Why We're Not Concerned About LANXESS Aktiengesellschaft's (ETR:LXS) Share Price

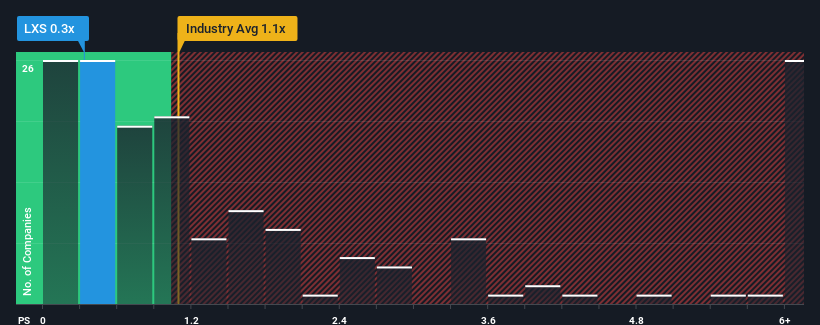

There wouldn't be many who think LANXESS Aktiengesellschaft's (ETR:LXS) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Chemicals industry in Germany is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for LANXESS

How LANXESS Has Been Performing

LANXESS has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LANXESS.How Is LANXESS' Revenue Growth Trending?

In order to justify its P/S ratio, LANXESS would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.9% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 4.4% per year over the next three years. That's shaping up to be similar to the 4.7% per year growth forecast for the broader industry.

With this in mind, it makes sense that LANXESS' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On LANXESS' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at LANXESS' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for LANXESS that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:LXS

LANXESS

A specialty chemicals company, engages in the development, manufacture, and marketing of chemical intermediates, additives, and consumer protection products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives