- Germany

- /

- Semiconductors

- /

- XTRA:AIXA

How Investors Are Reacting To AIXTRON (XTRA:AIXA) Joining imec's GaN Power Electronics Program

Reviewed by Sasha Jovanovic

- Earlier this month, imec announced that AIXTRON SE has joined its expanded 300 mm GaN Power Electronics Program by contributing the Hyperion GaN MOCVD system, which will support advanced power applications for electric vehicles, solar panels, and AI data centers.

- The collaboration leverages 300 mm substrates to potentially lower manufacturing costs and speed up the development of next-generation gallium nitride devices for diverse and rapidly evolving markets.

- We'll now examine how AIXTRON's role as a technology supplier in imec's 300 mm GaN program may reshape its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AIXTRON Investment Narrative Recap

AIXTRON's investment case revolves around belief in accelerating demand for compound semiconductors as power electronics shift to gallium nitride and silicon carbide, especially for electric vehicles and AI infrastructure. While the new partnership with imec signals technology leadership and supports short-term catalysts by broadening AIXTRON's relevance in 300 mm GaN, it does not immediately change the overriding risk: ongoing overcapacity and underutilization in key end markets, which could still weigh on equipment demand and earnings visibility over the next few years.

A recent announcement highlighting strong SiC demand was the shipment of AIXTRON's 100th G10-SiC system to a major European power device manufacturer. This underscores growth in established compound semiconductor markets, a crucial factor, since both the recent imec partnership and ongoing equipment sales to industry leaders are needed to offset risks from delayed recovery or market stagnation.

On the other hand, investors should not overlook the significance of persistent overcapacity in GaN and SiC, as this could ...

Read the full narrative on AIXTRON (it's free!)

AIXTRON's outlook anticipates €741.5 million in revenue and €113.5 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.4% and a €4.9 million increase in earnings from the current earnings of €108.6 million.

Uncover how AIXTRON's forecasts yield a €15.97 fair value, a 23% upside to its current price.

Exploring Other Perspectives

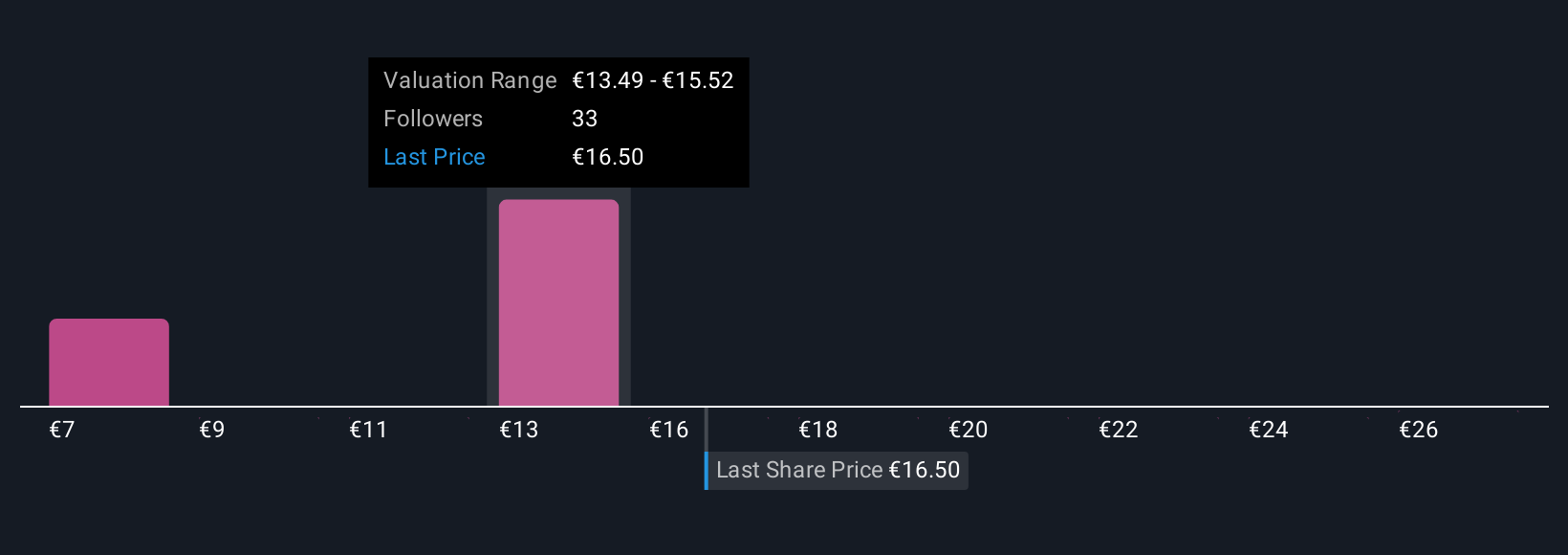

Three members of the Simply Wall St Community assessed AIXTRON's fair value, yielding estimates from €15.97 to €40.81 per share. While recent technology partnerships appear promising for product relevance, most analysts view persistent overcapacity as an ongoing drag on new equipment demand and near-term earnings.

Explore 3 other fair value estimates on AIXTRON - why the stock might be worth over 3x more than the current price!

Build Your Own AIXTRON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AIXTRON research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free AIXTRON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AIXTRON's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AIXA

AIXTRON

Provides deposition equipment to the semiconductor industry in Asia, Europe, and the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)