Exasol AG's (ETR:EXL) 27% Jump Shows Its Popularity With Investors

Despite an already strong run, Exasol AG (ETR:EXL) shares have been powering on, with a gain of 27% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

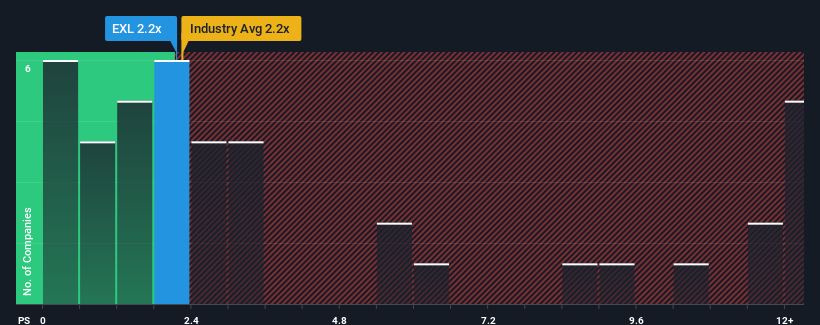

In spite of the firm bounce in price, there still wouldn't be many who think Exasol's price-to-sales (or "P/S") ratio of 2.2x is worth a mention when it essentially matches the median P/S in Germany's Software industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Exasol

How Has Exasol Performed Recently?

There hasn't been much to differentiate Exasol's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Exasol will help you uncover what's on the horizon.How Is Exasol's Revenue Growth Trending?

In order to justify its P/S ratio, Exasol would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 5.7% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 13% per annum over the next three years. That's shaping up to be similar to the 13% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Exasol's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Exasol's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Exasol's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Having said that, be aware Exasol is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Exasol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EXL

Exasol

A technology company, engages in the provision of an analytics engine to access and analyze a company’s data in Germany, Austria, Switzerland, Rest of Europe, United Kingdom, and Region America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)