As the German DAX index recently experienced a slight decline of 0.99%, reflecting broader European market trends amid cautious monetary policy signals from the ECB, investors are increasingly seeking stable income sources in uncertain times. Dividend stocks can offer a reliable stream of income, making them an attractive option for those looking to mitigate volatility while capitalizing on potential yield opportunities.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Deutsche Post (XTRA:DHL) | 4.90% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.90% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

| Mensch und Maschine Software (XTRA:MUM) | 3.07% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.99% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.17% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.70% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.20% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, with a market cap of €425.79 million, develops, produces, and markets frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe.

Operations: FRoSTA Aktiengesellschaft generates revenue from its operations in the frozen food sector across Germany, Poland, Austria, Italy, and Eastern Europe.

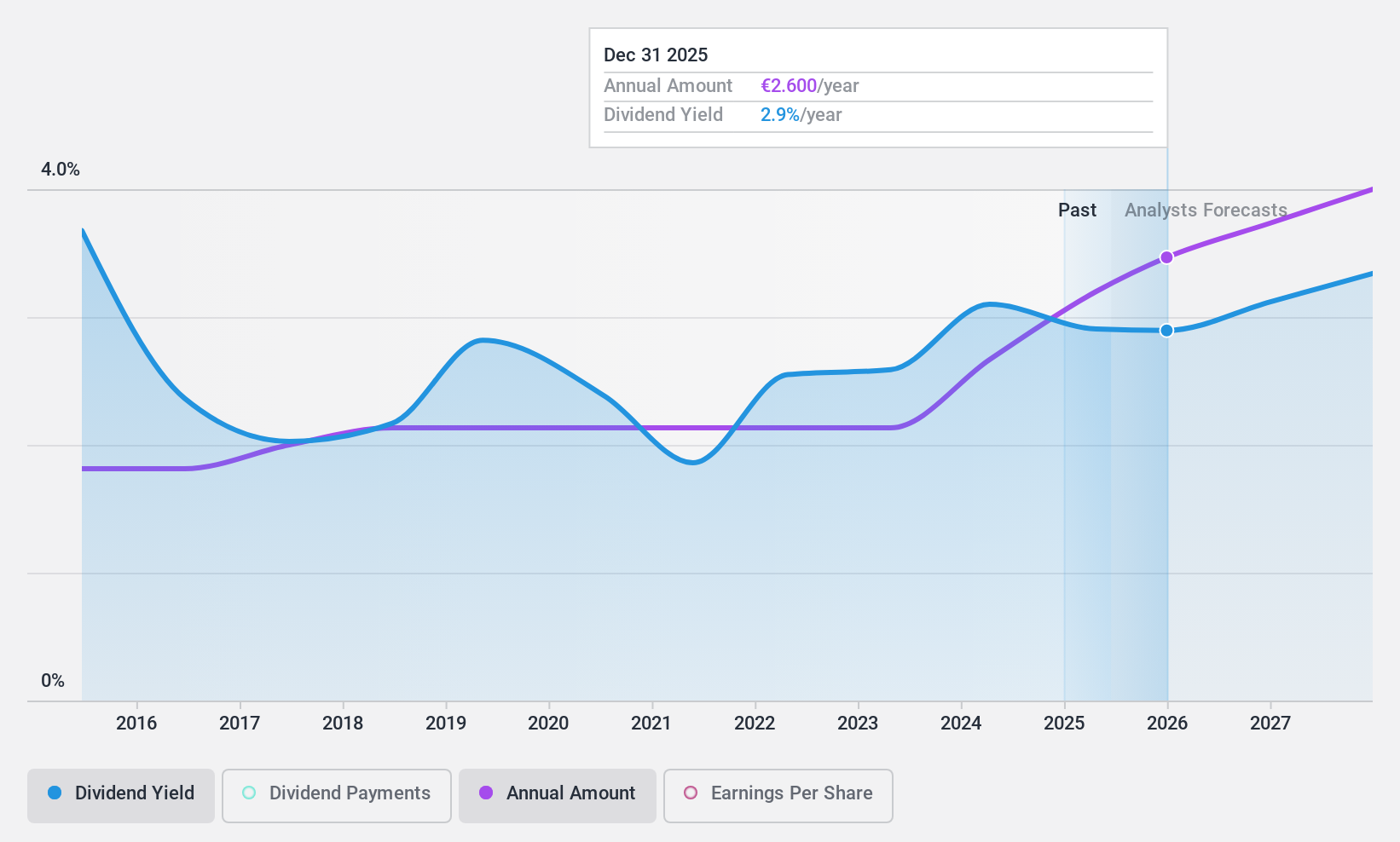

Dividend Yield: 3.2%

FRoSTA offers a dividend yield of 3.2%, which is below the top quartile of German dividend payers. However, its dividends are well-covered by earnings with a payout ratio of 40% and cash flow with a cash payout ratio of 19.3%. The company has maintained stable and reliable dividend payments over the past decade, with consistent growth in dividends during this period, supported by strong earnings growth averaging 16% annually over five years.

- Click here to discover the nuances of FRoSTA with our detailed analytical dividend report.

- The valuation report we've compiled suggests that FRoSTA's current price could be quite moderate.

Bertrandt (XTRA:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bertrandt Aktiengesellschaft offers engineering services and has a market cap of €210.20 million.

Operations: Bertrandt Aktiengesellschaft generates revenue through its segments of Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

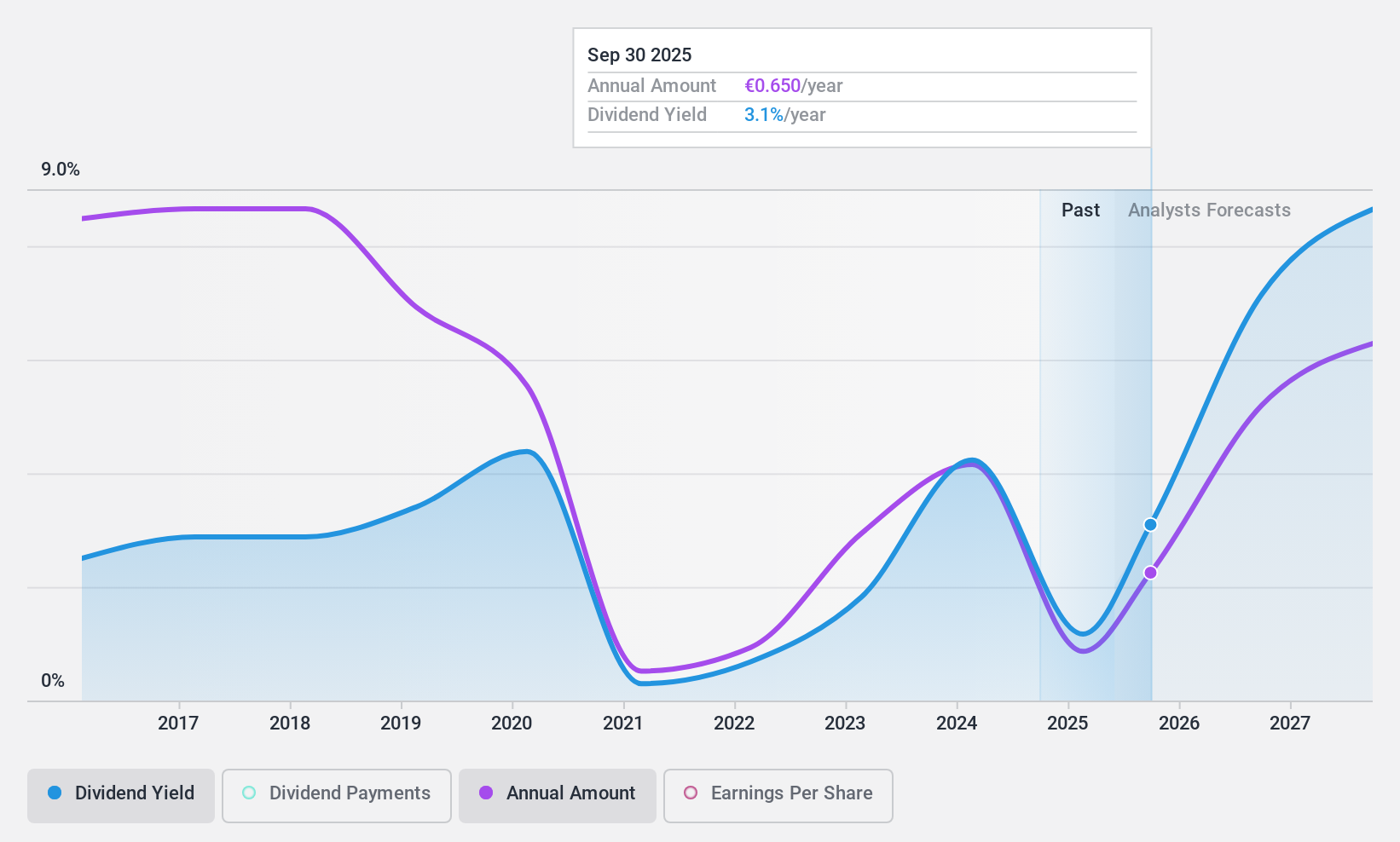

Dividend Yield: 5.8%

Bertrandt's dividend yield of 5.77% ranks in the top 25% of German dividend payers, supported by a payout ratio of 71.1%, indicating dividends are covered by earnings. The cash payout ratio is favorable at 26.8%, suggesting strong cash flow coverage. However, its dividend history has been volatile and unreliable over the past decade, with payments declining more than once by over 20%. Recent financial performance shows challenges, including a net loss in Q3 despite increased sales.

- Navigate through the intricacies of Bertrandt with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Bertrandt is priced lower than what may be justified by its financials.

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in the development of vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle industries globally, with a market cap of €201 million.

Operations: EDAG Engineering Group AG's revenue is primarily derived from Vehicle Engineering (€485.66 million), Production Solutions (€276.56 million), and Electrics/Electronics (€110.02 million).

Dividend Yield: 6.8%

EDAG Engineering Group's dividend yield of 6.84% places it among the top 25% of German dividend payers, with a sustainable payout ratio of 54.1%. The cash payout ratio is low at 28.5%, indicating solid coverage by cash flows. However, its dividend track record over the past nine years has been unreliable and volatile, with payments decreasing significantly at times. Recent financial results show stable sales but declining net income and earnings per share compared to last year.

- Dive into the specifics of EDAG Engineering Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that EDAG Engineering Group is priced higher than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 32 companies within our Top German Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Flawless balance sheet established dividend payer.