€25.00: That's What Analysts Think Exasol AG (ETR:EXL) Is Worth After Its Latest Results

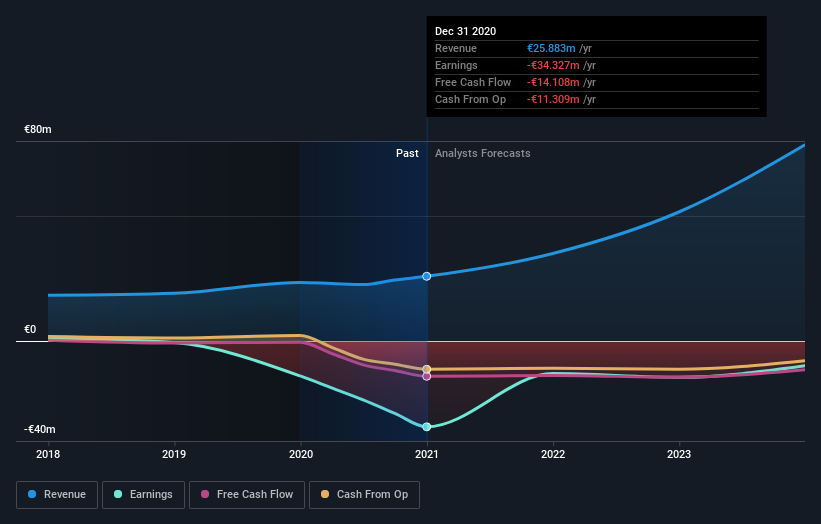

Exasol AG (ETR:EXL) missed earnings with its latest annual results, disappointing overly-optimistic forecasts. It was a pretty negative result overall, with revenues of €26m missing analyst predictions by 3.1%. Worse, the business reported a statutory loss of €1.40 per share, much larger than the analyst had forecast prior to the result. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Exasol

After the latest results, the one analyst covering Exasol are now predicting revenues of €35.0m in 2021. If met, this would reflect a substantial 35% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 43% to €0.53. Before this latest report, the consensus had been expecting revenues of €36.2m and €0.52 per share in losses.

The analyst has cut their price target 7.4% to €25.00per share, signalling that the declining revenue and ongoing losses are contributing to the lower valuation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analyst is definitely expecting Exasol's growth to accelerate, with the forecast 35% annualised growth to the end of 2021 ranking favourably alongside historical growth of 11% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 7.5% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Exasol is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analyst reconfirmed their loss per share estimates for next year. They also downgraded their revenue estimates, although industry data suggests that Exasol's revenues are expected to grow faster than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Exasol's future valuation.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Exasol going out as far as 2023, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with Exasol .

When trading Exasol or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exasol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:EXL

Exasol

A technology company, engages in the provision of an analytics engine to access and analyze a company’s data in Germany, Austria, Switzerland, Rest of Europe, United Kingdom, and Region America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)