- Germany

- /

- Industrials

- /

- XTRA:MBB

3 Stocks Estimated To Be Trading Below Their Intrinsic Values In January 2025

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and European growth estimates revised lower, investors are keenly observing the performance of major indices like the Nasdaq Composite and S&P 500, which have shown resilience amidst these fluctuations. In this environment, identifying stocks that are potentially trading below their intrinsic values can be an appealing strategy for those looking to capitalize on market inefficiencies; such stocks may offer long-term value if they possess strong fundamentals despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.83 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.77 | €5.51 | 49.7% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7645.06 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.77 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.87 | 49.8% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

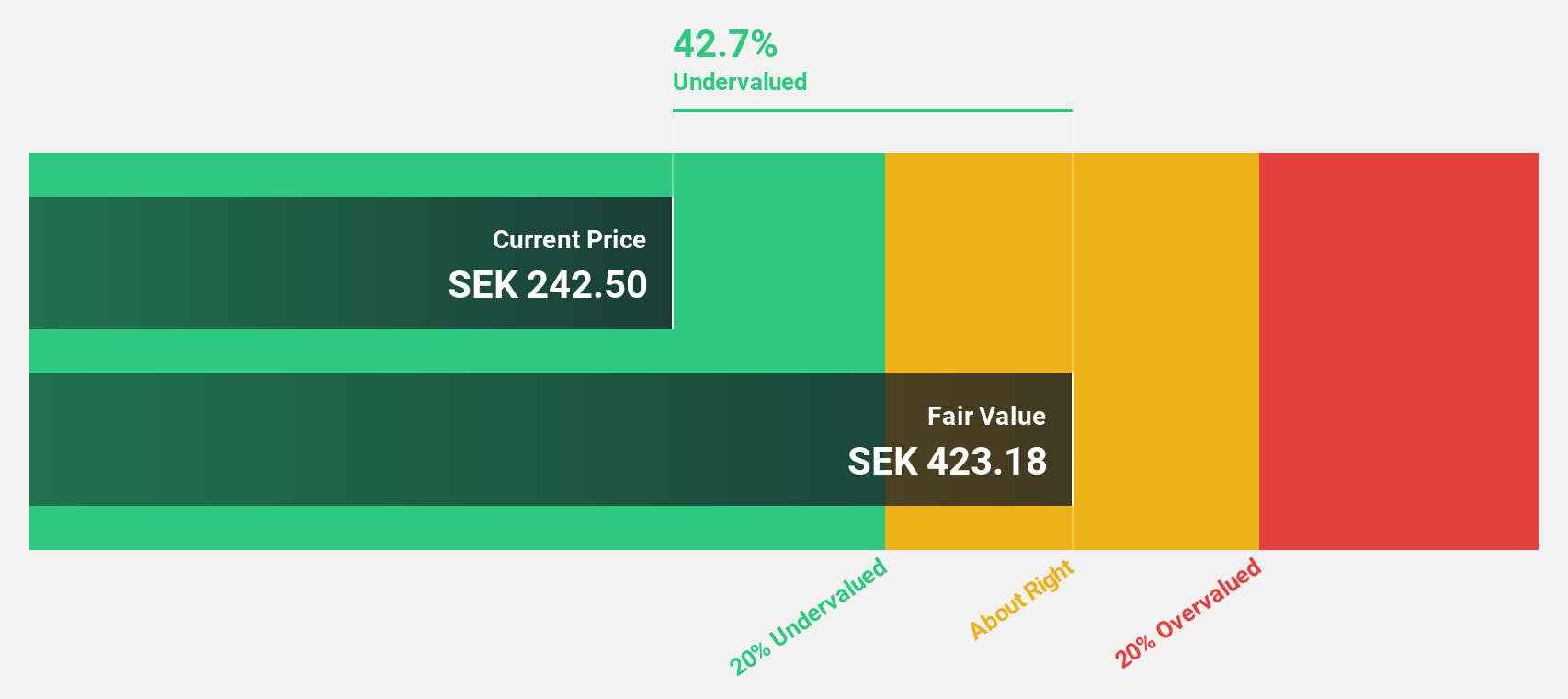

CTT Systems (OM:CTT)

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.52 billion.

Operations: The company generates SEK301.40 million in revenue from its Aerospace & Defense segment, focusing on humidity control systems for aircraft.

Estimated Discount To Fair Value: 18.7%

CTT Systems is trading at SEK281, below its estimated fair value of SEK345.42, indicating potential undervaluation. Despite a recent decline in quarterly sales and earnings, the company forecasts significant annual earnings growth of 33.3%, surpassing the Swedish market's 14.6%. Revenue is expected to grow at 24.2% annually, outpacing market averages. However, recent guidance adjustments suggest caution as net sales projections for late 2024 have been lowered significantly from previous estimates.

- In light of our recent growth report, it seems possible that CTT Systems' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of CTT Systems stock in this financial health report.

Sansan (TSE:4443)

Overview: Sansan, Inc. is a Japanese company that plans, develops, and sells cloud-based solutions with a market cap of ¥289.30 billion.

Operations: The company's revenue is primarily generated from its Sansan/Bill One Business, which accounts for ¥31.79 billion, and the Eight Business, contributing ¥3.80 billion.

Estimated Discount To Fair Value: 33.5%

Sansan is trading at ¥2295, below its estimated fair value of ¥3452.38, indicating it may be undervalued based on cash flows. The company has experienced significant earnings growth of 163.2% over the past year and is expected to continue growing earnings at 40% annually, outpacing the Japanese market's average growth rate. Despite this potential, Sansan's share price has been highly volatile recently and revenue growth projections are moderate at 16.3% per year.

- Our expertly prepared growth report on Sansan implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Sansan here with our thorough financial health report.

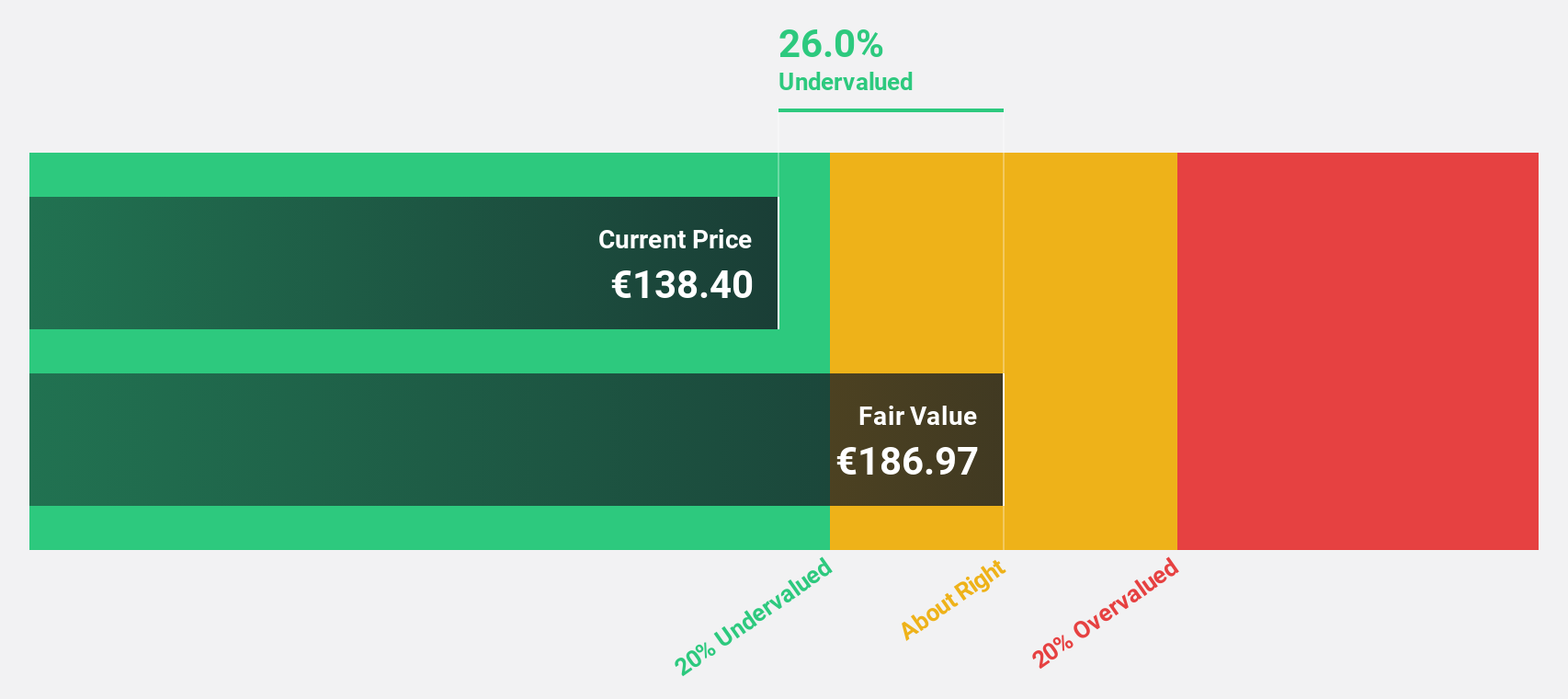

MBB (XTRA:MBB)

Overview: MBB SE, with a market cap of €543.07 million, focuses on acquiring and managing medium-sized companies in the technology and engineering sectors both in Germany and internationally.

Operations: The company generates revenue from three main segments: Consumer Goods (€95.32 million), Technical Applications (€391.22 million), and Service & Infrastructure (€542.03 million).

Estimated Discount To Fair Value: 30.3%

MBB is trading at €99.9, considerably below its estimated fair value of €143.23, highlighting potential undervaluation based on cash flows. The company's recent earnings surged by a very large margin over the past year and are projected to grow significantly at 20.5% annually, surpassing the German market's growth rate. Despite these positive indicators, MBB's return on equity remains forecasted to be modest in three years at 10.8%, with revenue growth expected to be moderate at 6.5% annually.

- The analysis detailed in our MBB growth report hints at robust future financial performance.

- Get an in-depth perspective on MBB's balance sheet by reading our health report here.

Seize The Opportunity

- Click through to start exploring the rest of the 875 Undervalued Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBB

MBB

Engages in the acquisition and management of medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)