As the pan-European STOXX Europe 600 Index recently ended a 10-week streak of gains, investor sentiment has been impacted by uncertainties surrounding U.S. trade policy, although prospects for increased defense and infrastructure spending in Germany and the European Union have helped moderate losses. In this environment of fluctuating market conditions, identifying high growth tech stocks requires a focus on companies that demonstrate robust innovation potential and adaptability to economic shifts, such as those featured in our discussion including Banijay Group.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Truecaller | 20.10% | 24.70% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Devyser Diagnostics | 27.27% | 98.23% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Banijay Group (ENXTAM:BNJ)

Simply Wall St Growth Rating: ★★★★☆☆

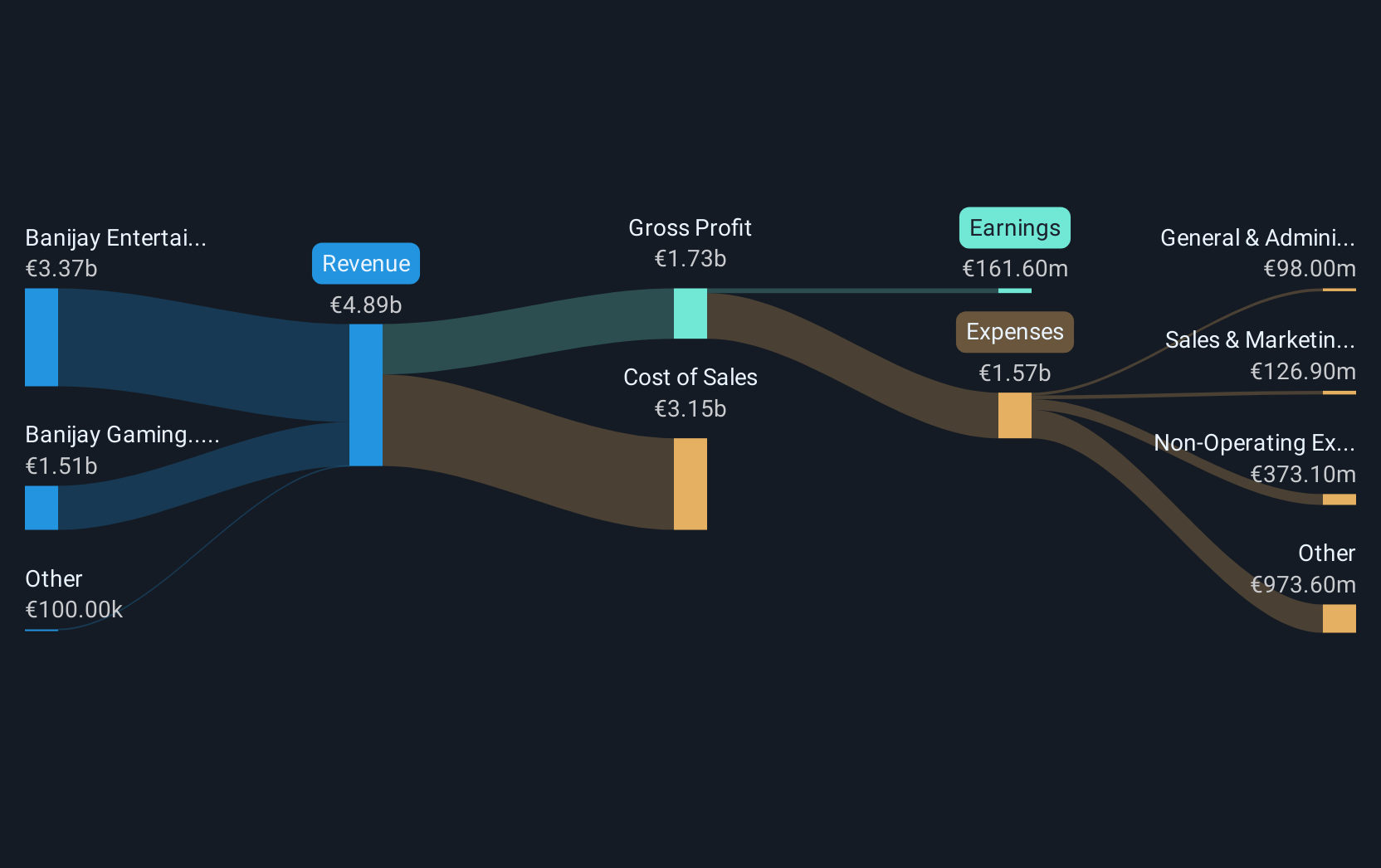

Overview: Banijay Group N.V. is involved in content production, distribution, online sports betting, and gaming across the United States, Europe, and internationally with a market cap of €3.60 billion.

Operations: Banijay Group generates revenue primarily from its two main segments: Banijay Gaming, contributing €1.46 billion, and Banijay Entertainment & Live, which brings in €3.35 billion. The company operates across diverse geographical markets including the United States and Europe.

Banijay Group, a notable entity in the entertainment sector, has demonstrated robust financial dynamics with earnings surging by 140.3% over the past year, significantly outpacing the industry's growth of 10.2%. Despite facing a substantial one-off loss of €79.1M last year, the company's strategic maneuvers are poised to sustain momentum; earnings are projected to grow at an annual rate of 29%, eclipsing the Dutch market forecast of 12.5%. Moreover, with a very high forecasted Return on Equity of 64.9% in three years and recent affirmations of a dividend payout ratio at 35%, Banijay is reinforcing its financial health and shareholder commitment amidst slower than market revenue growth projections (7.4%). This blend of high profit growth potential coupled with strong return metrics positions Banijay intriguingly in its competitive landscape.

- Dive into the specifics of Banijay Group here with our thorough health report.

Examine Banijay Group's past performance report to understand how it has performed in the past.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

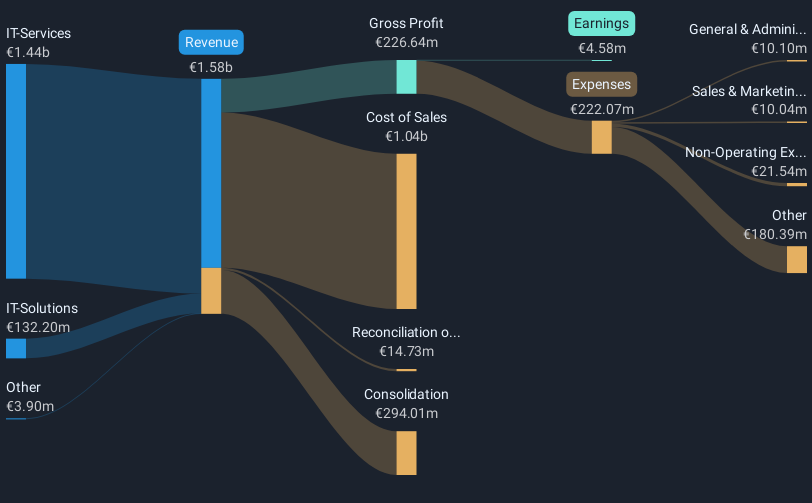

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and other international markets with a market cap of €546.66 million.

Operations: The company generates revenue primarily from IT services (€1.44 billion) and IT solutions (€132.20 million). The gross profit margin shows an interesting trend, reflecting the company's efficiency in managing its cost structure relative to its revenue streams.

Adesso, navigating through an evolving tech landscape, has earmarked substantial resources for innovation, with R&D expenses climbing to €120 million last year. This investment aligns with a 10.1% annual revenue growth and an impressive 36.9% surge in earnings, outpacing the broader German market's growth rates of 5.8% and 16.1%, respectively. The company's commitment is further underscored by its recent dividend increase and a confident earnings forecast for 2025, projecting sales between €1.35 billion and €1.45 billion, which suggests a strategic positioning to capitalize on emerging tech trends while enhancing shareholder value.

- Navigate through the intricacies of adesso with our comprehensive health report here.

Gain insights into adesso's historical performance by reviewing our past performance report.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★☆☆

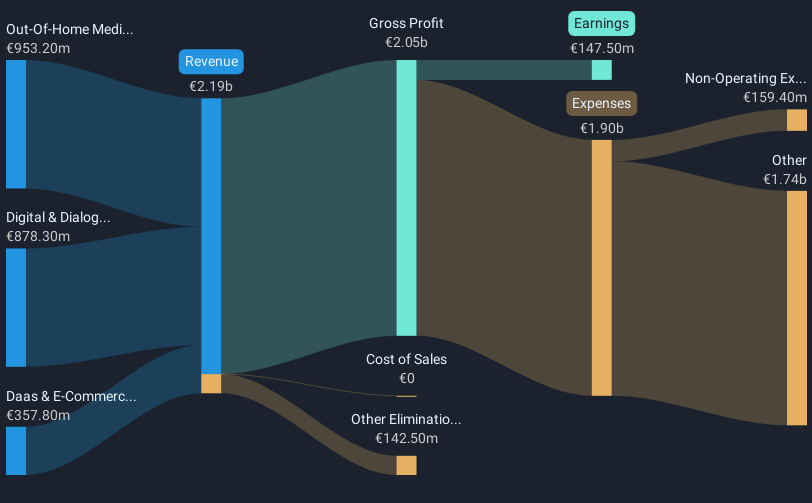

Overview: Ströer SE & Co. KGaA is a company that offers out-of-home media and online advertising solutions both in Germany and internationally, with a market cap of €3.13 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily from three segments: Out-Of-Home Media (€953.20 million), Digital & Dialog Media (€878.30 million), and Daas & E-Commerce (€357.80 million). The company's focus on out-of-home media is the largest contributor to its revenue stream, highlighting its significant role in the advertising landscape.

Ströer SE & Co. KGaA has demonstrated robust financial performance, with a notable 6.3% increase in annual revenue to €2.05 billion and a significant 30% rise in net income to €147.5 million for the fiscal year ended December 2024. This growth trajectory is reinforced by its strategic focus on digital and out-of-home advertising, sectors poised for expansion as digital transformation accelerates across Europe. The company's recent discussions about potentially divesting its core advertising business underscore a proactive approach to capitalizing on high market valuations, which could reshape its operational focus and unlock additional shareholder value moving forward. With earnings projected to grow at an annual rate of 19.3%, Ströer is positioning itself as a dynamic player within the evolving tech landscape of Europe.

- Unlock comprehensive insights into our analysis of Ströer SE KGaA stock in this health report.

Evaluate Ströer SE KGaA's historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 245 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADN1

adesso

Provides IT services in Germany, Austria, Switzerland, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)