FORTEC Elektronik AG (ETR:FEV) Looks Interesting, And It's About To Pay A Dividend

FORTEC Elektronik AG (ETR:FEV) stock is about to trade ex-dividend in 3 days. Investors can purchase shares before the 12th of February in order to be eligible for this dividend, which will be paid on the 16th of February.

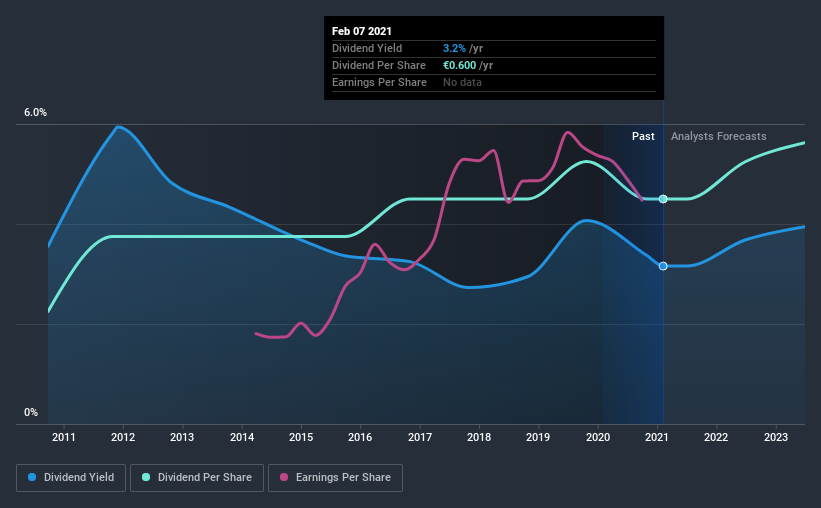

FORTEC Elektronik's next dividend payment will be €0.60 per share. Last year, in total, the company distributed €0.60 to shareholders. Based on the last year's worth of payments, FORTEC Elektronik has a trailing yield of 3.2% on the current stock price of €19. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether FORTEC Elektronik can afford its dividend, and if the dividend could grow.

View our latest analysis for FORTEC Elektronik

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately FORTEC Elektronik's payout ratio is modest, at just 45% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out more than three-quarters (85%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit FORTEC Elektronik paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. For this reason, we're glad to see FORTEC Elektronik's earnings per share have risen 16% per annum over the last five years. The company paid out most of its earnings as dividends over the last year, even though business is booming and earnings per share are growing rapidly. We're surprised that management has not elected to reinvest more in the business to accelerate growth further.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. FORTEC Elektronik has delivered an average of 7.2% per year annual increase in its dividend, based on the past 10 years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is FORTEC Elektronik worth buying for its dividend? Earnings per share have grown at a nice rate in recent times and over the last year, FORTEC Elektronik paid out less than half its earnings and a bit over half its free cash flow. Overall we think this is an attractive combination and worthy of further research.

While it's tempting to invest in FORTEC Elektronik for the dividends alone, you should always be mindful of the risks involved. For example, we've found 2 warning signs for FORTEC Elektronik that we recommend you consider before investing in the business.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading FORTEC Elektronik or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:FEV

FORTEC Elektronik

Manufactures and sells components and systems in the areas of display and embedded computer technology, and power supplies in Germany and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026