- Germany

- /

- Capital Markets

- /

- XTRA:DBAN

Top Growth Companies With Strong Insider Ownership In December 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of recent Federal Reserve rate cuts and looming political uncertainties, investors are keenly observing the impact on major indices like the S&P 500, which has experienced a notable streak of more decliners than gainers. Amidst this cautious sentiment, identifying growth companies with substantial insider ownership can offer insights into potential resilience and alignment between management and shareholder interests. In such an environment, stocks with strong insider ownership may provide a level of confidence as they often indicate that those who know the company best have significant skin in the game.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Dohome (SET:DOHOME)

Simply Wall St Growth Rating: ★★★★☆☆

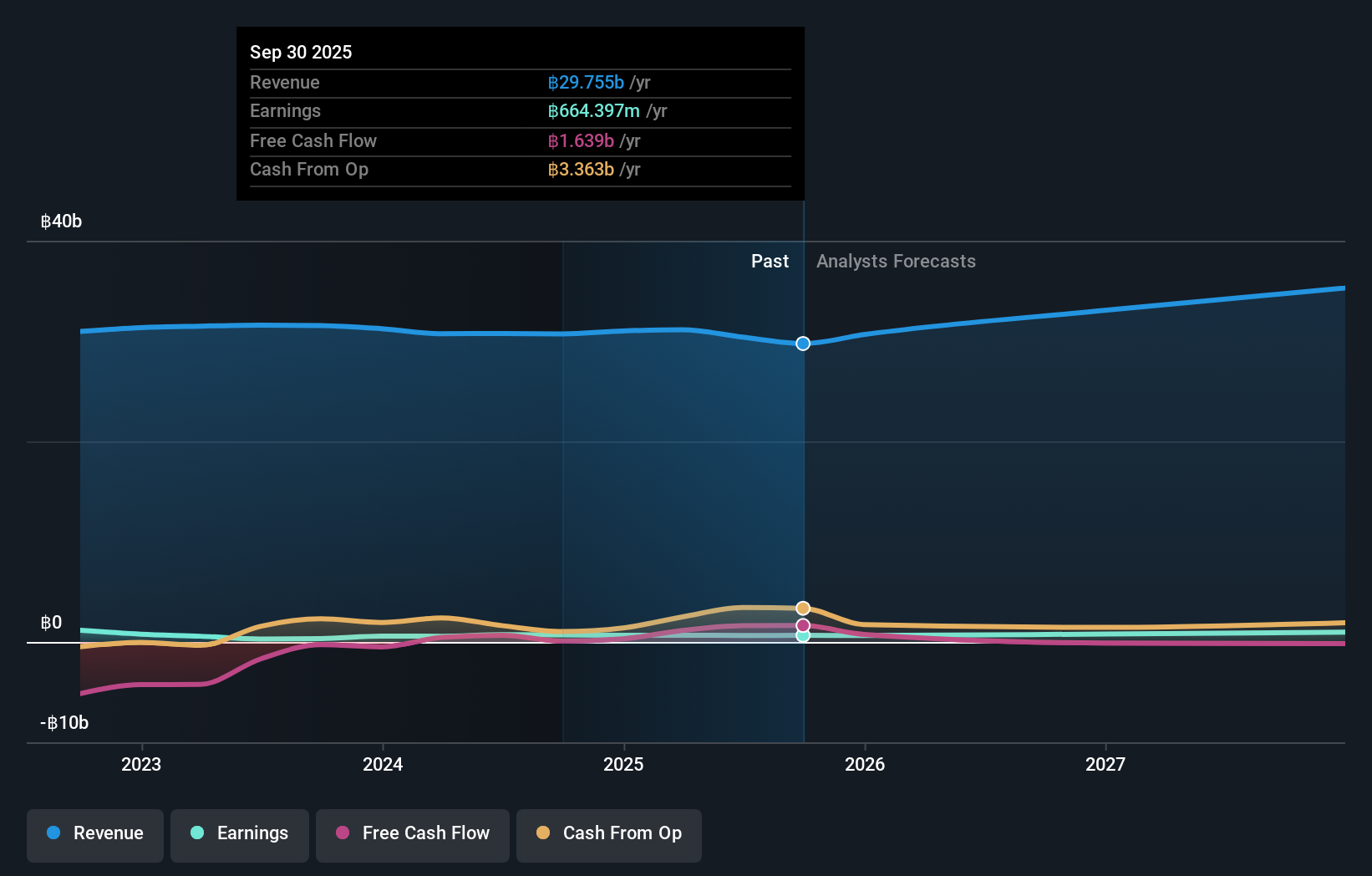

Overview: Dohome Public Company Limited, with a market cap of THB29.39 billion, operates in Thailand as a retailer and wholesaler of construction materials, office equipment, and household products.

Operations: The company's revenue from retail and wholesale activities in construction materials, office equipment, and household products amounts to THB30.71 billion.

Insider Ownership: 35%

Dohome's recent earnings report shows mixed results with a slight decline in quarterly net income but significant growth over nine months. Despite this, the company is expected to experience substantial annual profit growth of 24.4%, outpacing the Thai market average. Revenue growth is projected at 9.7% annually, surpassing market expectations but not reaching high-growth thresholds. Insider ownership remains stable without recent substantial insider buying or selling activity, indicating confidence in its long-term prospects amidst financial challenges like interest coverage issues.

- Get an in-depth perspective on Dohome's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Dohome's current price could be inflated.

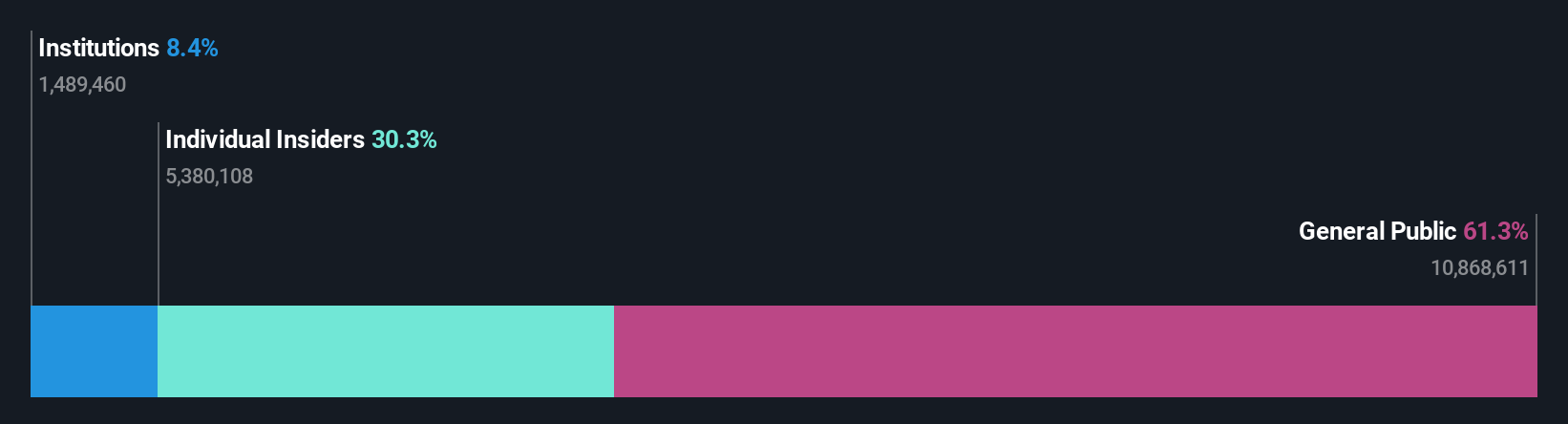

Sri Trang Agro-Industry (SET:STA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sri Trang Agro-Industry Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of natural rubber products across Thailand, China, the United States, Singapore, Japan, and other international markets; it has a market cap of approximately THB27.03 billion.

Operations: The company's revenue primarily comes from the Natural Rubbers segment, generating THB86.85 billion, followed by Gloves with THB23.30 billion.

Insider Ownership: 21.6%

Sri Trang Agro-Industry's earnings are forecast to grow significantly at 54.2% annually, outpacing the Thai market. Despite lower profit margins and large one-off items affecting earnings quality, recent results show a turnaround with net income of THB 517.29 million for Q3 2024, compared to a loss last year. The company trades below estimated fair value but faces challenges like inadequate interest coverage and unsustainable dividends. No substantial insider trading activity was reported recently.

- Unlock comprehensive insights into our analysis of Sri Trang Agro-Industry stock in this growth report.

- Our valuation report here indicates Sri Trang Agro-Industry may be overvalued.

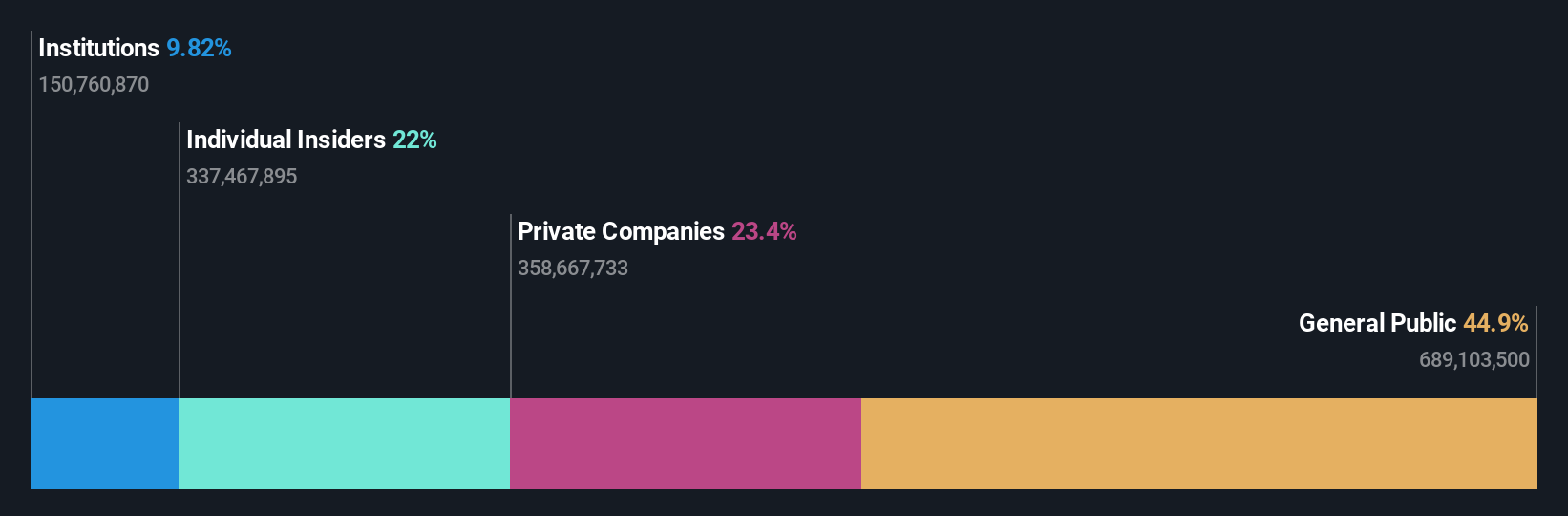

Deutsche Beteiligungs (XTRA:DBAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm that specializes in direct and fund of fund investments, with a market cap of €411.64 million.

Operations: The company's revenue is primarily generated from Private Equity Investments (€61.14 million) and Fund Investment Services (€48.40 million).

Insider Ownership: 39.8%

Deutsche Beteiligungs AG, despite a decline in revenue to €108.68 million and net income to €47.51 million for the year ending September 30, 2024, is trading at a substantial discount to its estimated fair value and peers. Its earnings are forecasted to grow significantly at 35.32% annually, outpacing the German market's growth expectations. However, profit margins have decreased from last year and dividends remain unsustainable with current free cash flows. No significant insider trading activity has been observed recently.

- Click to explore a detailed breakdown of our findings in Deutsche Beteiligungs' earnings growth report.

- According our valuation report, there's an indication that Deutsche Beteiligungs' share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 1513 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBAN

Deutsche Beteiligungs

A private equity and venture capital firm specializing in direct and fund of fund investments.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives