- Germany

- /

- Professional Services

- /

- XTRA:BDT

Top German Dividend Stocks To Consider In September 2024

Reviewed by Simply Wall St

As the German market faces renewed concerns about global economic growth, with the DAX recently declining by 3.20%, investors are increasingly turning their attention to stable income-generating options like dividend stocks. In such uncertain times, a good dividend stock offers not only consistent payouts but also resilience against market volatility, making it an attractive choice for those seeking reliable returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| All for One Group (XTRA:A1OS) | 3.07% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.46% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.31% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.88% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.57% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.35% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.31% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

We'll examine a selection from our screener results.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, with a market cap of €415.57 million, develops, produces, and markets frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe.

Operations: FRoSTA Aktiengesellschaft generates revenue through the development, production, and marketing of frozen food products in several European countries including Germany, Poland, Austria, Italy, and Eastern Europe.

Dividend Yield: 3.3%

FRoSTA offers a stable dividend, having consistently increased payouts over the past decade. With a current yield of 3.31%, it falls below the top tier in Germany but remains attractive due to its reliability and coverage by both earnings (40% payout ratio) and cash flows (19.3% cash payout ratio). The stock trades near fair value, supported by steady earnings growth of 16% annually over five years, with recent half-year revenue at €319.81 million and net income at €15.5 million.

- Take a closer look at FRoSTA's potential here in our dividend report.

- According our valuation report, there's an indication that FRoSTA's share price might be on the cheaper side.

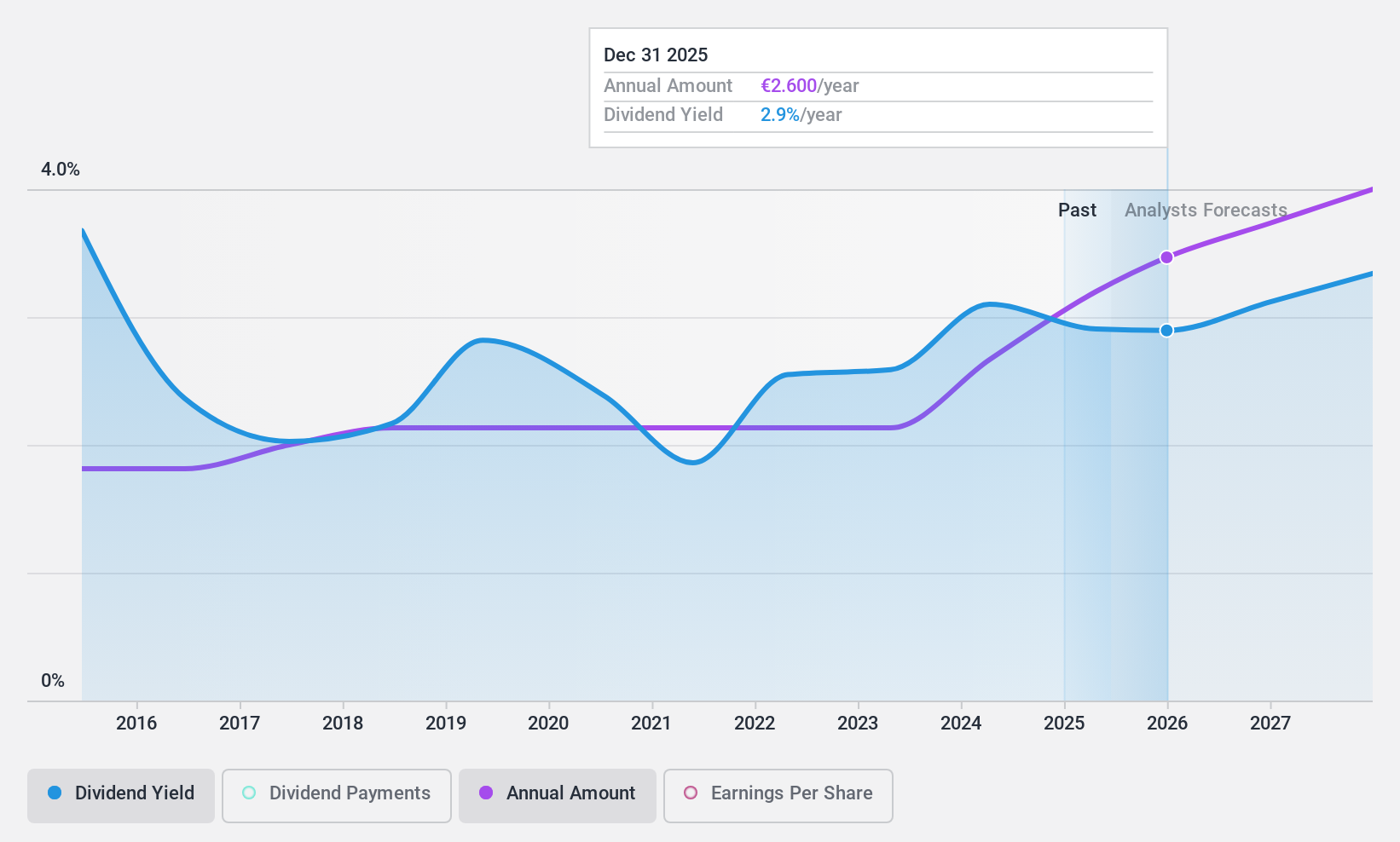

Bertrandt (XTRA:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bertrandt Aktiengesellschaft, with a market cap of €209.19 million, provides engineering services.

Operations: Bertrandt Aktiengesellschaft generates revenue through Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

Dividend Yield: 5.8%

Bertrandt's dividend yield of 5.8% places it in the top 25% of German dividend payers, although its payout has been volatile over the past decade. Despite a reasonable payout ratio (71.1%) and strong cash flow coverage (26.8%), recent earnings results show a net loss for Q3 2024 at €6.95 million compared to a net income of €4.71 million last year, raising concerns about future dividend stability and sustainability despite trading below fair value by 50.8%.

- Unlock comprehensive insights into our analysis of Bertrandt stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bertrandt shares in the market.

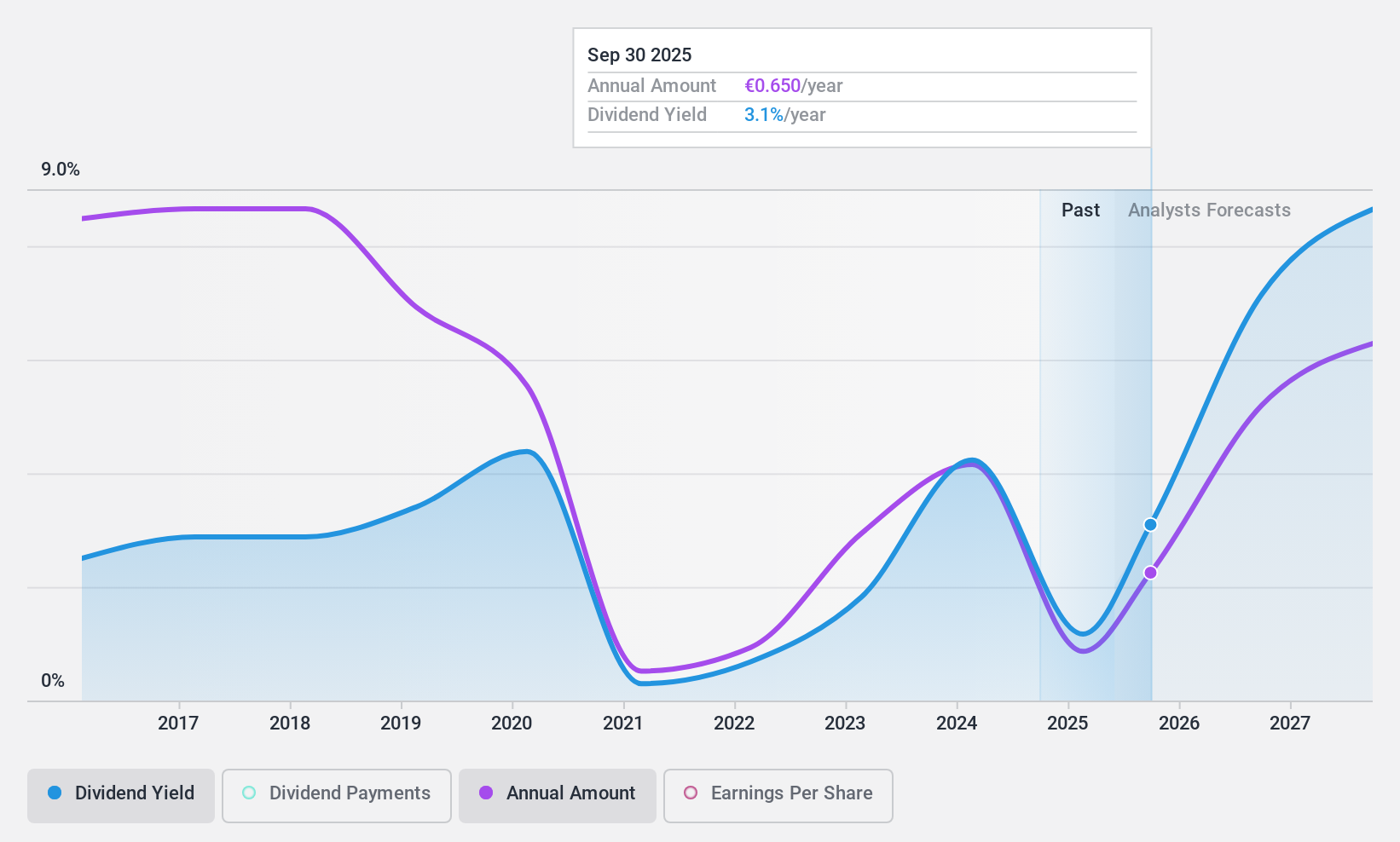

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in developing vehicles, derivatives, modules, and production facilities for the global automotive and commercial vehicle industries, with a market cap of €246.50 million.

Operations: EDAG Engineering Group AG's revenue segments include Vehicle Engineering (€485.66 million), Production Solutions (€276.56 million), and Electrics/Electronics (€110.02 million).

Dividend Yield: 5.6%

EDAG Engineering Group's dividend yield of 5.58% ranks in the top 25% of German payers, but its payout has been volatile over eight years. Despite a low cash payout ratio (28.5%) and reasonable earnings coverage (54.1%), recent earnings show a decline, with Q2 net income at €3.46 million compared to €5.63 million last year, raising concerns about dividend sustainability and stability despite an attractive price-to-earnings ratio of 9.7x against the market's 16.4x.

- Delve into the full analysis dividend report here for a deeper understanding of EDAG Engineering Group.

- Our valuation report unveils the possibility EDAG Engineering Group's shares may be trading at a premium.

Next Steps

- Discover the full array of 32 Top German Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bertrandt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BDT

Undervalued with adequate balance sheet.