- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Infineon Technologies (XTRA:IFX): Valuation Check After GaN Patent Win and Potential Import Ban Risks

Reviewed by Simply Wall St

Infineon Technologies (XTRA:IFX) just scored a meaningful win in its GaN patent fight, with a U.S. trade judge preliminarily finding Innoscience in violation, and a potential import ban hanging over competing products.

See our latest analysis for Infineon Technologies.

That backdrop helps explain why momentum in Infineon’s 1 month share price return of 14.61 percent and 90 day share price return of 17.83 percent is building, even though the 1 year total shareholder return of 13.69 percent has been more modest.

If Infineon’s GaN edge has your attention, it might be worth seeing what else is setting up for growth in high growth tech and AI stocks right now.

With earnings growing faster than revenue, a sizeable intrinsic value discount and fresh legal tailwinds in GaN, is Infineon still trading below its true potential, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 14% Undervalued

With Infineon closing at €37.51 against a narrative fair value near €43.61, the current setup leans toward upside if the long term plan holds.

The analysts have a consensus price target of €42.945 for Infineon Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €50.0, and the most bearish reporting a price target of just €37.0.

Want to see what is powering this optimism? The story blends rapid earnings expansion, rising margins and a punchy future multiple. Curious how those pieces really fit?

Result: Fair Value of $43.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering geopolitical tensions and softer EV demand could restrain Infineon’s growth trajectory and challenge the bullish assumptions behind today’s valuation narrative.

Find out about the key risks to this Infineon Technologies narrative.

Another Angle on Valuation

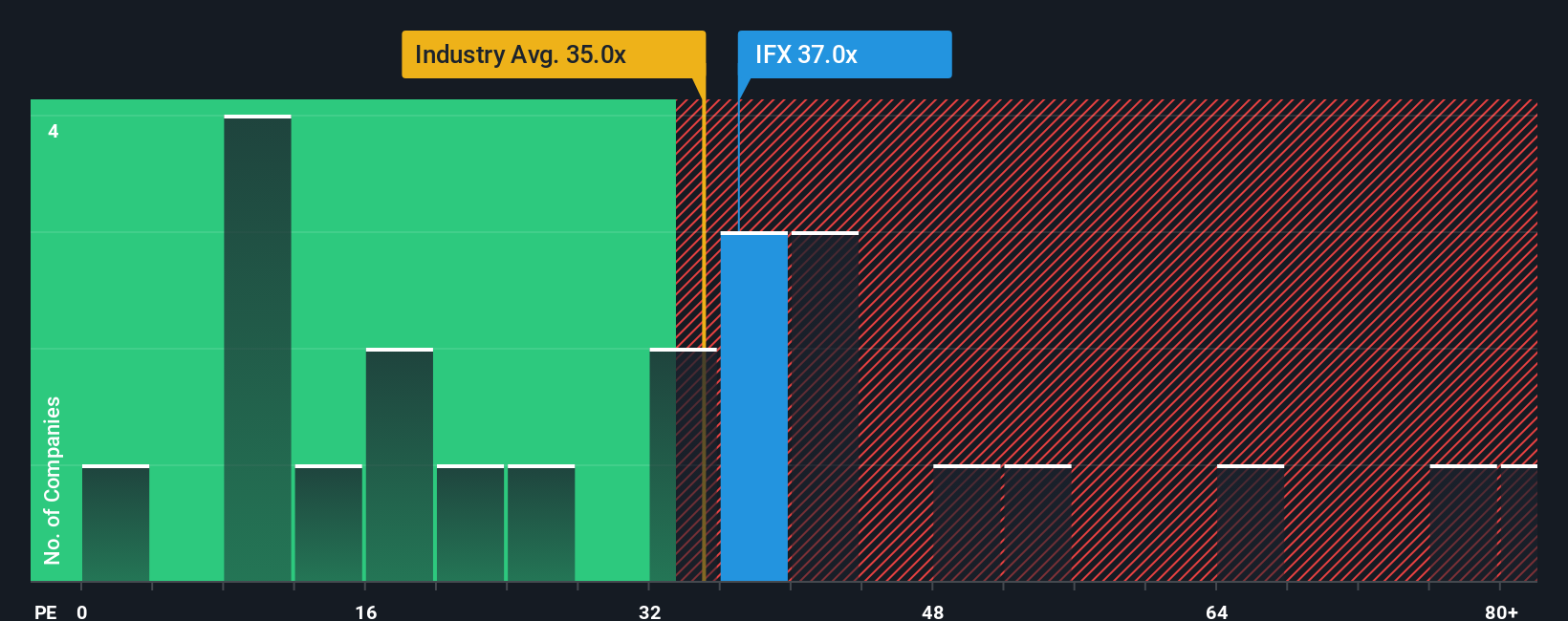

While narratives and fair value estimates point to upside, Infineon’s current price to earnings ratio of 49.5 times screens as rich versus the European semiconductor average of 39 times, a peer average of 23.2 times, and a fair ratio closer to 30 times. This raises the question of how much good news is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Infineon Technologies Narrative

If you would rather follow your own process instead of relying on this view, you can quickly build a personalized take in under three minutes: Do it your way.

A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge by using the Simply Wall St Screener to tap into fresh opportunities most investors overlook, before sentiment and prices race ahead.

- Capture early growth potential by reviewing these 3591 penny stocks with strong financials that already back their stories with solid financial foundations.

- Sharpen your tech exposure by targeting these 27 AI penny stocks positioned to benefit from accelerating breakthroughs in artificial intelligence.

- Boost your income strategy by focusing on these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Develops, manufactures, and markets semiconductors and semiconductor-based solutions in Germany, Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, the Asia-Pacific, Japan, the United States, and the Americas.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026