- Germany

- /

- Transportation

- /

- XTRA:SIX2

Dividend Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions and consumer spending concerns, investors are closely monitoring the impact of tariffs and economic data on major indices. Amid these challenges, dividend stocks continue to draw attention for their potential to provide steady income streams in uncertain times. A good dividend stock often combines a strong track record of payouts with resilience against market volatility, making it an attractive option for those seeking stability in turbulent conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2009 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that distributes electronic components and semiconductor products across various regions including Hong Kong, Mainland China, Taiwan, the USA, Vietnam, Singapore, and Macao with a market cap of approximately HK$2.62 billion.

Operations: S.A.S. Dragon Holdings Limited generates its revenue primarily from the distribution of electronic components and semiconductor products, amounting to HK$26.73 billion.

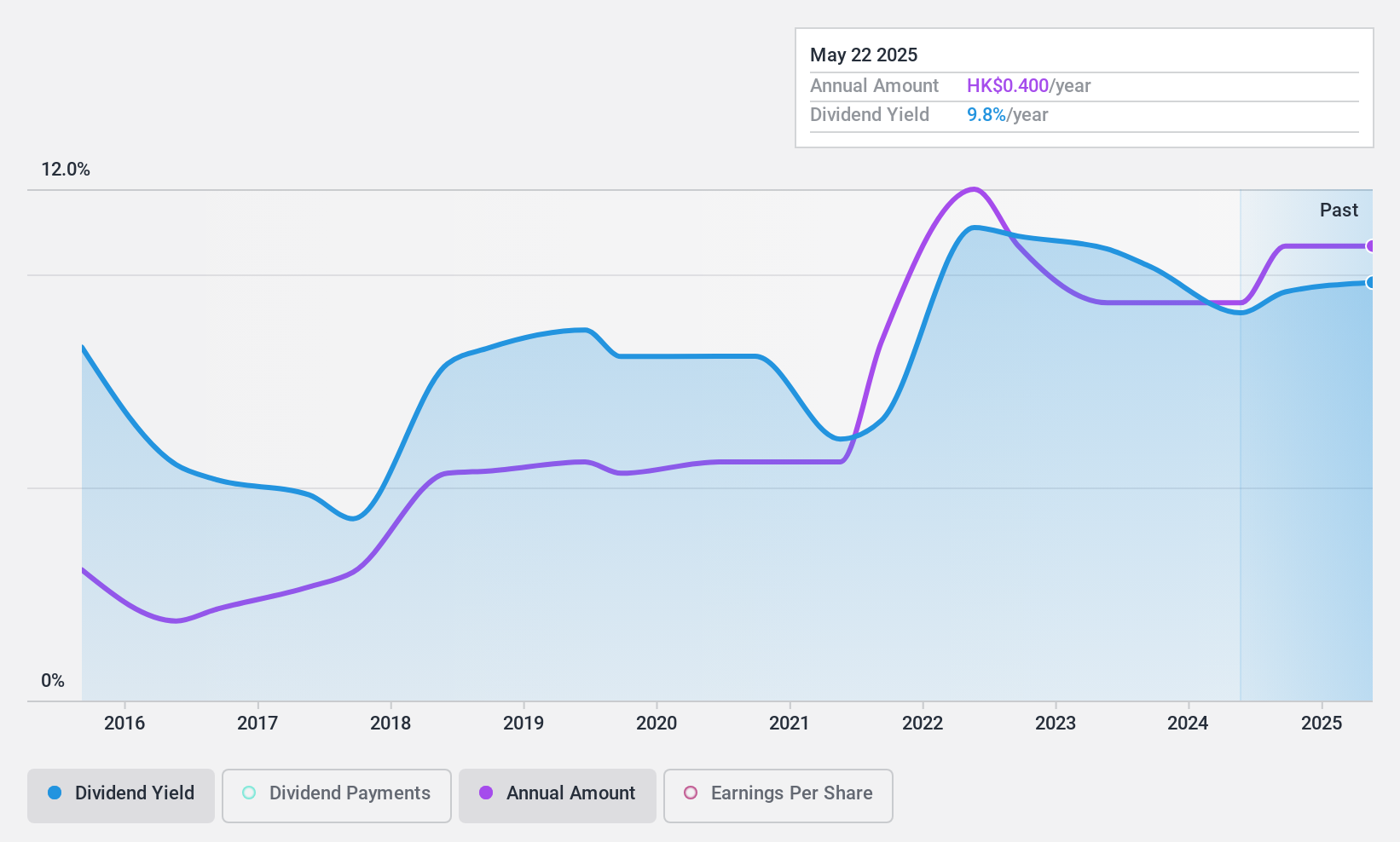

Dividend Yield: 9.6%

S.A.S. Dragon Holdings offers a high dividend yield of 9.57%, placing it in the top 25% of Hong Kong market payers, but its sustainability is questionable due to lack of free cash flow coverage and reliance on non-cash earnings. Despite a reasonable payout ratio, dividends have been volatile over the past decade with significant annual drops. Recent board changes may impact future strategies, as Mr. Wong Sui Chuen transitions to a non-executive role after over two decades as an executive director.

- Delve into the full analysis dividend report here for a deeper understanding of S.A.S. Dragon Holdings.

- The valuation report we've compiled suggests that S.A.S. Dragon Holdings' current price could be quite moderate.

Sansei Technologies (TSE:6357)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sansei Technologies, Inc. is involved in the planning, design, manufacturing, installation, repair, and maintenance of amusement rides, stage equipment, elevators, and other specialized equipment both in Japan and internationally; it has a market cap of ¥25.80 billion.

Operations: Sansei Technologies generates revenue primarily from its amusement rides, stage equipment, and elevator segments in both domestic and international markets.

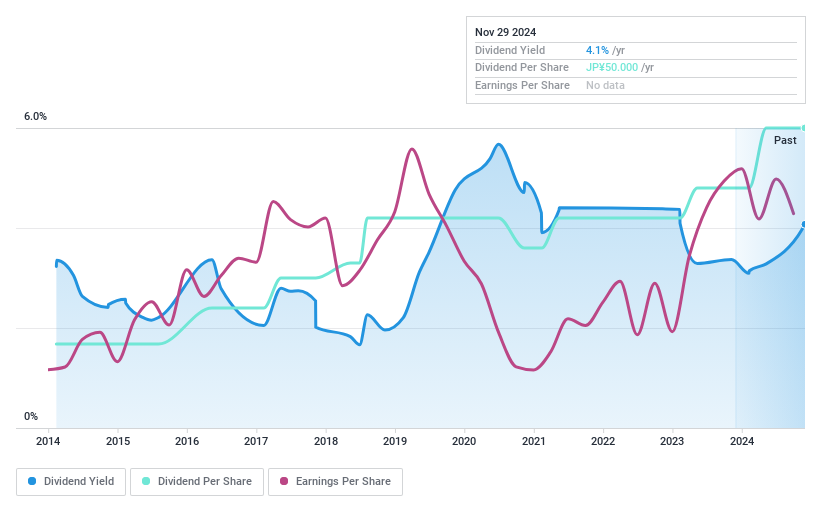

Dividend Yield: 3.6%

Sansei Technologies' dividend payments are well-supported by a low payout ratio of 40.5% and a cash payout ratio of 12.4%, indicating strong coverage from earnings and cash flows. However, despite the dividends growing over the past decade, they have been unreliable due to volatility with significant annual drops exceeding 20%. The current yield of 3.62% is below Japan's top quartile payers, and its unstable track record raises sustainability concerns.

- Unlock comprehensive insights into our analysis of Sansei Technologies stock in this dividend report.

- Our expertly prepared valuation report Sansei Technologies implies its share price may be too high.

Sixt (XTRA:SIX2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE, with a market cap of €3.40 billion, offers global mobility services for private and business customers through its network of corporate and franchise stations.

Operations: Sixt SE's revenue is primarily derived from its operations in Europe (€1.52 billion), Germany (€1.24 billion), and North America (€1.27 billion).

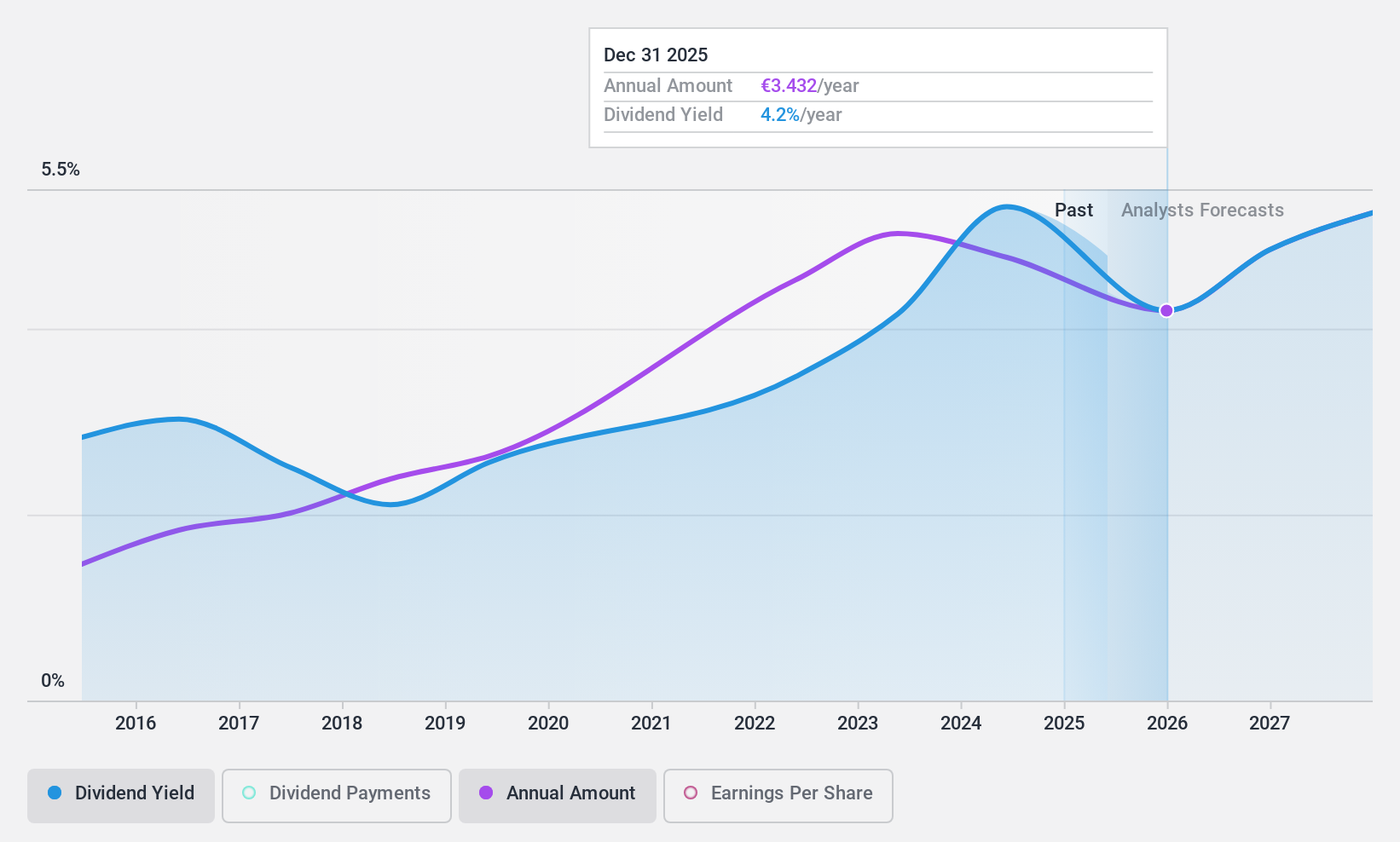

Dividend Yield: 4.9%

Sixt's dividend yield of 4.89% ranks among the top 25% in Germany, yet its sustainability is questionable due to a high cash payout ratio of 134.3%, indicating dividends aren't well-covered by cash flows despite being covered by earnings at a 75.8% payout ratio. Historically volatile with over 20% annual drops, the dividend's reliability is uncertain despite growth over the past decade. Recent expansions in North America may enhance future financial stability and support dividend improvements.

- Get an in-depth perspective on Sixt's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Sixt is priced higher than what may be justified by its financials.

Seize The Opportunity

- Unlock our comprehensive list of 2009 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIX2

Sixt

Through its subsidiaries, provides mobility services through corporate and franchise station network for private and business customers worldwide.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives