These Analysts Think ProCredit Holding AG & Co. KGaA's (ETR:PCZ) Sales Are Under Threat

The analysts covering ProCredit Holding AG & Co. KGaA (ETR:PCZ) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

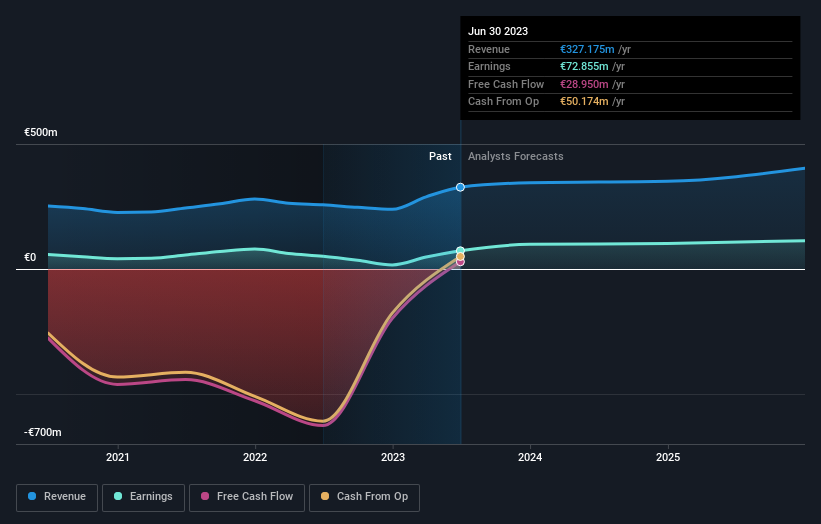

Following the downgrade, the latest consensus from ProCredit Holding KGaA's two analysts is for revenues of €345m in 2023, which would reflect a credible 5.5% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 35% to €1.67. Before this latest update, the analysts had been forecasting revenues of €386m and earnings per share (EPS) of €1.68 in 2023. So there's been a clear change in analyst sentiment in the recent update, with the analysts making a substantial drop in revenues and reconfirming their earnings per share estimates.

See our latest analysis for ProCredit Holding KGaA

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting ProCredit Holding KGaA's growth to accelerate, with the forecast 11% annualised growth to the end of 2023 ranking favourably alongside historical growth of 3.0% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 3.6% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect ProCredit Holding KGaA to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion from this consensus update is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of ProCredit Holding KGaA going forwards.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PCZ

ProCredit Holding

Provides commercial banking services for small and medium enterprises and private customers in Europe, South America, and Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives