- Germany

- /

- Electrical

- /

- DB:3CA

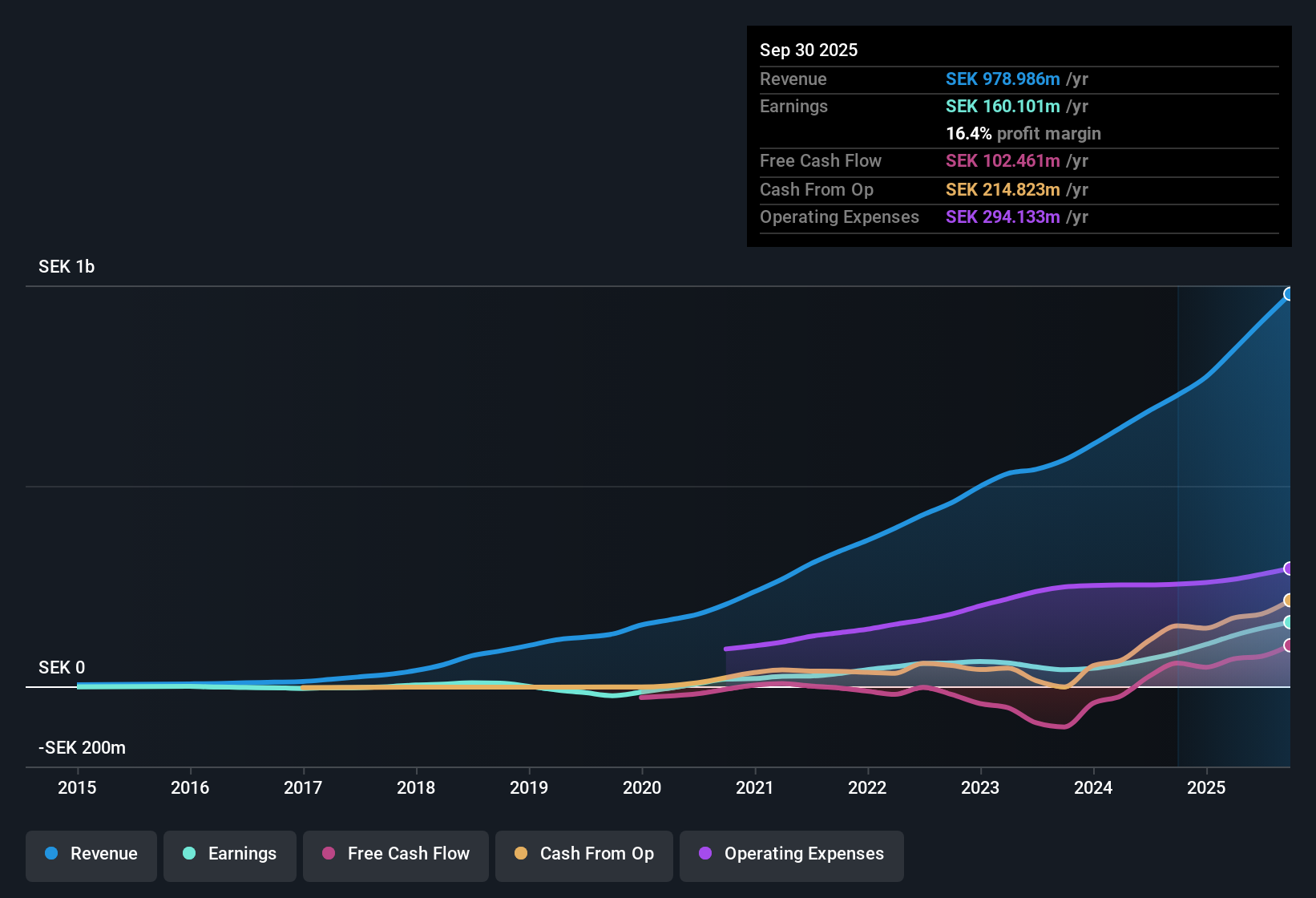

Plejd (DB:3CA) Profit Margin Jumps to 15.9%, Reinforcing Bullish Growth Narrative

Reviewed by Simply Wall St

Plejd (DB:3CA) reported a surge in net profit margins to 15.9%, up from 10% last year, highlighting a significant step-up in profitability. Over the past year, earnings leapt by 112% and have been compounding at an impressive 35.5% annual rate over five years. Current forecasts call for annual revenue growth of 21.9% and earnings growth of 31.5%, both handily outpacing the broader German market’s trends. Notably, Plejd trades at a price-to-earnings ratio of 71.4x, which, while below peer group averages, remains substantially above the wider European electrical industry. This signals elevated investor expectations.

See our full analysis for Plejd.Next, we’ll see how this latest batch of numbers lines up with the consensus narratives shaping sentiment around Plejd. We will spotlight areas of agreement as well as any surprises that may challenge prevailing views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Race Ahead of Peers

- Plejd's net profit margin climbed to 15.9%, which is not only higher than last year's 10% but also puts it ahead of many industry competitors as margins are steadily widening.

- What stands out is that rapid margin expansion heavily supports the narrative that Plejd is efficiently converting sales into profits. This strength gives the company room to reinvest in growth and absorb potential future costs.

- The 5.9 percentage point jump in margins over the past year aligns with views that Plejd has boosted earnings quality, suggesting management's focus on profitability is paying off.

- With current profit margins already above historical averages and sector norms, the company’s fundamentals tightly back up growth optimism rather than simply riding industry trends.

Revenue Growth Leaves Market in the Dust

- Annual revenue at Plejd is forecast to jump by 21.9%, compared to the broader German market’s average of just 6% per year. This highlights how Plejd is outpacing country-wide business growth rates by a wide margin.

- Bulls argue that such strong, broad-based revenue momentum marks Plejd as a standout for investors targeting high-growth companies, especially when combined with rapidly compounding earnings.

- The consistency of revenue and profit gains shown over the past five years (earnings compounding at 35.5% annually) heavily supports the idea that Plejd is not dependent on one-off events or lucky breaks.

- With forecasts calling for 31.5% yearly profit expansion, Plejd’s growth story looks resilient and fits the bullish claim that underlying business drivers remain robust even in a tough market.

Valuation Remains a Sticking Point

- Shares trade at a price-to-earnings ratio of 71.4x, which is lower than peer group averages of 81.6x but still far above the industry norm of 23.4x, showing that investors are willing to pay a premium for Plejd’s rapid growth.

- However, what’s striking is that even with all of Plejd’s operating strengths, the sizable valuation gap signals high expectations must be met to justify the current share price of 81.10.

- Bulls see upside as long as Plejd delivers on growth projections, but the current valuation means any earnings miss or slowdown could trigger a sharp investor reaction.

- Relative to both direct peers and the wider European electrical sector, investors should be alert to how sentiment reacts if Plejd’s forecasted momentum ever stalls, since the premium leaves little margin for error.

See our latest analysis for Plejd.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Plejd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Plejd’s elevated price-to-earnings ratio signals high expectations, meaning any stumble in growth or earnings could cause investors to face a sudden valuation correction.

If you want more value for your investment, check out these 873 undervalued stocks based on cash flows for opportunities trading at more attractive prices relative to their future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:3CA

Plejd

A technology company, develops products and services for smart lighting control in Sweden, Norway, Finland, the Netherlands, Germany, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)