- Germany

- /

- Medical Equipment

- /

- XTRA:AFX

If You Like EPS Growth Then Check Out Carl Zeiss Meditec (ETR:AFX) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Carl Zeiss Meditec (ETR:AFX), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Carl Zeiss Meditec

How Quickly Is Carl Zeiss Meditec Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Carl Zeiss Meditec has managed to grow EPS by 24% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

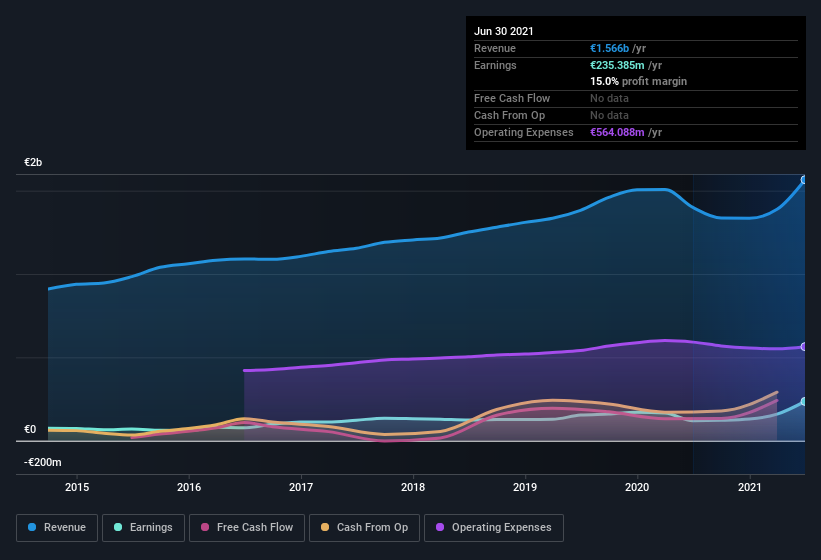

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Carl Zeiss Meditec shareholders can take confidence from the fact that EBIT margins are up from 14% to 22%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Carl Zeiss Meditec?

Are Carl Zeiss Meditec Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like Carl Zeiss Meditec, with market caps over €6.7b, is about €3.8m.

The Carl Zeiss Meditec CEO received €1.9m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Carl Zeiss Meditec Deserve A Spot On Your Watchlist?

You can't deny that Carl Zeiss Meditec has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, it probably has its best days ahead, and the modest CEO pay suggests the company is careful with cash. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Carl Zeiss Meditec shapes up to industry peers, when it comes to ROE.

Although Carl Zeiss Meditec certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Carl Zeiss Meditec, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives