- Germany

- /

- Basic Materials

- /

- XTRA:HEI

A Piece Of The Puzzle Missing From Heidelberg Materials AG's (ETR:HEI) 27% Share Price Climb

Heidelberg Materials AG (ETR:HEI) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

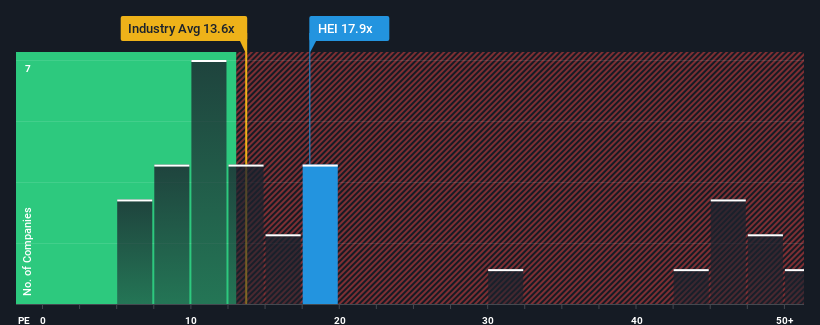

Although its price has surged higher, there still wouldn't be many who think Heidelberg Materials' price-to-earnings (or "P/E") ratio of 17.9x is worth a mention when the median P/E in Germany is similar at about 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Heidelberg Materials hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Heidelberg Materials

Is There Some Growth For Heidelberg Materials?

In order to justify its P/E ratio, Heidelberg Materials would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.0% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 17% each year over the next three years. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader market.

In light of this, it's curious that Heidelberg Materials' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Heidelberg Materials' P/E

Heidelberg Materials appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Heidelberg Materials' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Heidelberg Materials has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HEI

Heidelberg Materials

Produces and distributes cement, aggregates, ready-mixed concrete, and asphalt worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives