High Growth Tech Stocks in Germany to Watch This August 2024

Reviewed by Simply Wall St

Germany's DAX Index has recently climbed 3.38%, reflecting a broader optimism in the European markets fueled by hopes of interest rate cuts and resilient economic indicators. Against this backdrop, investors are keenly eyeing high-growth tech stocks, which often stand out due to their innovative capabilities and potential for substantial returns in a recovering market environment.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Allgeier | 5.54% | 34.27% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.86% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| medondo holding | 34.52% | 71.99% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| Rubean | 43.51% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

We'll examine a selection from our screener results.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG develops, manufactures, and supplies supercomputer and quantum computer solutions with a market cap of €504.00 million.

Operations: ParTec AG specializes in developing, manufacturing, and supplying supercomputer and quantum computer solutions. The company's revenue is derived from its advanced computing solutions tailored for various industries.

ParTec, a prominent player in the high-growth tech sector in Germany, has shown impressive revenue growth of 165.1% over the past year. The company’s future looks promising with an expected annual revenue increase of 41.2%, significantly outpacing the German market's forecasted 5.2%. Notably, ParTec's earnings are projected to grow at an annual rate of 63.31%, with a high Return on Equity forecasted at 73.2% within three years. Their commitment to innovation is evident from substantial R&D expenses, ensuring they remain competitive in the rapidly evolving tech landscape.

- Take a closer look at ParTec's potential here in our health report.

Gain insights into ParTec's past trends and performance with our Past report.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

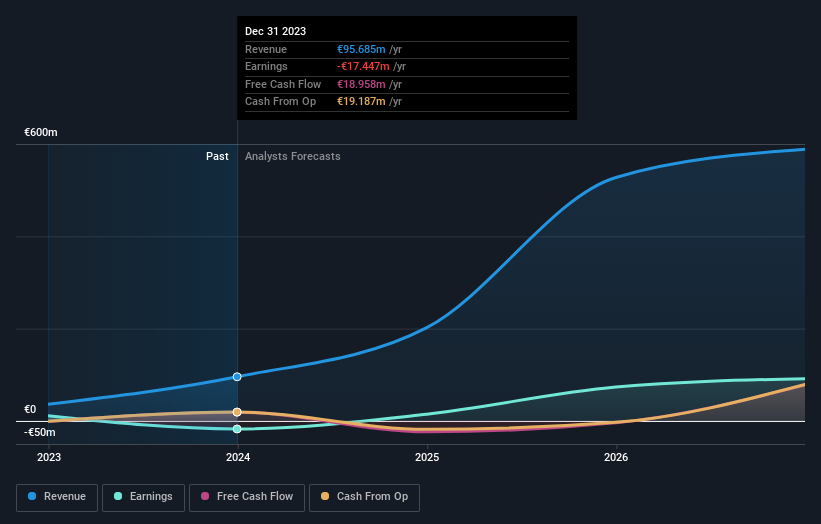

Overview: Formycon AG, a biotechnology company, develops biosimilar drugs in Germany and Switzerland with a market cap of €893.44 million.

Operations: Formycon AG focuses on the development of biosimilar drugs, generating revenue primarily from its Drug Delivery Systems segment, which brought in €60.80 million.

Formycon, a notable player in Germany's tech sector, reported H1 2024 sales of €26.89M, down from €43.79M a year ago, with a net loss of €10.09M compared to last year's net income of €1.8M. Despite this setback, FYB's revenue is expected to grow at 32.5% annually, significantly outpacing the German market's 5.2% forecasted growth rate and its earnings are projected to increase by 30.9% per year over the next three years. The company allocates substantial R&D expenses to maintain competitive advantage and foster innovation in biosimilars development.

- Delve into the full analysis health report here for a deeper understanding of Formycon.

Examine Formycon's past performance report to understand how it has performed in the past.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €544.16 million.

Operations: Verve Group SE generates revenue primarily from its Supply Side Platforms (SSP) (€318.35 million) and Demand Side Platforms (DSP) (€51.53 million), with a minor offset from eliminations (-€34.18 million). The company specializes in the automated trading of digital advertising space across North America and Europe.

Verve Group SE has increased its earnings guidance for 2024, projecting revenues between €400M and €420M. The company’s R&D expenses have shown a consistent rise, reaching €45.6M in the latest fiscal year to support innovation in digital media and ad technology. With earnings expected to grow at 20.5% annually, Verve is outpacing the German market's forecasted growth of 19.8%. Additionally, recent acquisitions like Jun Group have bolstered their demand-side capabilities significantly.

- Click here to discover the nuances of Verve Group with our detailed analytical health report.

Assess Verve Group's past performance with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 44 German High Growth Tech and AI Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

High growth potential with excellent balance sheet.