Does Software Aktiengesellschaft's (ETR:SOW) P/E Ratio Signal A Buying Opportunity?

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). To keep it practical, we'll show how Software Aktiengesellschaft's (ETR:SOW) P/E ratio could help you assess the value on offer. Software has a price to earnings ratio of 14.40, based on the last twelve months. That means that at current prices, buyers pay €14.40 for every €1 in trailing yearly profits.

See our latest analysis for Software

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Software:

P/E of 14.40 = €32.71 ÷ €2.27 (Based on the year to September 2019.)

Is A High P/E Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Software Have A Relatively High Or Low P/E For Its Industry?

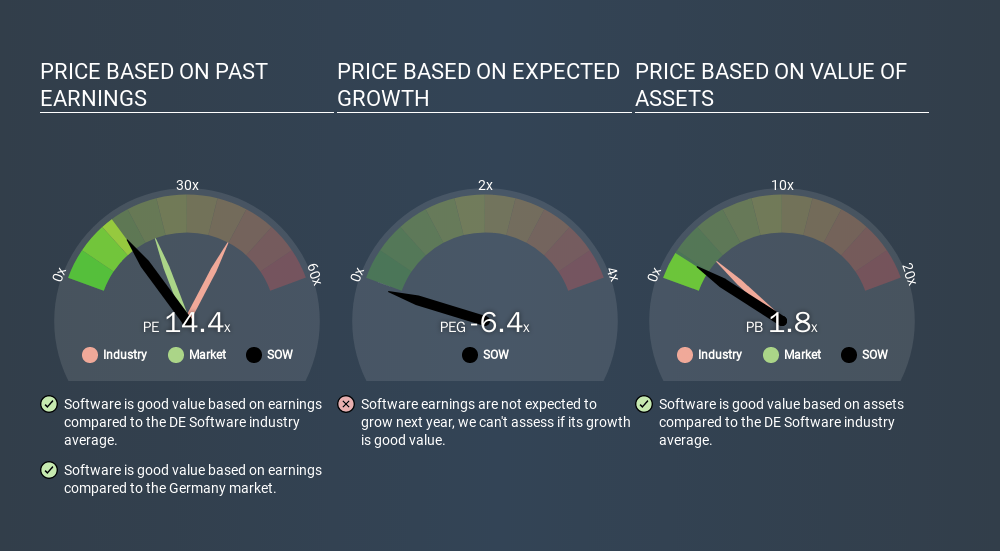

We can get an indication of market expectations by looking at the P/E ratio. If you look at the image below, you can see Software has a lower P/E than the average (41.8) in the software industry classification.

This suggests that market participants think Software will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Most would be impressed by Software earnings growth of 11% in the last year. And earnings per share have improved by 11% annually, over the last five years. This could arguably justify a relatively high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Software's Balance Sheet Tell Us?

Since Software holds net cash of €226m, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Verdict On Software's P/E Ratio

Software trades on a P/E ratio of 14.4, which is below the DE market average of 21.0. Not only should the net cash position reduce risk, but the recent growth has been impressive. The below average P/E ratio suggests that market participants don't believe the strong growth will continue.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Software. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:SOW

Software

Provides software development, licensing, maintenance, and IT services in Germany, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)