- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Infineon Technologies (XTRA:IFX): Assessing Valuation as AutoSens Europe 2025 Spotlights Automotive Sensor Innovation

Reviewed by Kshitija Bhandaru

Infineon Technologies (XTRA:IFX) is drawing extra attention this week as the company plays a prominent role at AutoSens Europe 2025 in Barcelona. Several of its leaders are scheduled to present on automotive sensor technologies.

See our latest analysis for Infineon Technologies.

Infineon’s recent buzz at AutoSens Europe comes against a backdrop of solid long-term returns and some recent volatility. While the share price is up 5.7% year to date, the 1-year total shareholder return sits at 10.1%, and the impressive 3-year total return is 41.6%. Investors seem to be weighing near-term uncertainty against the company’s growth potential in key technologies.

If you're watching how the auto tech space is shifting, consider exploring the full range of players in the sector with our See the full list for free.

With Infineon’s shares still trading nearly 28% below consensus price targets, investors may be questioning whether the market is underestimating its future earnings power or if all the upside from its tech wins is already reflected in the stock price.

Most Popular Narrative: 22.7% Undervalued

With Infineon shares closing at €33.18 and the most closely followed fair value estimate sitting at €42.95, the latest narrative paints a bullish gap between price and potential. This valuation sets expectations high for future performance. Here is a key insight driving that conviction.

Infineon's power and sensor solutions are experiencing accelerating demand from AI data center build-outs, with projected revenues in this segment growing from ~€600 million this year to €1 billion next year, reflecting a strong multi-year increase in high-margin revenue from the rapid proliferation of AI infrastructure and rising chip content per device.

Curious why the fair value sees room for double-digit upside? The narrative’s secret sauce is a bold bet on surging demand, swelling margins, and transformational earnings growth. Discover which assumptions spark analyst confidence and could be game changers for your investing playbook.

Result: Fair Value of €42.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions or weaker-than-expected electric vehicle demand could quickly alter analysts’ bullish view and challenge the optimism surrounding Infineon’s trajectory.

Find out about the key risks to this Infineon Technologies narrative.

Another View: Is the Price Tag Justified?

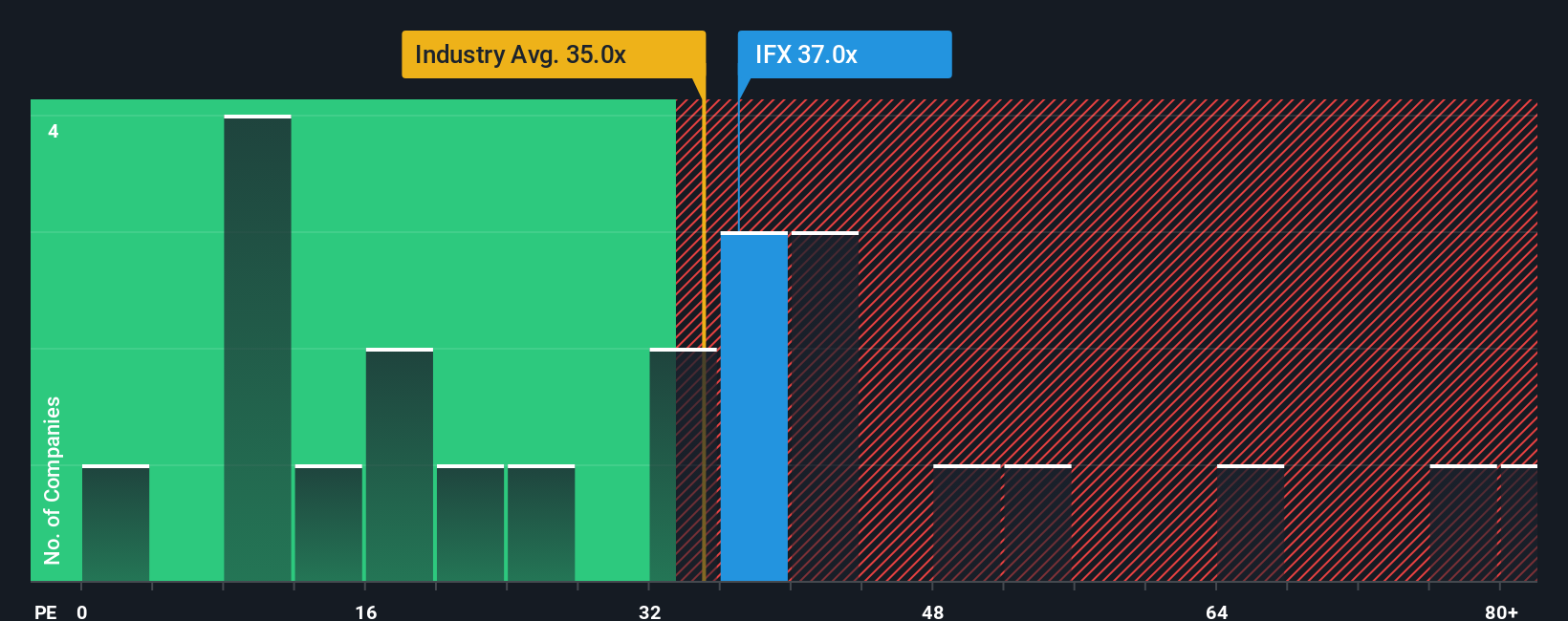

While analysts see upside based on future earnings, a look at the market’s favored valuation measure raises an eyebrow. Infineon’s current price-to-earnings ratio is 38.3x, notably higher than both European semiconductor peers (35x) and the peer group average (20.8x). With a fair ratio estimated at 40.2x, this places shares at the high end of what the market could eventually justify. Are investors overpaying for growth, or will fundamentals catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Infineon Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Infineon Technologies Narrative

Prefer a different take or eager to dig into the numbers yourself? You can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Broaden your strategy with these handpicked approaches to help you spot tomorrow’s winners sooner and capture exciting new trends in the market.

- Uncover high-potential opportunities by checking out these 889 undervalued stocks based on cash flows, where value investors are finding overlooked gems for the next big move.

- Boost your income by exploring companies making waves with generous payouts, all highlighted through these 19 dividend stocks with yields > 3%.

- Capitalize on major tech innovation by targeting these 26 AI penny stocks leading dramatic shifts in AI and automation-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Engages in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives