- Germany

- /

- Diversified Financial

- /

- XTRA:CHG

Should CHAPTERS Group’s Surging Sales and Deeper Losses Reshape Investor Views on XTRA:CHG?

Reviewed by Sasha Jovanovic

- CHAPTERS Group AG recently reported its earnings results for the half year ended June 30, 2025, posting sales of €70.96 million compared to €50.02 million in the prior year period and a net loss of €16.08 million versus €4.48 million previously.

- This earnings update highlights a substantial increase in sales alongside a much larger net loss, presenting a complex financial picture for the period.

- We’ll explore how the company’s simultaneous sales growth and increased losses reshape its investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is CHAPTERS Group's Investment Narrative?

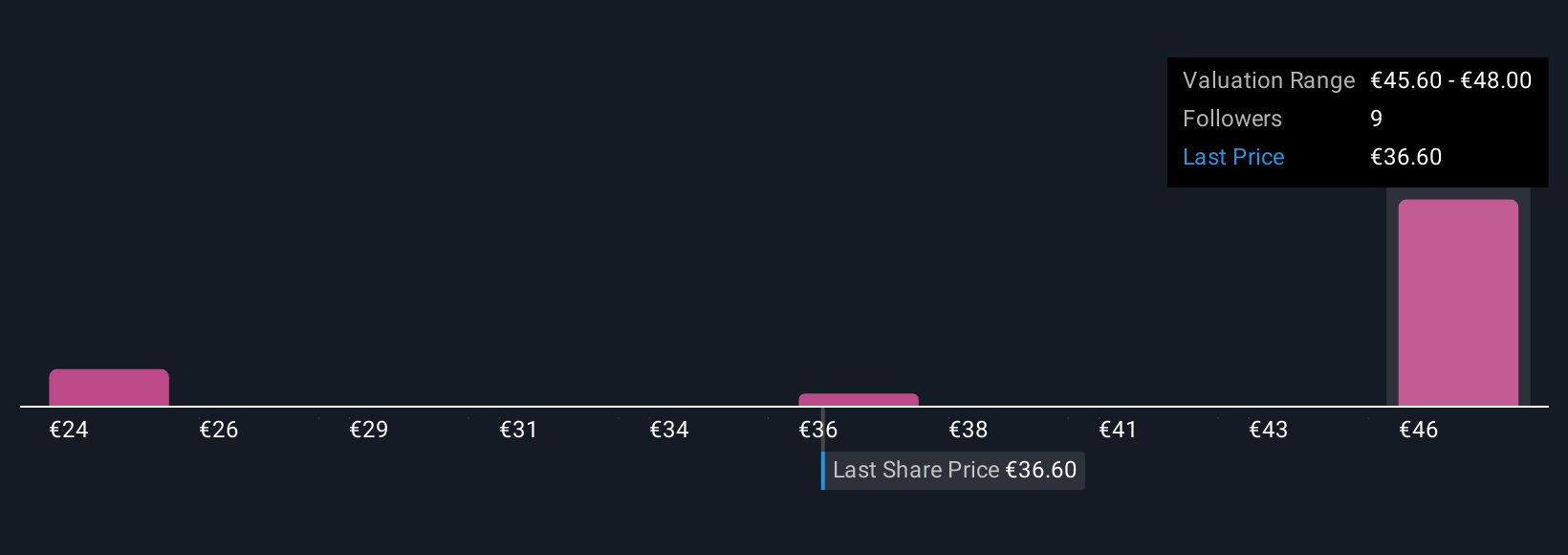

For shareholders, the big picture with CHAPTERS Group is all about belief in a business scaling fast while staying resilient against rising losses. The most recent earnings update, with sales reaching €70.96 million but net losses widening to €16.08 million, lands just as the company pivots to organic revenue growth and pursues an M&A-driven expansion using newly secured debt. Prior to this update, key short-term catalysts included organic growth targets and successful M&A execution, underpinned by the recent €32 million debt placement and a shifting executive team. However, the sharper-than-expected jump in losses challenges confidence in the balance between growth and financial discipline; this may now put more market focus on near-term profitability milestones and debt-servicing risks. These results are likely to make the risk profile more visible, prompting investors to scrutinize capital efficiency and cost control as the company seeks to justify its ambitious growth forecasts. Recent price action suggests the market reaction has been relatively muted so far, but scrutiny on losses could now shift sentiment and risk assessment short term.

But while revenue is climbing, the pressure from rising losses is a risk investors should not overlook.

Exploring Other Perspectives

Explore 4 other fair value estimates on CHAPTERS Group - why the stock might be worth as much as 26% more than the current price!

Build Your Own CHAPTERS Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CHAPTERS Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free CHAPTERS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CHAPTERS Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CHG

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion