Talanx (XTRA:TLX): Evaluating Valuation as Shares Hold Steady in 2024

Reviewed by Kshitija Bhandaru

Talanx (XTRA:TLX) shares recently saw modest movement, sparking renewed interest in the insurer’s fundamentals and long-term performance. Investors are weighing both current valuation as well as the company’s steady financial track record.

See our latest analysis for Talanx.

After trending sideways for much of 2024, Talanx's steady share price has caught investors’ attention as the broader sector shifts. The stock’s 1-year total shareholder return of 0.54% highlights a pattern of resilient and measured growth as momentum builds for potential longer-term gains.

If you’re interested in finding companies with similar momentum and rising confidence from insiders, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With Talanx trading close to analyst price targets and boasting years of consistent returns, investors are left to consider whether there is value still to be unlocked or if the market is already factoring in its future growth.

Most Popular Narrative: 6% Overvalued

Talanx’s closing price sits well above the consensus fair value, a gap that challenges investor expectations and suggests a possible misalignment between the market’s momentum and analyst caution.

The company’s focus on maintaining a conservative combined ratio in Corporate & Specialty, although achievable, could signal caution about profit expansion and impact future earnings growth. The proposed strategic expansion into niche markets rather than acquisitions in Mexico and the U.S. might limit rapid growth potential, affecting revenue and market positioning.

What assumptions power this cautious outlook? Analysts are considering questions of margin pressure and the actual payoff from Talanx's international moves. The numbers behind the headline reveal a delicate balancing act between stable profit and unrealized growth. Want to know how they built their future scenario and if it holds up?

Result: Fair Value of €104.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Talanx’s broad diversification and underwriting discipline could counterbalance challenges and help to support stable revenue and profit growth despite market pressures.

Find out about the key risks to this Talanx narrative.

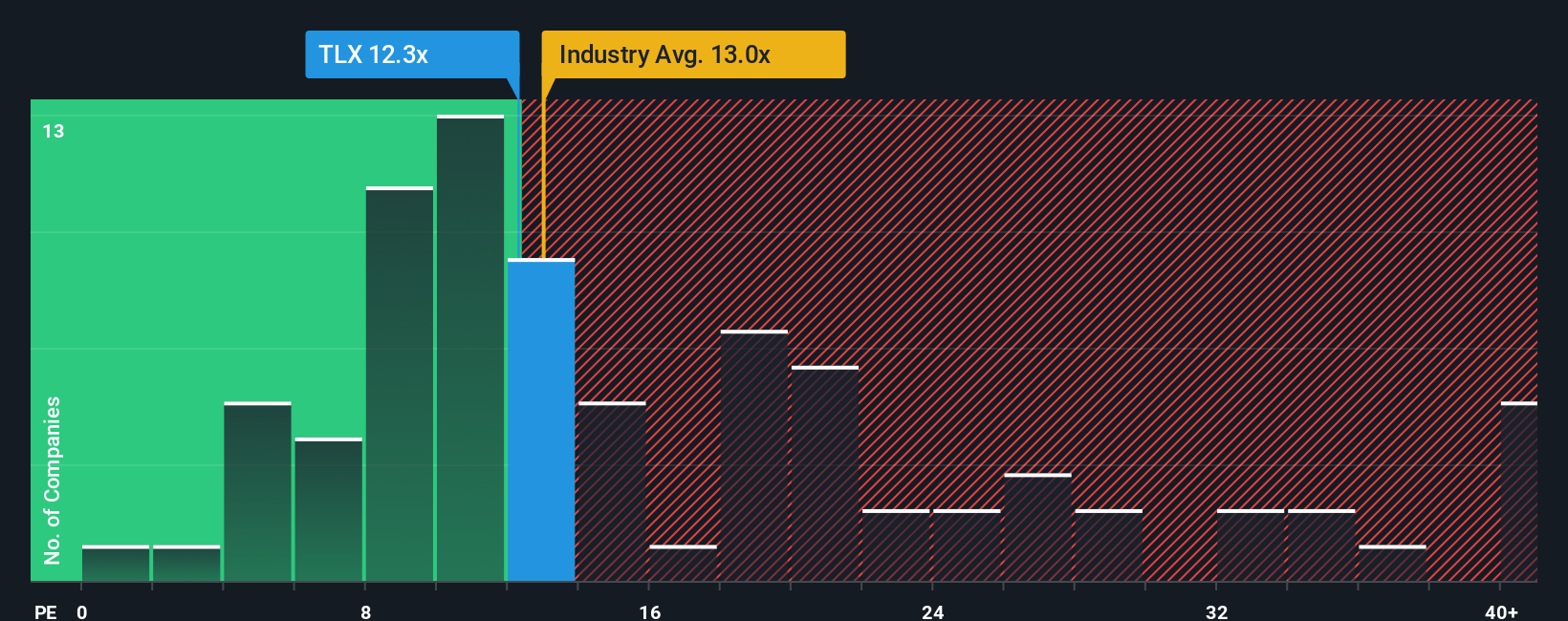

Another View: What About Its Earnings Multiple?

Looking at Talanx through the lens of its earnings ratio offers a more optimistic outlook. The company trades at 12.6 times earnings, which is cheaper than its peer group average of 14.5 times. However, the market's current ratio is slightly above the fair ratio of 12.1. For investors, this signals that while Talanx may appear good value today compared to others, there is only a small margin of safety if expectations shift. Which approach better captures the upside and risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Talanx Narrative

If you have your own perspective or want to take a closer look yourself, you can build a fresh Talanx narrative in just a few minutes, your way. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Talanx.

Looking for more investment ideas?

Stay ahead of the curve by targeting opportunities beyond Talanx. Let these unique stock screens guide you to exciting sectors and undervalued gems before others catch on.

- Amplify your portfolio's potential by reviewing these 896 undervalued stocks based on cash flows, which may be trading below their true worth and positioned for a rebound.

- Capitalize on the growth of artificial intelligence with these 24 AI penny stocks, featuring companies leading in machine learning and automation.

- Get ahead of financial trends by uncovering robust income streams through these 19 dividend stocks with yields > 3%, including companies with attractive yields and proven resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Talanx might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TLX

Talanx

Provides insurance and reinsurance products and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)