In the midst of a volatile global market, small-cap stocks have faced significant challenges, with the Russell 2000 Index dipping into correction territory and inflation concerns persisting. Despite these hurdles, investors remain on the lookout for promising opportunities within this segment, as resilient labor markets and economic indicators offer glimmers of potential stability. Identifying a good stock in such an environment often involves assessing its underlying fundamentals and growth prospects while considering how it might navigate current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, focuses on developing, producing, and marketing frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €446.23 million.

Operations: FRoSTA's revenue primarily stems from its operations in Germany, Poland, Austria, Italy, and Eastern Europe. The company has a market capitalization of €446.23 million.

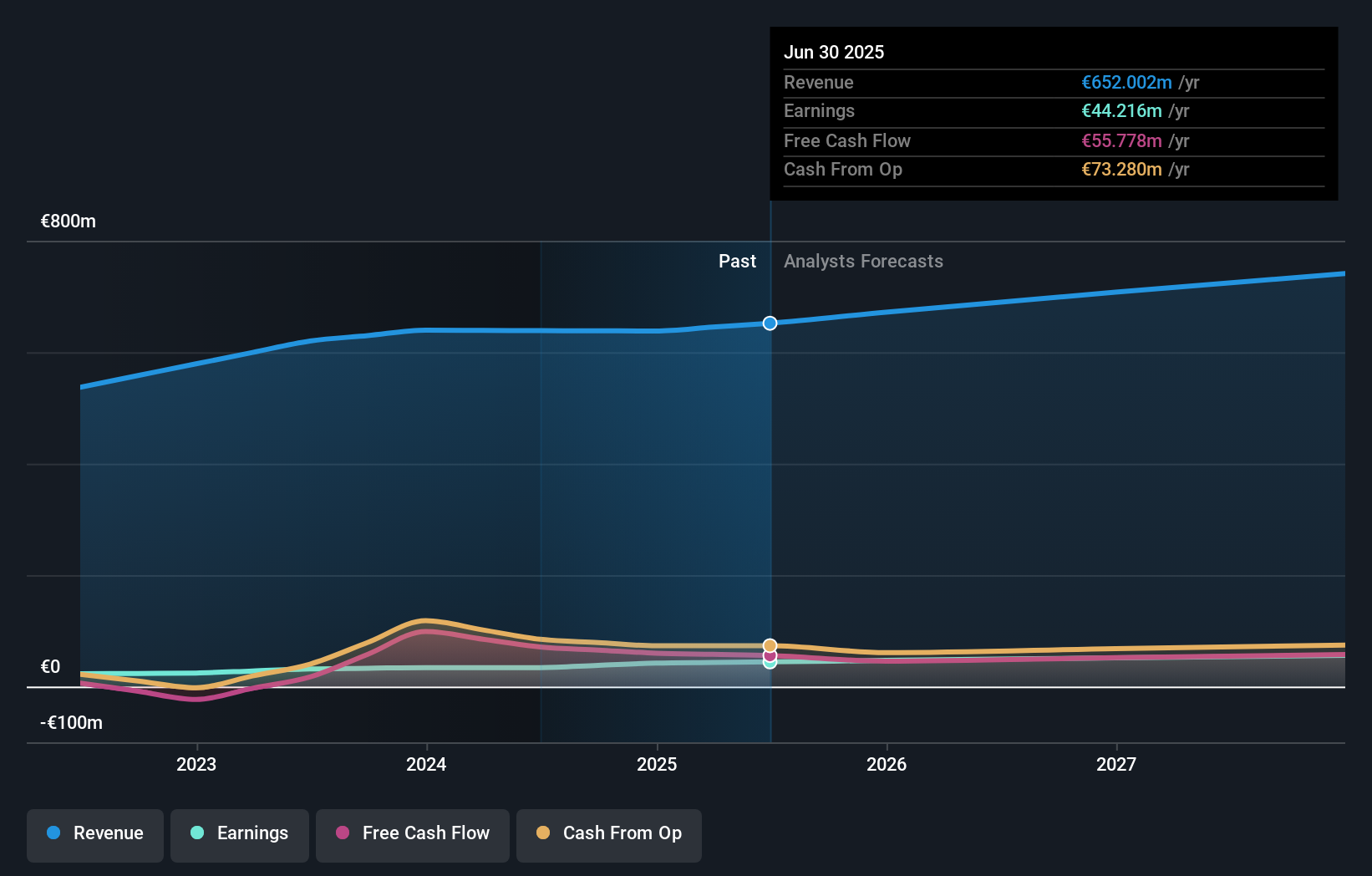

FRoSTA, a smaller player in the food industry, has demonstrated robust financial health with earnings growing 16% annually over the past five years. The company is trading at 95.7% below its estimated fair value, suggesting potential undervaluation. Over this period, FRoSTA's debt to equity ratio improved significantly from 31.6% to 8.2%, indicating effective debt management. Despite not outperforming the broader food industry's recent growth of 48.7%, FRoSTA maintains high-quality earnings and sufficient interest coverage, positioning it as a resilient contender in its sector with room for future appreciation given current valuations.

- Click here to discover the nuances of FRoSTA with our detailed analytical health report.

Gain insights into FRoSTA's historical performance by reviewing our past performance report.

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is a company that offers IT and digital communication consultancy services to both public and private sector clients across Norway, Sweden, and internationally, with a market cap of NOK8.04 billion.

Operations: Bouvet generates revenue primarily from IT consultancy services, amounting to NOK3.87 billion. The company's net profit margin stands at 8.5%.

Bouvet, a nimble player in the IT sector, has shown impressive financial health with no debt over the past five years. The company reported a robust earnings growth of 13.6% last year, outpacing the industry average of 0.1%, and forecasts suggest an annual growth rate of 7.66%. Bouvet's high-quality earnings are complemented by positive free cash flow, which reached NOK 641 million recently. In recent developments, Bouvet announced increased dividends and strong quarterly results with sales climbing to NOK 878 million from NOK 778 million year-on-year, reflecting its solid performance trajectory in the market.

- Navigate through the intricacies of Bouvet with our comprehensive health report here.

Explore historical data to track Bouvet's performance over time in our Past section.

Hualan Group (SZSE:301027)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hualan Group Co., Ltd. offers integrated services for urban and rural construction projects in China, with a market cap of CN¥2.32 billion.

Operations: Hualan Group generates revenue primarily through its integrated services for construction projects in China. The company's financial performance is reflected in its market capitalization of CN¥2.32 billion, indicating the scale of its operations within the industry.

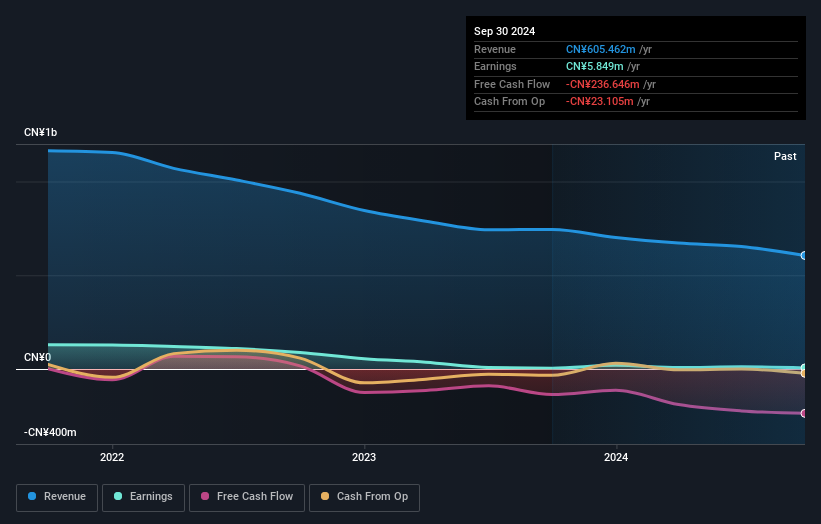

Hualan Group, a lesser-known player in its sector, has experienced notable financial shifts recently. Over the past year, earnings surged by 26.6%, outpacing the construction industry's -3.9% growth rate, yet over five years, earnings have decreased by 47.7% annually. The company reduced its debt-to-equity ratio from 36.5% to 31.1%, indicating improved financial management despite not being free cash flow positive currently. Recent earnings for nine months ending September 2024 showed sales of CNY 307 million versus CNY 403 million last year with a net loss of CNY 23 million compared to CNY 10 million previously, hinting at ongoing challenges in revenue generation and profitability amidst industry competition and economic conditions.

- Click here and access our complete health analysis report to understand the dynamics of Hualan Group.

Gain insights into Hualan Group's past trends and performance with our Past report.

Make It Happen

- Reveal the 4562 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives