What Allianz (XTRA:ALV)'s Appointment of Ritu Arora Means for Its India Expansion Strategy

Reviewed by Sasha Jovanovic

- Allianz recently appointed Ritu Arora as India country head, effective immediately, following her leadership as CEO and CIO of Allianz Investment Management Asia Pacific and her advisory role to the Allianz SE Board.

- Arora’s extensive experience in managing multi-billion dollar portfolios and shaping investment flows into India highlights Allianz’s intensified focus on tapping the country’s insurance and asset management potential.

- We’ll look at how Arora’s appointment could influence Allianz’s narrative around expansion in high-growth emerging markets like India.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Allianz Investment Narrative Recap

To own Allianz stock, investors typically need to believe in the group's ability to grow earnings and dividends by executing on expansion in emerging markets and delivering operational efficiencies, while managing regulatory, market, and digital risk. The appointment of Ritu Arora as India country head underscores Allianz's commitment to capitalizing on India's insurance and asset management market, but this leadership change is unlikely to materially affect near-term catalysts such as group earnings growth or the primary risk of foreign exchange and emerging market volatility.

Another recent event with relevant implications is Allianz's progress with its share buyback program, having purchased €1,500 million worth of shares by July 2025. This underscores Allianz's continued focus on capital management, reinforcing a key catalyst for shareholder value alongside its expansion efforts in high-growth regions.

However, it's important for investors to be equally aware that, despite leadership appointments, persistent FX headwinds and emerging market exposures still pose...

Read the full narrative on Allianz (it's free!)

Allianz is projected to achieve €198.0 billion in revenue and €12.5 billion in earnings by 2028. This outlook is based on an anticipated annual revenue growth rate of 22.0% and an earnings increase of €2.4 billion from the current €10.1 billion.

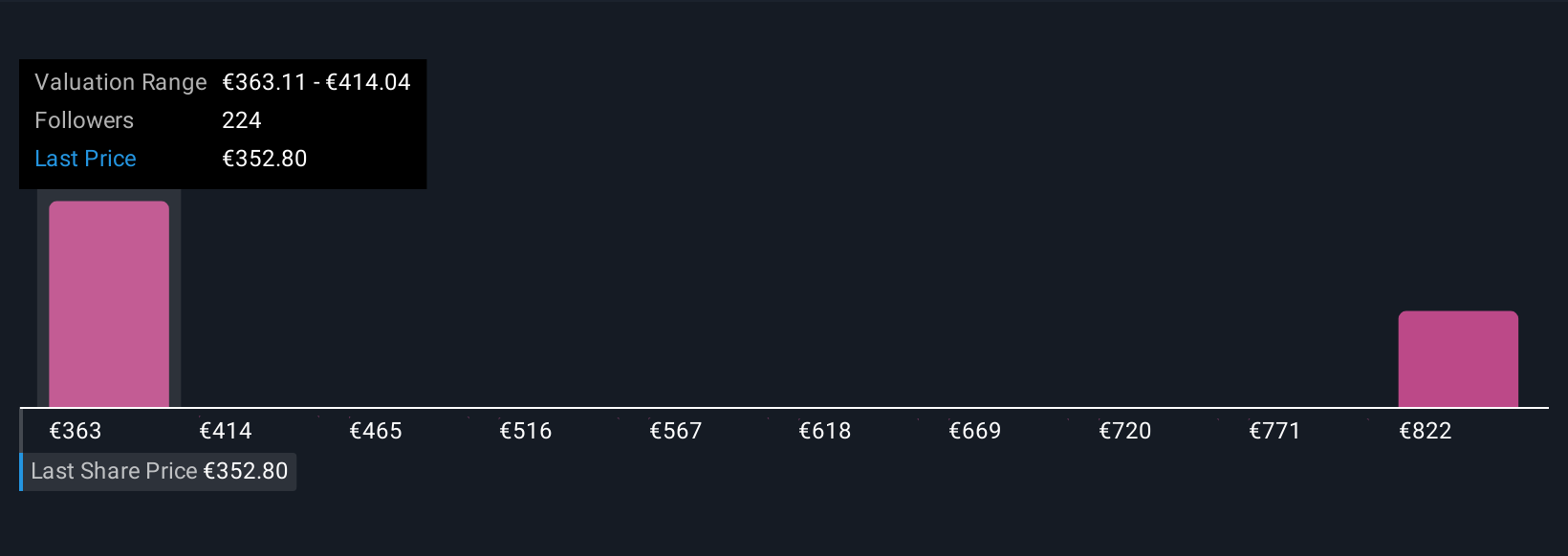

Uncover how Allianz's forecasts yield a €363.11 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 11 fair value estimates for Allianz, ranging from €363 to €872, highlighting a wide span of viewpoints. As you weigh these estimates, remember that foreign exchange risk and exposure to volatile emerging markets remain key factors potentially influencing Allianz's future results.

Explore 11 other fair value estimates on Allianz - why the stock might be worth just €363.11!

Build Your Own Allianz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allianz research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Allianz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allianz's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ALV

Allianz

Provides property-casualty insurance, life/health insurance, and asset management products and services Internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)