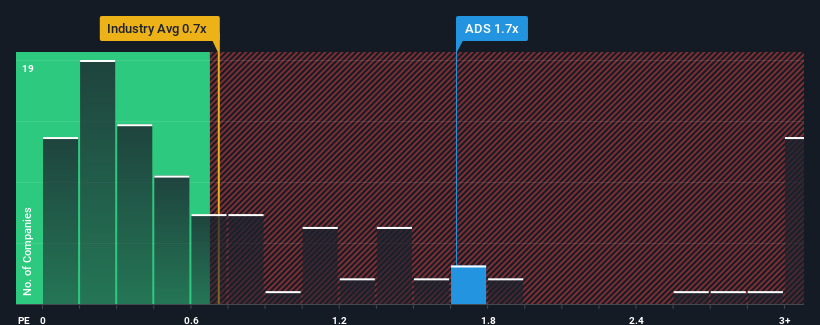

adidas AG's (ETR:ADS) price-to-sales (or "P/S") ratio of 1.7x may not look like an appealing investment opportunity when you consider close to half the companies in the Luxury industry in Germany have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for adidas

What Does adidas' Recent Performance Look Like?

There hasn't been much to differentiate adidas' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think adidas' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For adidas?

The only time you'd be truly comfortable seeing a P/S as high as adidas' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen a 12% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.7% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 8.4% per annum growth forecast for the broader industry.

With this information, we find it interesting that adidas is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From adidas' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting adidas' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for adidas with six simple checks on some of these key factors.

If you're unsure about the strength of adidas' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade adidas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives