- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Will U.S. Patent Win and Possible Import Ban Shift Infineon Technologies' (XTRA:IFX) GaN Narrative?

Reviewed by Sasha Jovanovic

- In December 2025, the U.S. International Trade Commission issued a preliminary ruling that Innoscience violated one of Infineon Technologies’ gallium nitride (GaN) patents, confirming the validity of both asserted patents and potentially paving the way for a future import ban on the allegedly infringing products into the U.S.

- Combined with parallel wins in German courts, this decision highlights the strength of Infineon’s GaN intellectual property portfolio and its willingness to enforce it globally.

- We’ll now examine how this strengthening of Infineon’s GaN patent position could influence the company’s longer-term investment narrative and risk profile.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Infineon Technologies Investment Narrative Recap

To hold Infineon, you need to believe in its role as a core power semiconductor supplier to EVs, industrial electrification and AI data centers, underpinned by differentiated technologies like GaN and SiC. The recent ITC ruling strengthens Infineon’s GaN patent position, but it does not materially change the near term drivers, which still hinge on AI data center demand and a clean inventory recovery, nor does it remove key risks such as Chinese competition and trade tensions.

Among recent announcements, the collaboration with NVIDIA on high voltage DC power architectures for AI data centers ties directly into the GaN story. Stronger GaN patent protection could help Infineon defend pricing and content in this AI power segment, which many investors see as a crucial short term catalyst, especially as inventory normalization and Step Up cost savings aim to rebuild margins from currently compressed profit levels.

Yet beneath the patent wins, investors should be aware that rising Chinese competition and potential trade restrictions could still...

Read the full narrative on Infineon Technologies (it's free!)

Infineon Technologies' narrative projects €19.1 billion revenue and €3.4 billion earnings by 2028.

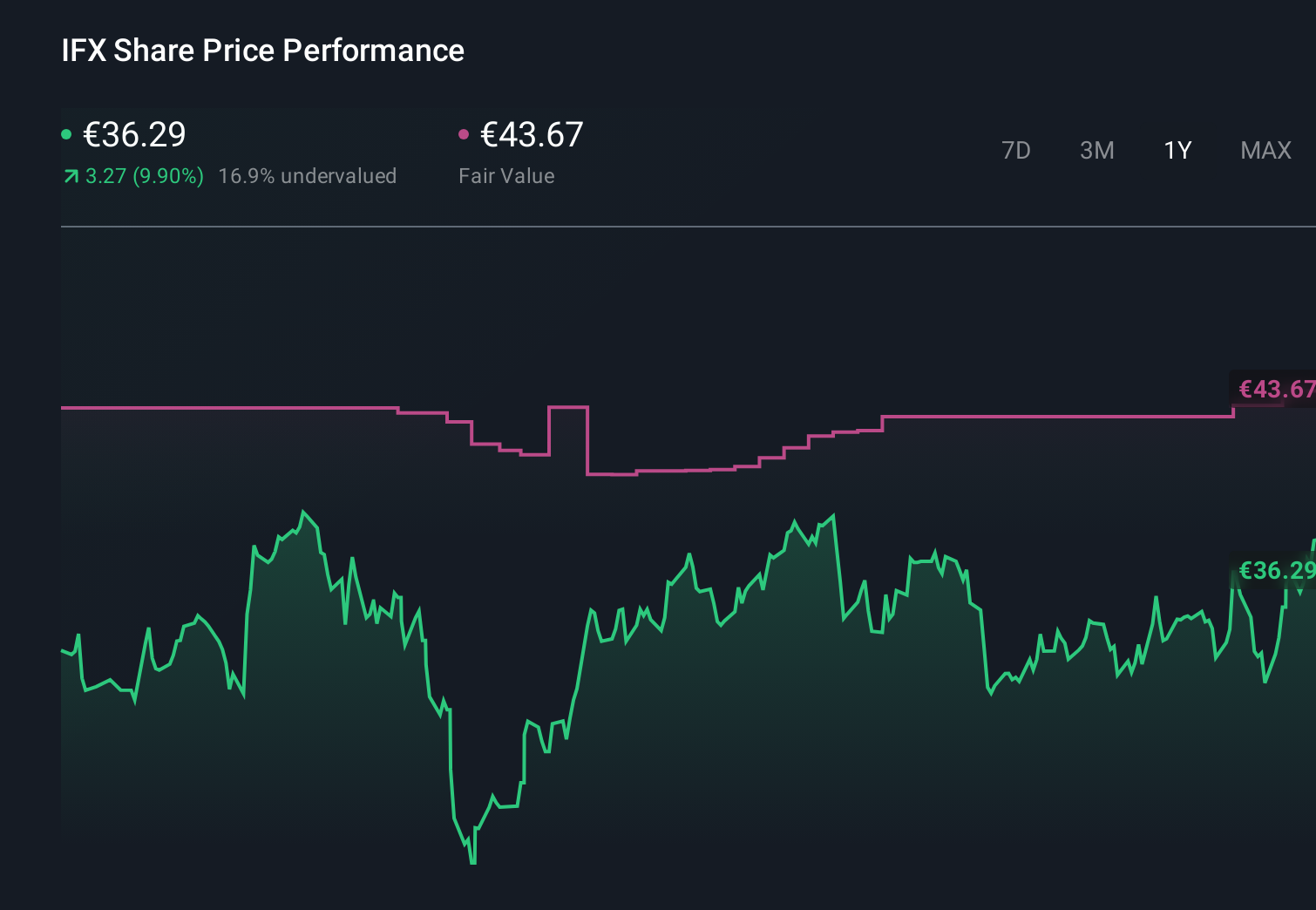

Uncover how Infineon Technologies' forecasts yield a €43.67 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Infineon between €32.93 and €55.27 per share, showing a wide spread in expectations. When you set this against the reliance on AI data center power demand as a key catalyst, it underlines why it helps to compare several different viewpoints on how sustainable Infineon’s earnings growth could be.

Explore 6 other fair value estimates on Infineon Technologies - why the stock might be worth as much as 51% more than the current price!

Build Your Own Infineon Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infineon Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infineon Technologies' overall financial health at a glance.

No Opportunity In Infineon Technologies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Develops, manufactures, and markets semiconductors and semiconductor-based solutions in Germany, Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, the Asia-Pacific, Japan, the United States, and the Americas.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion