Highlighting Samyung Trading And Two Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes nearing record highs and a strong labor market boosting sentiment, investors are increasingly focused on strategic opportunities amid ongoing geopolitical uncertainties and economic shifts. In this dynamic environment, dividend stocks like Samyung Trading offer potential stability and income generation, making them an attractive consideration for those seeking to balance growth with consistent returns in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.81% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

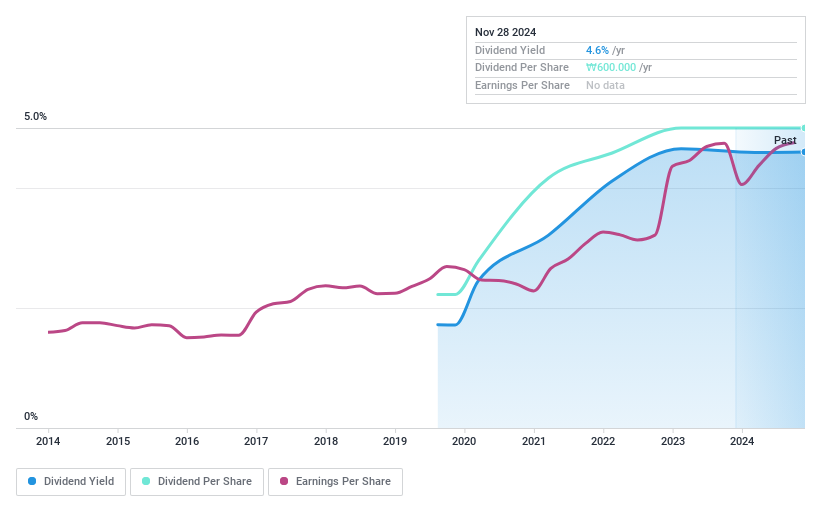

Samyung Trading (KOSE:A002810)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyung Trading Co., Ltd. primarily supplies organic and inorganic chemical products worldwide and has a market cap of ₩229.17 billion.

Operations: Samyung Trading Co., Ltd. generates its revenue from the supply of organic and inorganic chemical products on a global scale.

Dividend Yield: 4.6%

Samyung Trading offers a compelling dividend profile with a low payout ratio of 18%, ensuring dividends are well-covered by earnings. While the company has only been paying dividends for five years, they have shown stability and growth. The dividend yield of 4.62% places it in the top quartile of Korean market payers. With a price-to-earnings ratio significantly below the market average, it presents good value despite its brief dividend history. Recent earnings reports show steady growth, supporting its payout sustainability.

- Get an in-depth perspective on Samyung Trading's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Samyung Trading's share price might be too optimistic.

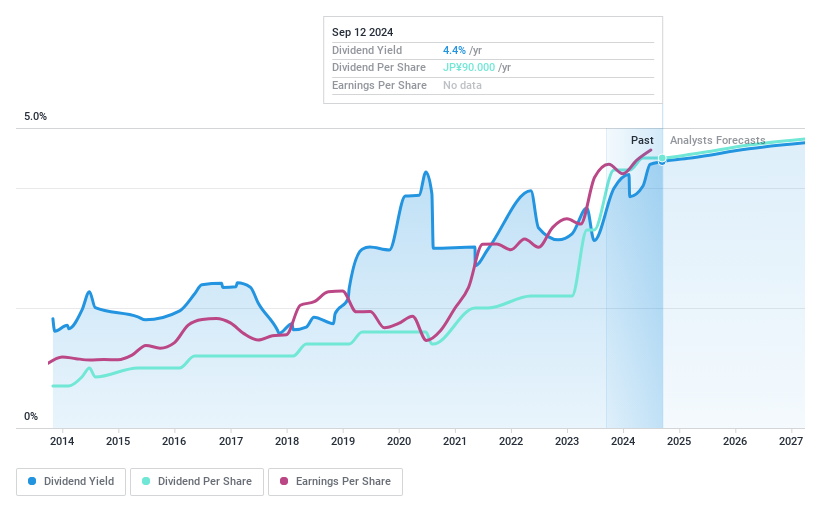

Okamura (TSE:7994)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Okamura Corporation, with a market cap of ¥188.71 billion, operates in Japan where it manufactures, sells, distributes, and installs office furniture, store displays, material handling systems, and industrial machinery.

Operations: Okamura Corporation generates revenue from its Office Environment Business at ¥160.63 billion, Commercial Environment Business at ¥117.68 billion, and Logistics System Business at ¥19.64 billion.

Dividend Yield: 4.5%

Okamura is trading at 70.5% below its estimated fair value, presenting a good relative value compared to peers. The dividend yield of 4.51% is among the top 25% in Japan, though it lacks coverage by free cash flows. Despite this, dividends are well-covered by earnings with a payout ratio of 46.1%. Over the past decade, dividends have been stable and reliable with consistent growth, although sustainability concerns remain due to insufficient cash flow coverage.

- Navigate through the intricacies of Okamura with our comprehensive dividend report here.

- Our expertly prepared valuation report Okamura implies its share price may be lower than expected.

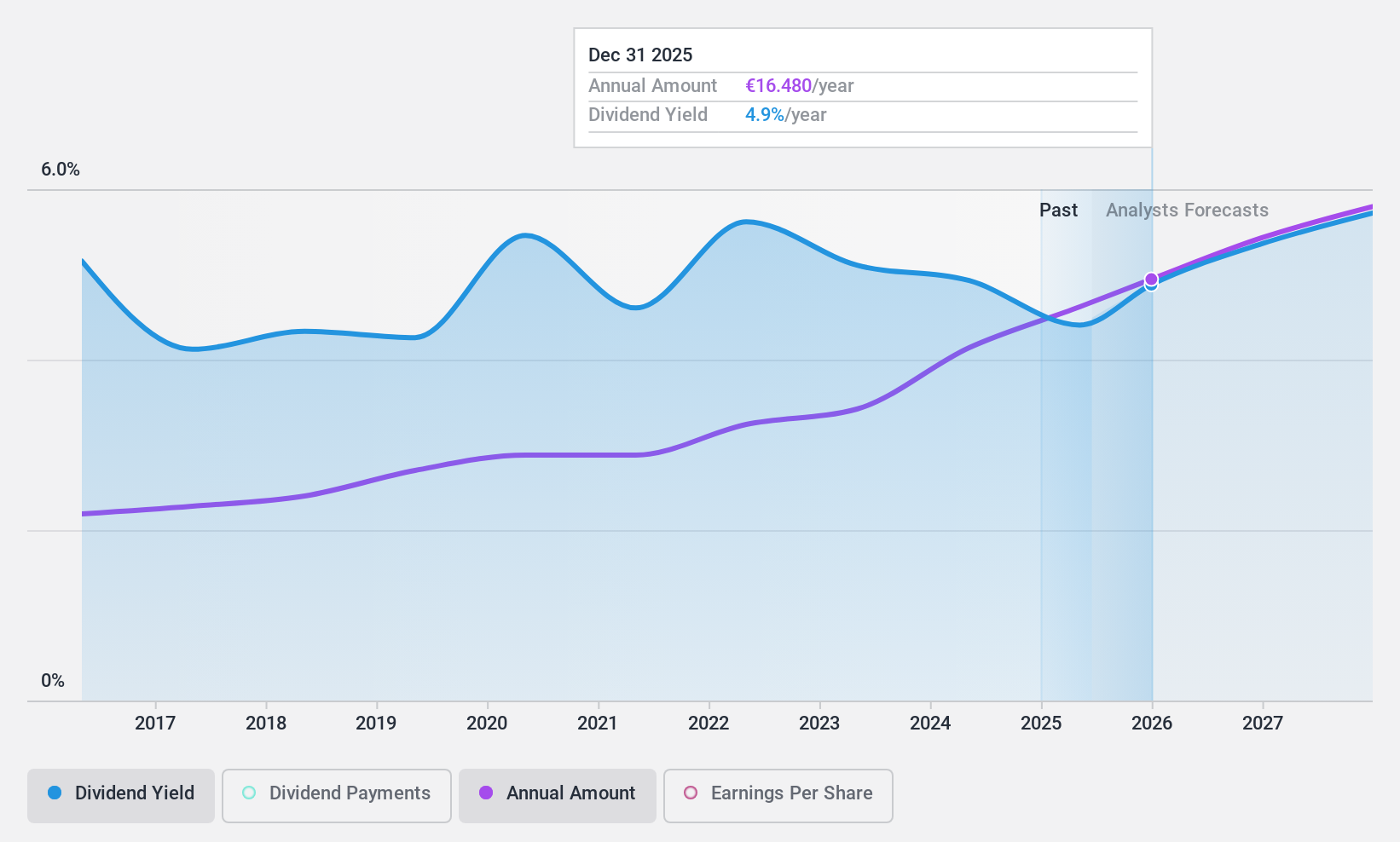

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Allianz SE, with a market cap of €112.03 billion, operates globally through its subsidiaries offering property-casualty insurance, life/health insurance, and asset management products and services.

Operations: Allianz SE generates revenue through its key segments: property-casualty insurance (€76.40 billion), life/health insurance (€37.11 billion), and asset management (€3.35 billion).

Dividend Yield: 4.8%

Allianz's dividend yield of 4.75% is reliable and well-covered by earnings and cash flows, with a payout ratio of 60% and a cash payout ratio of 23%. Dividends have been stable over the past decade, supported by consistent earnings growth. Recent Q3 results show net income at €2.47 billion, up from €2.02 billion last year, indicating strong financial health. The company also completed a share buyback worth €1.5 billion, enhancing shareholder value further.

- Unlock comprehensive insights into our analysis of Allianz stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Allianz shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 1960 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ALV

Allianz

Provides property-casualty insurance, life/health insurance, and asset management products and services Internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives