- France

- /

- Professional Services

- /

- ENXTPA:ASY

Assystem And 2 More European Companies Estimated To Be Priced Below Their Intrinsic Value

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index rising by 2.35% and major single-country indexes also posting gains, investors are increasingly focused on finding opportunities that may be undervalued amidst a relatively stable inflation environment. In such conditions, stocks that are priced below their intrinsic value present an attractive proposition for those looking to capitalize on potential market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.80 | PLN256.05 | 49.3% |

| Truecaller (OM:TRUE B) | SEK23.30 | SEK46.25 | 49.6% |

| PVA TePla (XTRA:TPE) | €22.18 | €44.14 | 49.8% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.88 | 48.9% |

| Mo-BRUK (WSE:MBR) | PLN304.00 | PLN598.65 | 49.2% |

| Jæren Sparebank (OB:JAREN) | NOK382.95 | NOK752.67 | 49.1% |

| Hemnet Group (OM:HEM) | SEK165.90 | SEK324.49 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.388 | €0.77 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.06 | €6.09 | 49.8% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

Assystem (ENXTPA:ASY)

Overview: Assystem S.A. is an engineering and infrastructure project management company operating in France, the United Kingdom, and internationally, with a market cap of €643.08 million.

Operations: The company's revenue segments include €388.20 million from France and €254.10 million from international operations.

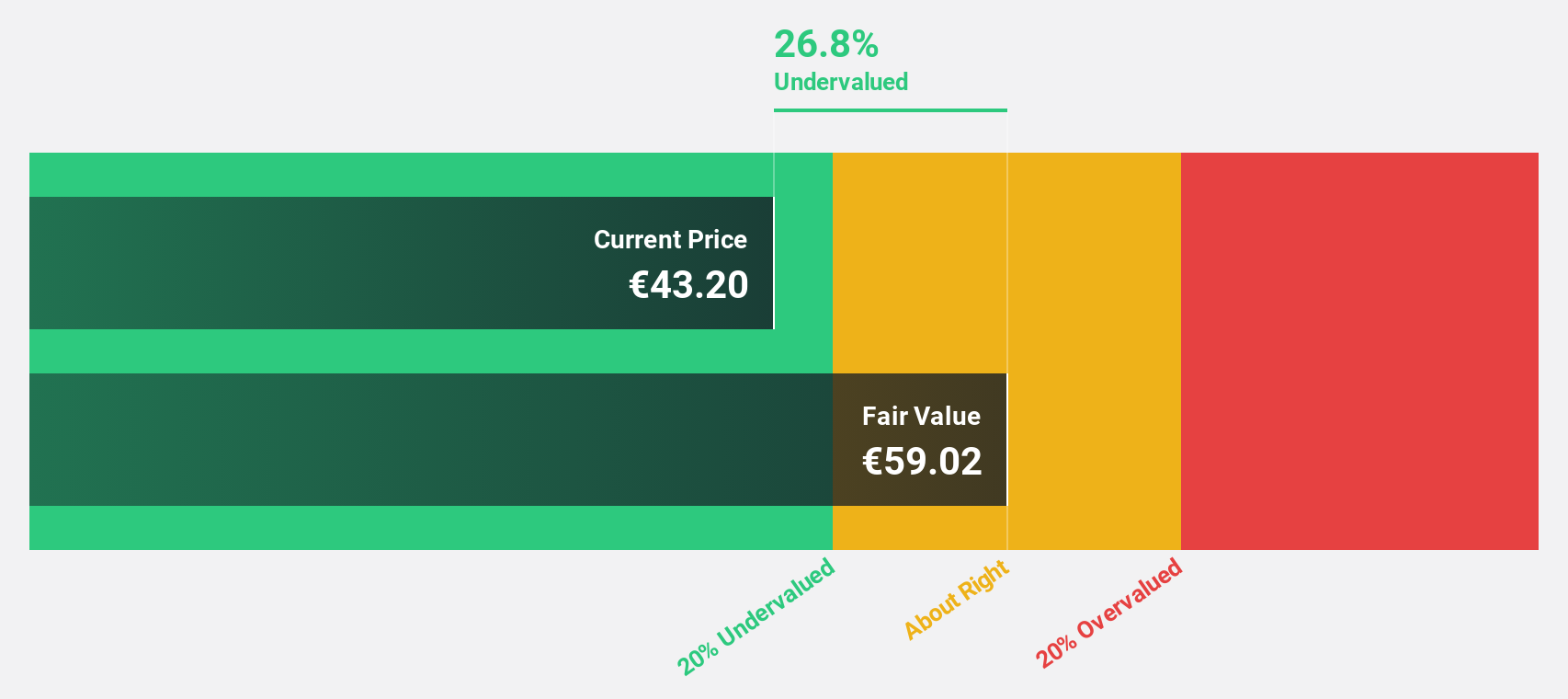

Estimated Discount To Fair Value: 24.7%

Assystem is trading at €43.3, significantly below its estimated fair value of €57.51, indicating potential undervaluation based on cash flows. Despite a decline in profit margins to 1.2% from 14.6% last year due to large one-off items, earnings are forecast to grow substantially at 53% annually over the next three years, outpacing the French market's growth rate. Recent partnerships in the nuclear sector may enhance Assystem’s future revenue streams and operational scale.

- The analysis detailed in our Assystem growth report hints at robust future financial performance.

- Dive into the specifics of Assystem here with our thorough financial health report.

YIT Oyj (HLSE:YIT)

Overview: YIT Oyj is a construction services company operating in Finland, the Czech Republic, Slovakia, Poland, and internationally with a market cap of €718.69 million.

Operations: The company's revenue segments consist of €0.48 billion from Infrastructure and €0.66 billion from Building Construction.

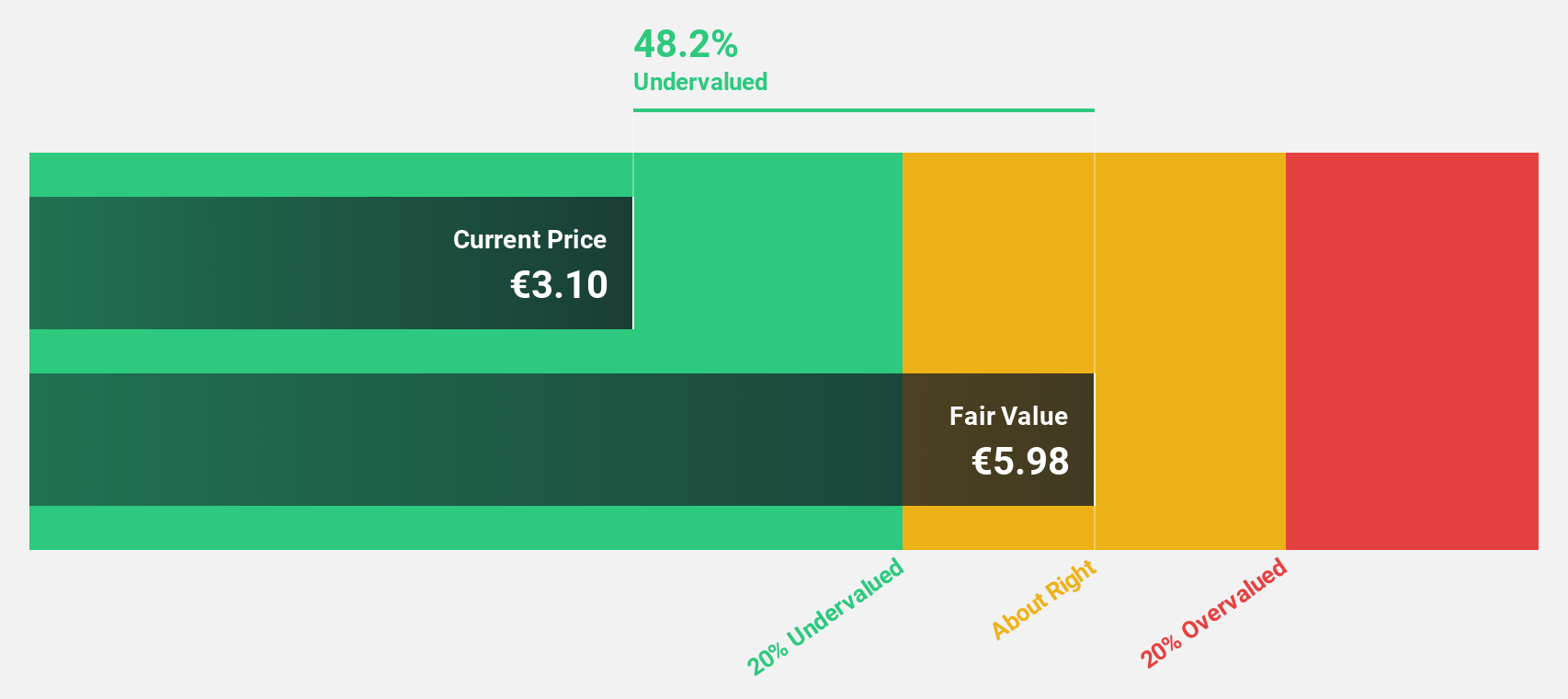

Estimated Discount To Fair Value: 48.1%

YIT Oyj, trading at €3.12, is priced well below its estimated fair value of €6.01, highlighting potential undervaluation based on cash flows. Despite recent losses, YIT is projected to achieve profitability within three years with earnings growth expected at 93.74% annually. New contracts in Helsinki and Espoo worth over €177 million bolster its order book and align with strategic goals for sustainable development projects, potentially enhancing future cash flow prospects.

- According our earnings growth report, there's an indication that YIT Oyj might be ready to expand.

- Unlock comprehensive insights into our analysis of YIT Oyj stock in this financial health report.

PVA TePla (XTRA:TPE)

Overview: PVA TePla AG, along with its subsidiaries, provides systems and solutions for producing components used in energy storage systems, photovoltaic modules, and wind turbines globally, with a market cap of €458.21 million.

Operations: The company's revenue streams are divided into Industrial Systems, generating €95.10 million, and Semiconductor Systems (including Solar Systems), contributing €168.56 million.

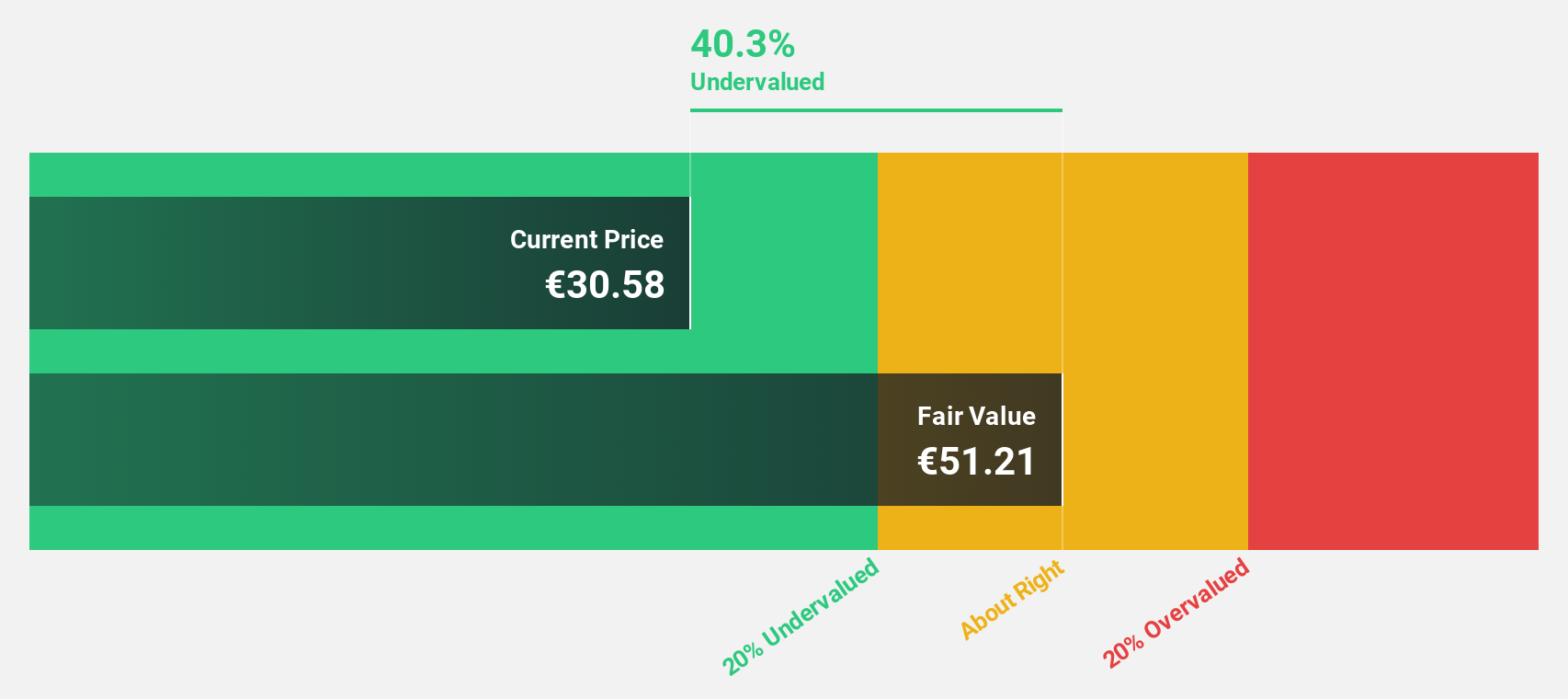

Estimated Discount To Fair Value: 49.8%

PVA TePla, trading at €22.18, is significantly undervalued with an estimated fair value of €44.14. Despite recent revenue declines and a net loss in Q3 2025, the company forecasts robust earnings growth of 29.9% annually over the next three years, outpacing the German market average. Revenue is expected to grow at 15.5% per year despite current trade policy uncertainties affecting short-term guidance, indicating strong potential for future cash flow enhancement.

- Our expertly prepared growth report on PVA TePla implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of PVA TePla.

Key Takeaways

- Click this link to deep-dive into the 201 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ASY

Assystem

Provides engineering and infrastructure project management services in France, the United Kingdom, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026