The CEO of ORBIS AG (ETR:OBS) is Thomas Gard, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether ORBIS pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for ORBIS

Comparing ORBIS AG's CEO Compensation With the industry

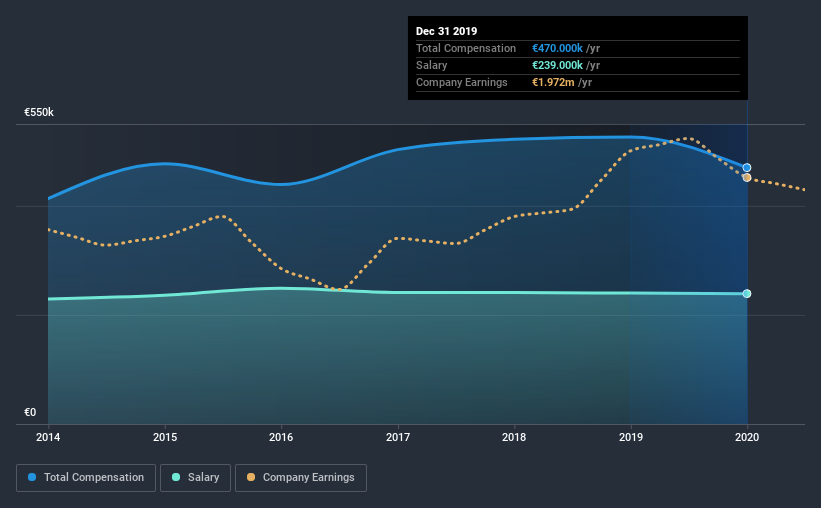

According to our data, ORBIS AG has a market capitalization of €60m, and paid its CEO total annual compensation worth €470k over the year to December 2019. That's a notable decrease of 11% on last year. In particular, the salary of €239.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below €165m, we found that the median total CEO compensation was €275k. This suggests that Thomas Gard is paid more than the median for the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €239k | €240k | 51% |

| Other | €231k | €286k | 49% |

| Total Compensation | €470k | €526k | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. Although there is a difference in how total compensation is set, ORBIS more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ORBIS AG's Growth

Over the past three years, ORBIS AG has seen its earnings per share (EPS) grow by 6.8% per year. In the last year, its revenue is up 10%.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. So while performance isn't amazing, we think it really does seem quite respectable. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ORBIS AG Been A Good Investment?

Boasting a total shareholder return of 34% over three years, ORBIS AG has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, ORBIS AG is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, shareholder returns for the last three years have been excellent. That's why we were hoping EPS growth would match this growth, but sadly that is not the case. So, although we would've liked to see stronger EPS growth, positive investor returns lead us to believe CEO compensation is reasonable.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for ORBIS you should be aware of, and 1 of them is significant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading ORBIS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:OBS

ORBIS

Provides software and business consultancy services in Germany and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)