- France

- /

- Semiconductors

- /

- ENXTPA:MEMS

European Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively stable amid ongoing trade discussions between the U.S. and Europe, investors are keenly observing economic developments across the continent. In such a market landscape, penny stocks—though an outdated term—continue to attract attention due to their potential for growth and value in smaller or newer companies. By focusing on those with strong financials, investors can uncover opportunities that might offer both stability and long-term potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €0.91 | €19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.47 | €45.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.496 | RON16.77M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.86 | €60.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.265 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.13 | €292.01M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.05M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Patria Bank (BVB:PBK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Patria Bank SA is a credit institution offering banking and financial services to individuals, small and medium enterprises, agribusinesses, and corporate customers in Romania with a market cap of RON331.16 million.

Operations: Patria Bank SA does not report specific revenue segments.

Market Cap: RON331.16M

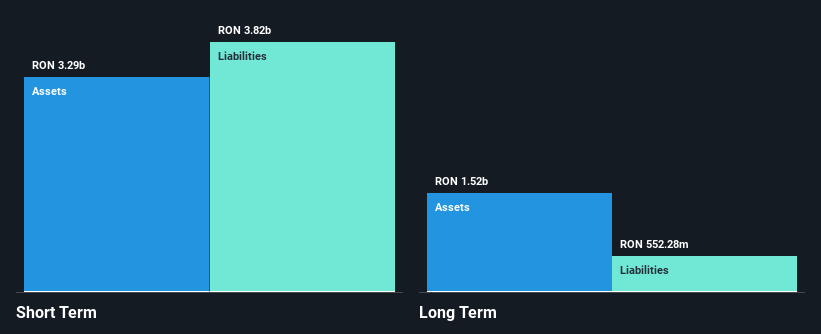

Patria Bank has demonstrated stable financial growth, with net interest income rising to RON 45.18 million and net income reaching RON 12.68 million in Q1 2025, reflecting a consistent upward trend compared to the previous year. The bank benefits from primarily low-risk funding through customer deposits and maintains an appropriate loans-to-assets ratio of 53%. Despite its high level of bad loans at 5.1%, Patria Bank's profit margins have improved, now at 18.4%. With a price-to-earnings ratio of 7.7x below the market average, it presents potential value for investors seeking exposure in this segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Patria Bank.

- Assess Patria Bank's future earnings estimates with our detailed growth reports.

MEMSCAP (ENXTPA:MEMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MEMSCAP, S.A. offers micro-electro-mechanical systems (MEMS) based solutions across aerospace and defense, optical communications, medical, and biomedical markets globally, with a market cap of €35.28 million.

Operations: The company's revenue is primarily derived from its Aerospace segment at €8.10 million, followed by Medical at €2.49 million, and Optical Communications at €1.27 million.

Market Cap: €35.28M

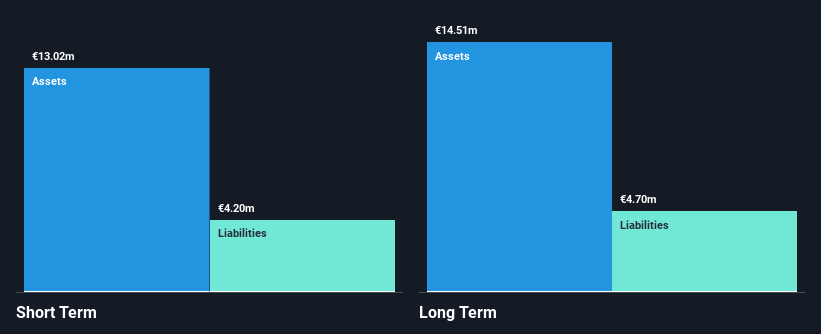

MEMSCAP, S.A. has faced challenges with a revenue decline to €3.11 million in Q1 2025 from €3.83 million the previous year and net income dropping to €0.292 million from €0.608 million. The company's debt is not well covered by operating cash flow, but interest payments are comfortably managed with EBIT coverage of 915 times. Despite negative earnings growth over the past year, MEMSCAP maintains high-quality earnings and a satisfactory net debt-to-equity ratio of 5.9%. Short-term assets exceed liabilities significantly, and earnings are forecasted to grow by over 63% annually, indicating potential future upside despite current setbacks.

- Click to explore a detailed breakdown of our findings in MEMSCAP's financial health report.

- Gain insights into MEMSCAP's future direction by reviewing our growth report.

H2APEX Group (XTRA:H2A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: H2APEX Group SCA develops, manufactures, and operates green hydrogen plants aimed at de-carbonizing industry and infrastructure in Germany and Luxembourg, with a market cap of €67.99 million.

Operations: H2APEX Group SCA has not reported any specific revenue segments.

Market Cap: €67.99M

H2APEX Group SCA, operating in the green hydrogen sector, is navigating financial challenges with a net loss of €8.13 million in Q1 2025 despite generating €2.06 million in sales. The company anticipates annual revenue between €6 million and €8 million from its hydrogen operations and related services this year, although it remains unprofitable with high debt levels—reflected by a net debt-to-equity ratio of 118.7%. Short-term assets cover liabilities, yet long-term obligations remain unmet. Despite these hurdles, H2APEX aims for revenue growth amid volatility and has recently raised additional capital to extend its cash runway.

- Dive into the specifics of H2APEX Group here with our thorough balance sheet health report.

- Evaluate H2APEX Group's prospects by accessing our earnings growth report.

Where To Now?

- Click this link to deep-dive into the 330 companies within our European Penny Stocks screener.

- Curious About Other Options? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEMS

MEMSCAP

Provides micro-electro-mechanical systems (MEMS) based solutions for aerospace and defense, optical communications, medical, and biomedical markets worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives