As European markets show mixed performance, with the pan-European STOXX Europe 600 Index rising slightly on hopes of interest rate cuts in the U.S. and UK, investors are keenly observing economic indicators such as inflation and GDP revisions. In this context, dividend stocks become an attractive option for those seeking steady income streams amidst market fluctuations. A good dividend stock often combines a reliable payout history with strong fundamentals, making it a potential anchor in uncertain economic climates.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.63% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.20% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.58% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.10% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.53% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.36% | ★★★★★★ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

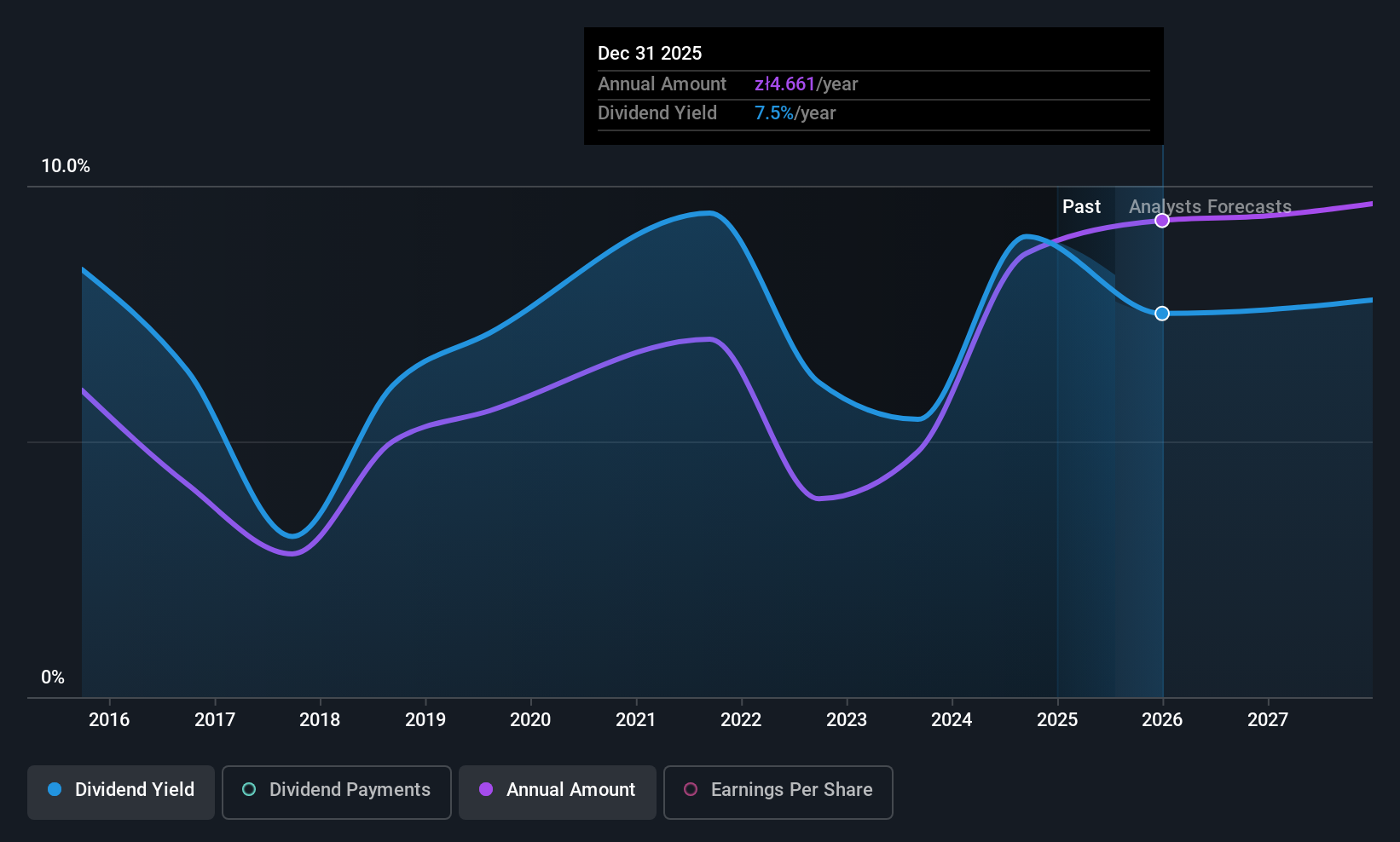

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services across Poland, the Baltic States, and Ukraine, with a market cap of PLN55.70 billion.

Operations: Powszechny Zaklad Ubezpieczen SA's revenue segments include Mass Insurance (PLN16.31 billion), Banking Activities (PLN42.39 billion), Group and Individually Continued Insurance (PLN11.95 billion), Corporate Insurance (PLN5.58 billion), Baltic Countries (PLN3.56 billion), Individual Protective Insurance (PLN1.58 billion), Investments (PLN917 million), Pensions (PLN378 million), Ukraine operations (PLN284 million), Life Investment Insurance (PLN116 million) and Investment Contracts (PLN40 million).

Dividend Yield: 6.9%

Powszechny Zaklad Ubezpieczen's dividend sustainability is supported by a payout ratio of 55.9% and a cash payout ratio of 42%, indicating dividends are well-covered by earnings and cash flows. However, its dividend reliability is questionable due to volatility over the past decade. Recent earnings growth, with net income reaching PLN 5.23 billion for nine months ending September 2025, highlights financial strength, though future earnings are expected to decline slightly. The company seeks acquisitions in healthcare to bolster growth prospects amidst trading at a significant discount to estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Powszechny Zaklad Ubezpieczen.

- Insights from our recent valuation report point to the potential undervaluation of Powszechny Zaklad Ubezpieczen shares in the market.

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg and internationally; it has a market cap of €208.37 million.

Operations: All for One Group SE generates revenue primarily from its CORE segment at €456.65 million and LOB segment at €74.61 million.

Dividend Yield: 3.7%

All for One Group's dividend yield of 3.68% is below the top quartile in Germany, yet it's reliably covered by earnings and cash flows, with payout ratios of 49% and 23.7%, respectively. The dividend has been stable and growing over the past decade. Recent product launches in digital transformation services highlight its strategic focus on innovation, potentially enhancing future financial performance while trading at a significant discount to estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of All for One Group.

- Our valuation report here indicates All for One Group may be undervalued.

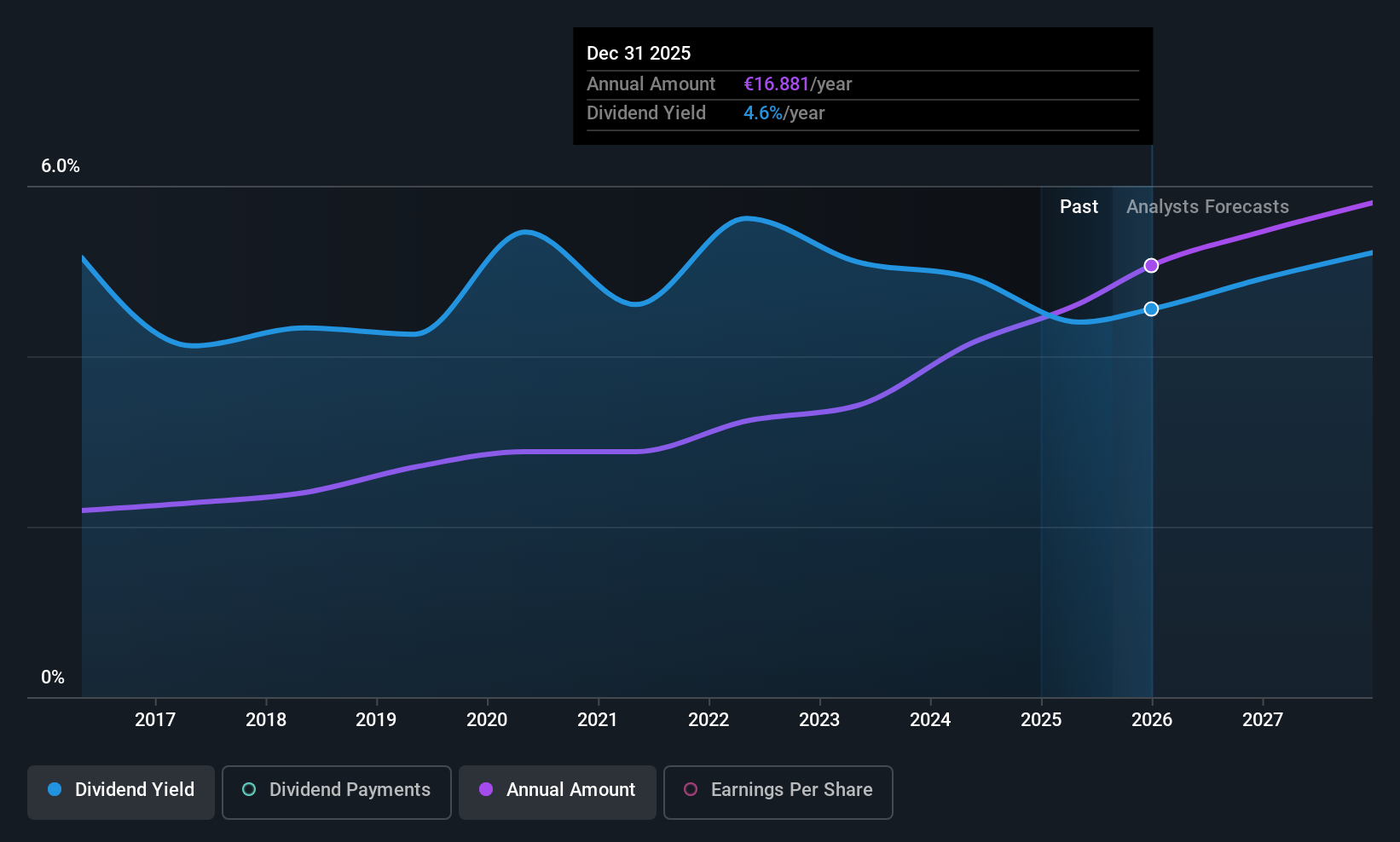

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Allianz SE, with a market cap of €144.07 billion, operates internationally through its subsidiaries offering property-casualty insurance, life/health insurance, and asset management products and services.

Operations: Allianz SE generates revenue from its primary segments, with property-casualty insurance contributing €80.70 billion, life/health insurance accounting for €16.08 billion, and asset management bringing in €8.64 billion.

Dividend Yield: 4.1%

Allianz's dividend is well-supported by a 59% earnings payout ratio and a low 16.8% cash payout ratio, reflecting strong coverage by both earnings and cash flows. The dividend has been stable and growing over the past decade, though its yield of 4.06% is below the top tier in Germany. Recent updates indicate robust financial health, with Allianz raising its full-year operating profit guidance to EUR 17-17.5 billion amidst solid earnings growth.

- Click here to discover the nuances of Allianz with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Allianz's share price might be too optimistic.

Key Takeaways

- Access the full spectrum of 205 Top European Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM primarily in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion