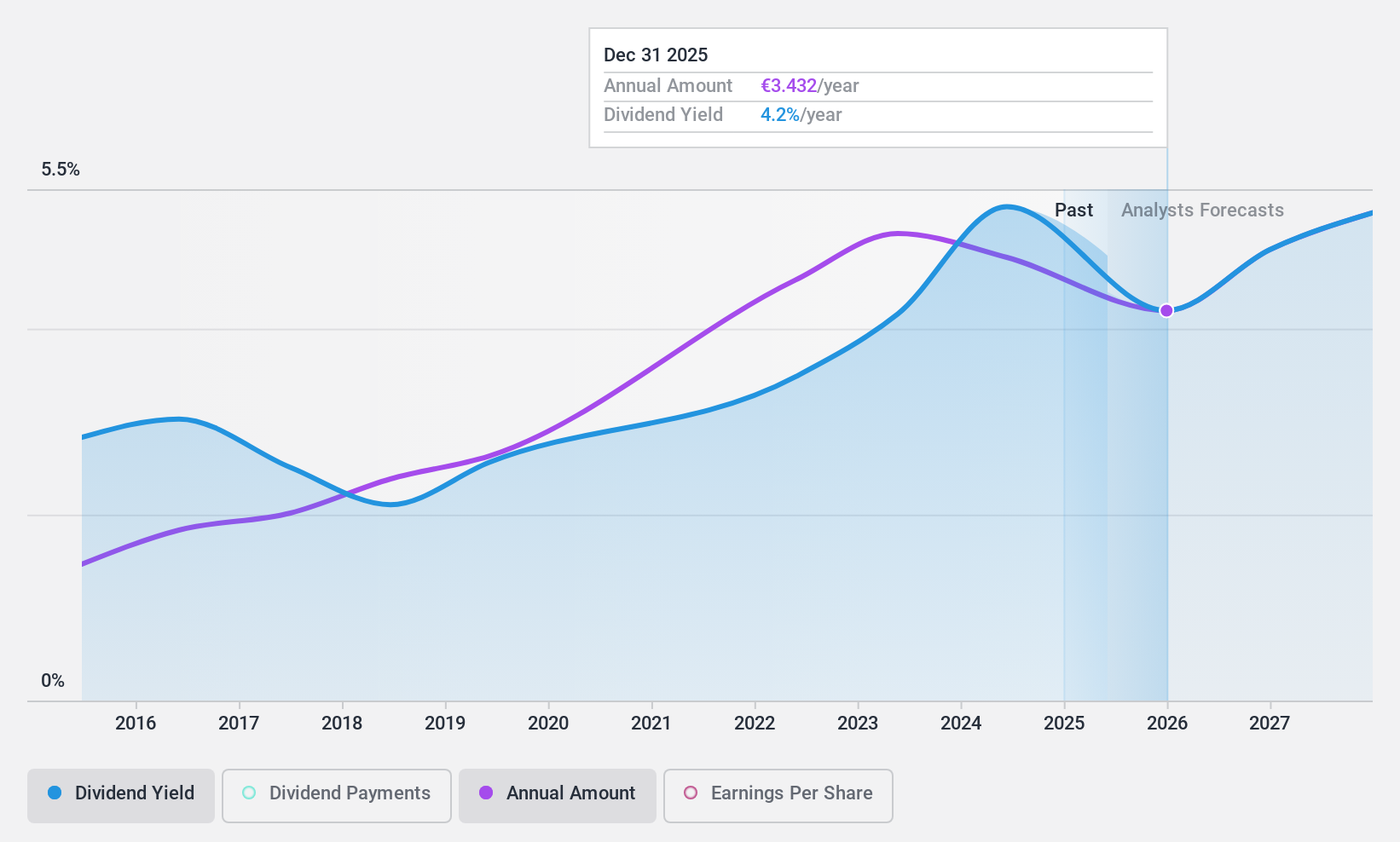

Sixt (XTRA:SIX2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE, with a market cap of €3.08 billion, offers mobility services globally through a network of corporate and franchise stations catering to both private and business customers.

Operations: Sixt SE generates revenue from its operations across various regions, including €1.52 billion from Europe, €1.24 billion from Germany, and €1.27 billion from North America.

Dividend Yield: 5.4%

Sixt SE's dividend profile presents challenges, with payments not well covered by cash flows, reflected in a high cash payout ratio of 134.3%. Despite being in the top 25% for yield in Germany at 5.44%, dividends have been volatile over the past decade. Recent earnings reports show growth in sales but a decline in net income year-over-year, indicating potential pressure on future payouts. The company's P/E ratio of 14.1x suggests it is undervalued compared to the German market average.

- Unlock comprehensive insights into our analysis of Sixt stock in this dividend report.

- In light of our recent valuation report, it seems possible that Sixt is trading beyond its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1963 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4235

Ultrafabrics HoldingsLtd

Manufactures and sells synthetic leather in Japan and internationally.

Undervalued established dividend payer.