- Germany

- /

- Electrical

- /

- XTRA:ENR

European Market Offers 3 Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

Amid hopes for easing trade tensions between China and the U.S., the pan-European STOXX Europe 600 Index has risen for a fourth consecutive week, reflecting a cautiously optimistic sentiment in European markets. As investors navigate this evolving landscape, identifying undervalued stocks becomes crucial, especially those that may offer potential value due to current market conditions or economic developments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Maire (BIT:MAIRE) | €9.875 | €19.55 | 49.5% |

| ILPRA (BIT:ILP) | €4.50 | €8.81 | 48.9% |

| Sword Group (ENXTPA:SWP) | €31.40 | €62.63 | 49.9% |

| Benefit Systems (WSE:BFT) | PLN3500.00 | PLN6989.78 | 49.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.72 | 48.7% |

| Lectra (ENXTPA:LSS) | €24.75 | €48.12 | 48.6% |

| dormakaba Holding (SWX:DOKA) | CHF711.00 | CHF1399.70 | 49.2% |

| MilDef Group (OM:MILDEF) | SEK229.20 | SEK445.21 | 48.5% |

| Martela Oyj (HLSE:MARAS) | €0.778 | €1.50 | 48.2% |

| About You Holding (DB:YOU) | €6.77 | €12.98 | 47.8% |

We'll examine a selection from our screener results.

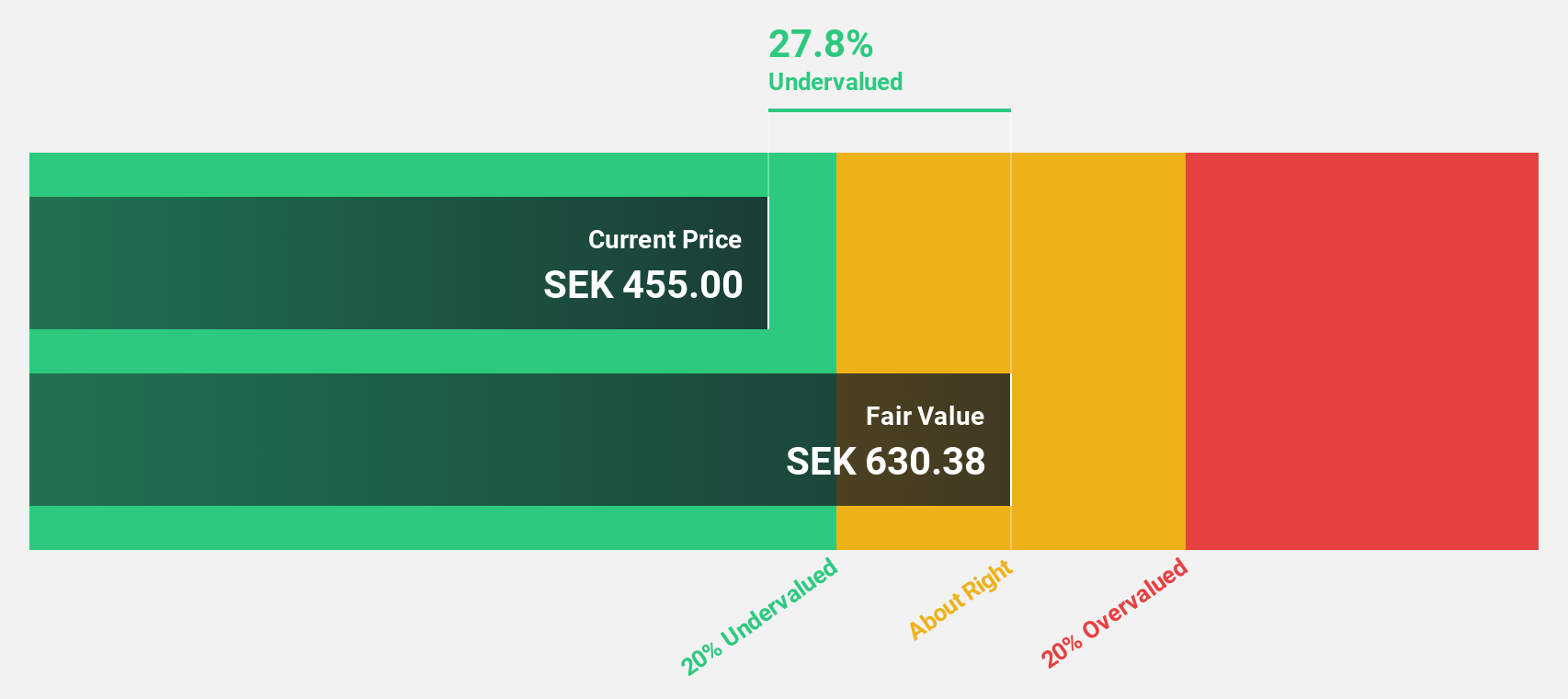

Mips (OM:MIPS)

Overview: Mips AB (publ) specializes in developing, manufacturing, and selling helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK10.87 billion.

Operations: The company's revenue segment includes Sporting Goods, generating SEK516 million.

Estimated Discount To Fair Value: 33.2%

Mips AB is trading at SEK410.2, significantly below its estimated fair value of SEK613.64, indicating potential undervaluation based on cash flows. Recent earnings for Q1 2025 showed growth in sales and net income, with revenue increasing to SEK116 million from SEK83 million a year ago. Analysts forecast robust annual profit growth of 37.3%, outpacing the Swedish market's 16.4%, and predict a substantial rise in stock price by 35.3%.

- The analysis detailed in our Mips growth report hints at robust future financial performance.

- Get an in-depth perspective on Mips' balance sheet by reading our health report here.

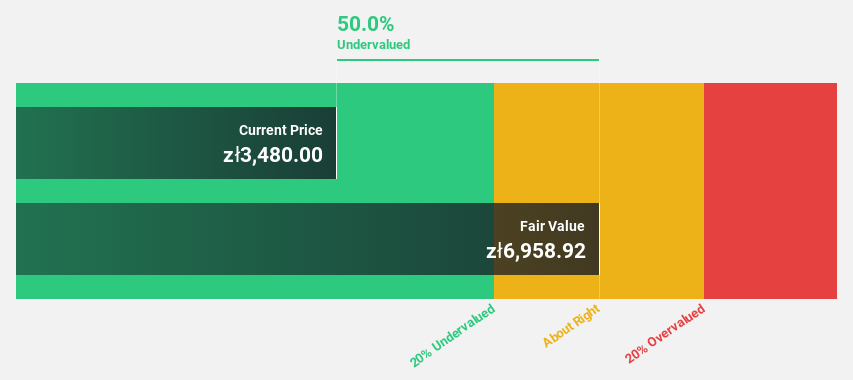

Benefit Systems (WSE:BFT)

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions across several countries including Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey with a market cap of PLN10.49 billion.

Operations: The company's revenue is primarily derived from Poland (including Cafeteria) at PLN2.47 billion and foreign markets at PLN922.87 million.

Estimated Discount To Fair Value: 49.9%

Benefit Systems is trading at PLN3,500, considerably below its fair value estimate of PLN6,989.78, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 22.6% annually over the next three years, surpassing the Polish market's growth rate of 14.2%. Recent financial results showed increased revenue to PLN3.4 billion and a slight rise in net income to PLN449.63 million for 2024 compared to the previous year.

- Our growth report here indicates Benefit Systems may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Benefit Systems.

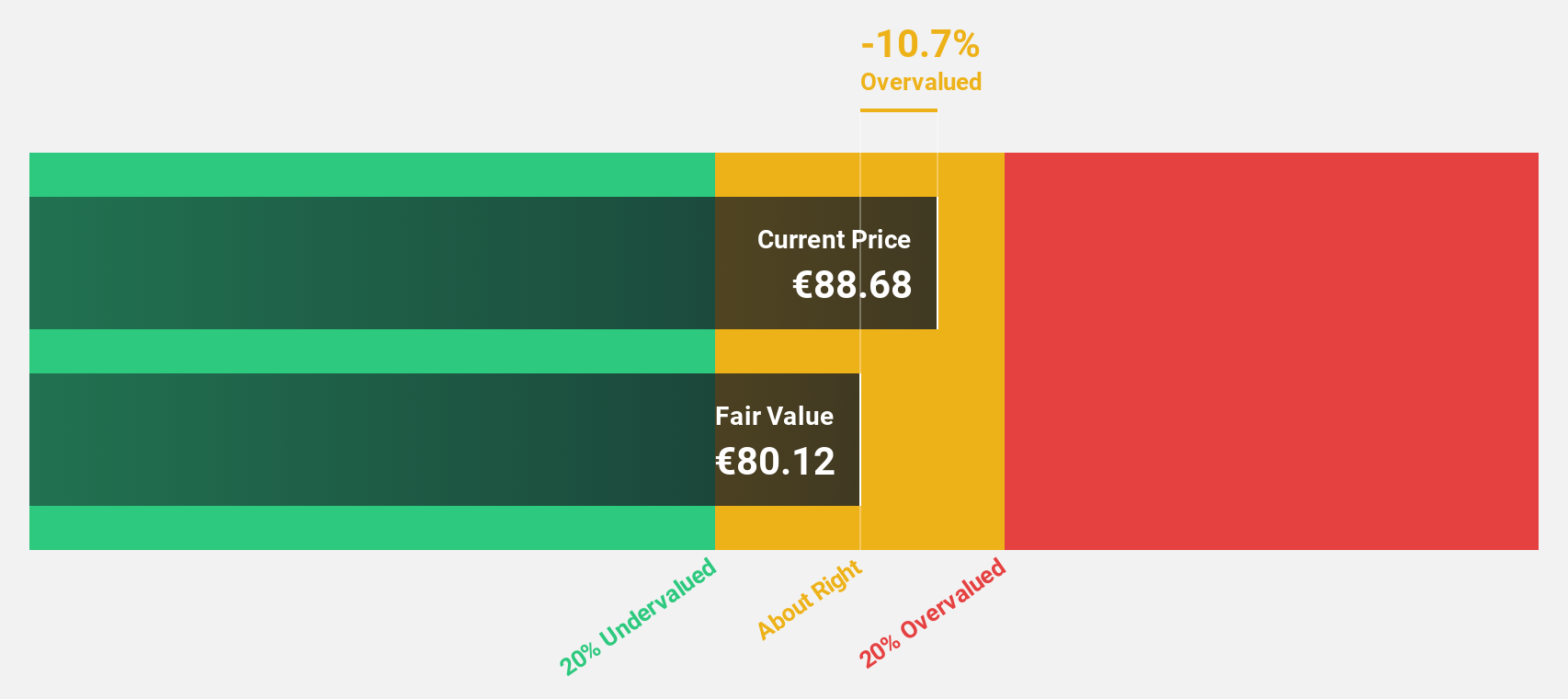

Siemens Energy (XTRA:ENR)

Overview: Siemens Energy AG is a global energy technology company with a market capitalization of approximately €59.75 billion.

Operations: The company's revenue is primarily derived from its Gas Services (€11.47 billion), Siemens Gamesa (€10.78 billion), Grid Technologies (€10.34 billion), and Transformation of Industry (€5.44 billion) segments.

Estimated Discount To Fair Value: 12.3%

Siemens Energy, trading at €75.62, is below its fair value estimate of €86.18, suggesting undervaluation based on cash flows. Despite recent volatility and a drop in net income to €632 million for the half year ended March 2025, revenue grew to €18.90 billion from the previous year. Earnings are projected to grow significantly by 44.84% annually, outpacing the German market's growth rate of 16.1%. Recent M&A activity may further streamline operations amidst cost challenges.

- Our comprehensive growth report raises the possibility that Siemens Energy is poised for substantial financial growth.

- Click here to discover the nuances of Siemens Energy with our detailed financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 174 Undervalued European Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives