As European markets navigate the complexities of escalating trade tensions and economic uncertainties, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this environment, selecting stocks with strong dividend yields can be an appealing strategy for those looking to mitigate volatility while still participating in market opportunities.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.28% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.78% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.00% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.85% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.55% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.20% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.70% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 242 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

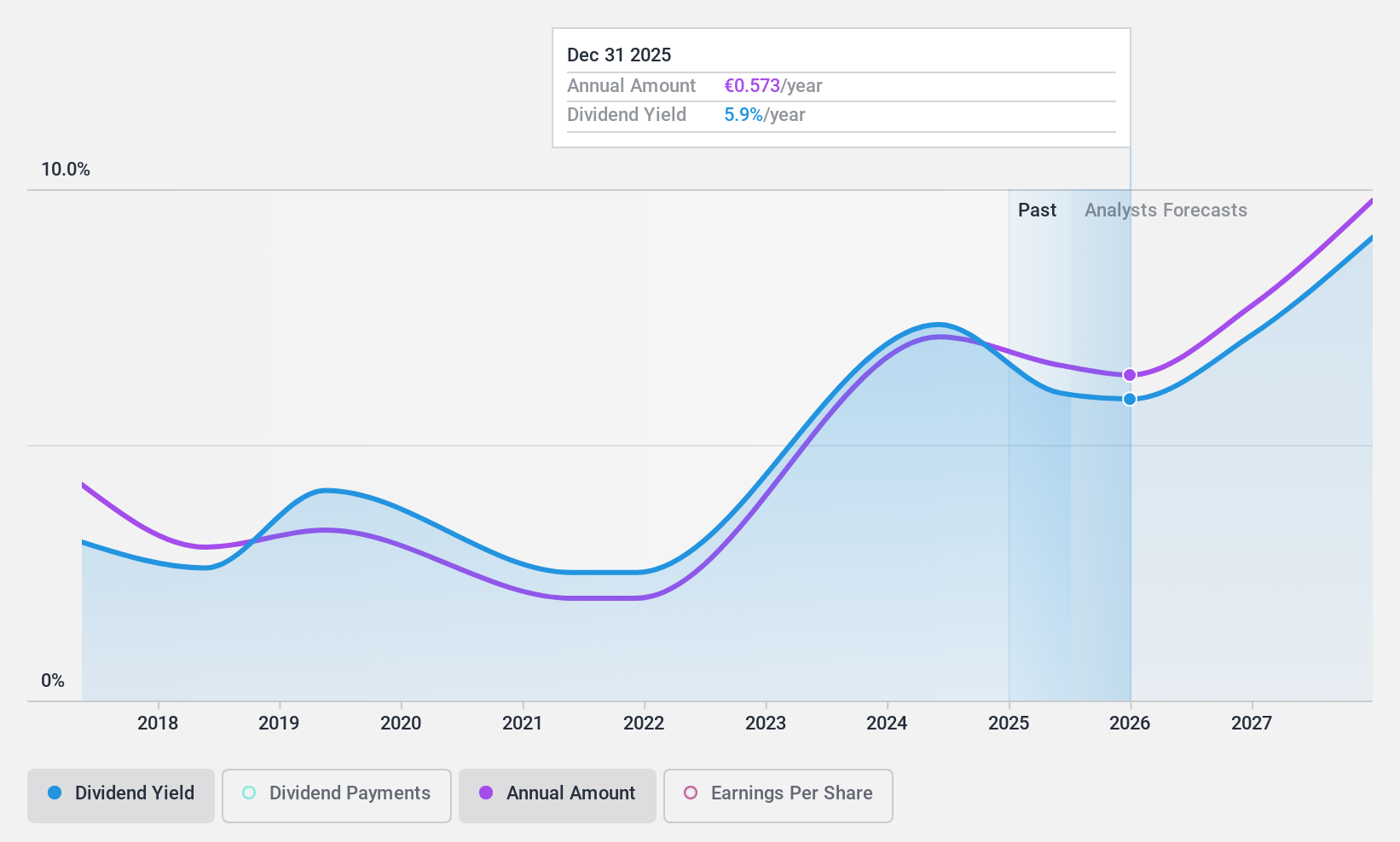

FinecoBank Banca Fineco (BIT:FBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinecoBank Banca Fineco S.p.A. offers a range of banking, credit, trading and investment services in Italy and has a market capitalization of approximately €10.06 billion.

Operations: FinecoBank Banca Fineco S.p.A. generates revenue primarily from its banking segment, which amounted to €1.31 billion.

Dividend Yield: 4.5%

FinecoBank Banca Fineco has proposed a dividend of €0.74 per share, marking a 7% increase year-on-year, supported by a payout ratio of 69.3%. Despite this growth, the bank's dividend history shows volatility over the past decade. Recent earnings indicate net income growth to €652.29 million for 2024 from €609.1 million in 2023, suggesting potential stability in future payouts. However, its current yield of 4.49% trails behind Italy's top-tier dividend payers at 6.07%.

- Take a closer look at FinecoBank Banca Fineco's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that FinecoBank Banca Fineco is priced higher than what may be justified by its financials.

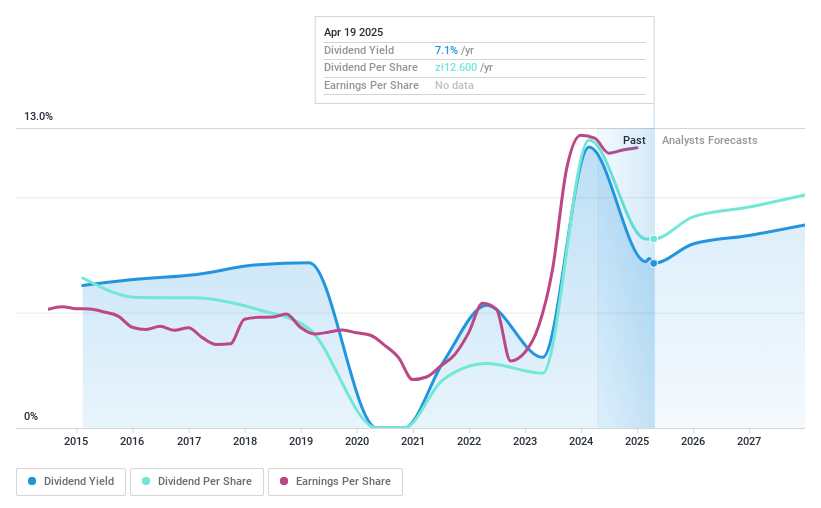

Bank Polska Kasa Opieki (WSE:PEO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Polska Kasa Opieki S.A. is a commercial bank offering a range of banking products and services to retail and corporate clients in Poland, with a market cap of PLN43.31 billion.

Operations: Bank Polska Kasa Opieki S.A. generates its revenue from several segments, including Retail Banking (PLN7.23 billion), Private Banking (PLN452 million), Business Banking (PLN2.50 billion), and Corporate and Investment Banking (PLN2.56 billion).

Dividend Yield: 7.6%

Bank Polska Kasa Opieki announced a dividend of PLN 12.60 per share, though its dividend history has been unstable over the past decade. The payout ratio stands at 51.9%, indicating dividends are covered by earnings and expected to remain so with a forecasted 65.2% in three years. Despite trading at good value, the bank faces challenges with high bad loans at 4.2%. Its current yield is slightly below Poland's top-tier payers.

- Dive into the specifics of Bank Polska Kasa Opieki here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bank Polska Kasa Opieki shares in the market.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €526.55 million, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany through its subsidiaries.

Operations: ProCredit Holding AG generates its revenue primarily from its banking segment, which amounts to €451.13 million.

Dividend Yield: 6.6%

ProCredit Holding's dividend yield of 6.6% ranks it among the top 25% in Germany, although its eight-year dividend history has been volatile with a recent decrease to €0.59 per share. The payout ratio remains low at 33.3%, ensuring dividends are well covered by earnings both now and in three years (33.2%). Despite trading below estimated fair value, challenges include a high bad loans ratio of 2.3%. Earnings growth is forecasted at 14.44% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of ProCredit Holding.

- Our comprehensive valuation report raises the possibility that ProCredit Holding is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Gain an insight into the universe of 242 Top European Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FBK

FinecoBank Banca Fineco

Provides banking, credit, trading and investment services in Italy.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives