Does BOSS's Apple Vision Pro Partnership Hint at a New Digital Growth Strategy for Hugo Boss (XTRA:BOSS)?

Reviewed by Sasha Jovanovic

- EPAM Systems announced it has partnered with BOSS to launch an immersive motorsport fan experience, powered by Apple Vision Pro, which debuted in select BOSS stores across major global cities on October 2, 2025, ahead of the Formula 1 Singapore Grand Prix.

- This initiative highlights BOSS's push into experiential retail and digital innovation, directly engaging motorsport enthusiasts in key international markets through advanced spatial technology.

- We'll examine how integrating Apple Vision Pro-powered immersive retail experiences could influence Hugo Boss's investment narrative and digital growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hugo Boss Investment Narrative Recap

To be a Hugo Boss shareholder, you have to believe that digital innovation, premium in-store experiences and ongoing cost discipline can reinvigorate growth, even amid muted consumer sentiment and ongoing pressure on brick-and-mortar traffic. The launch of Apple Vision Pro-powered motorsport fan zones is a visible signal of this digital push, but it is unlikely to materially alter the company's near-term catalyst: driving higher profitability through direct-to-consumer channels and omnichannel conversion in key global markets. The biggest current risk remains weak store traffic and consumer demand in the US and China, so while experiential retail builds brand engagement, it does not immediately solve for those core revenue pressures.

One of the most recent relevant announcements is Hugo Boss's latest half-year earnings, released in August, which detailed a modest drop in sales but an increase in net income and EPS. These results, alongside new experiences like the BOSS-EPAM motorsport collaboration, tie directly into the company's broader digital transformation and higher-margin sales ambitions, both key to supporting long-term EBIT improvement.

By contrast, investors should also be aware of the importance of understanding whether new immersive in-store initiatives can meaningfully offset persistent soft traffic in critical markets like the US and China...

Read the full narrative on Hugo Boss (it's free!)

Hugo Boss' narrative projects €4.6 billion revenue and €287.5 million earnings by 2028. This requires 2.8% yearly revenue growth and a €67 million earnings increase from €220.5 million.

Uncover how Hugo Boss' forecasts yield a €43.73 fair value, a 6% upside to its current price.

Exploring Other Perspectives

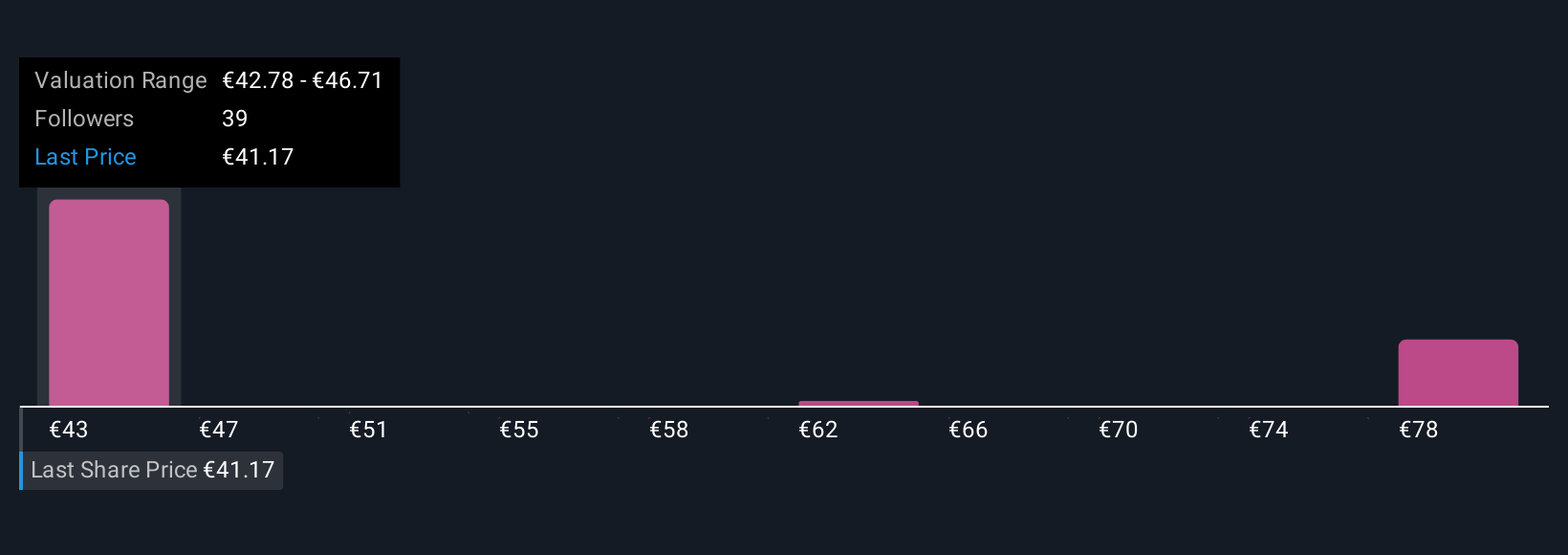

Fair value estimates from the Simply Wall St Community span €42.78 to €82.08 across five contributors. While many see opportunity for digital and omnichannel growth, your view may depend on how you assess the structural headwinds facing physical retail worldwide.

Explore 5 other fair value estimates on Hugo Boss - why the stock might be worth just €42.78!

Build Your Own Hugo Boss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hugo Boss research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hugo Boss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hugo Boss' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hugo Boss might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BOSS

Hugo Boss

Provides apparels, shoes, and accessories for men and women worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives