- Germany

- /

- Auto Components

- /

- XTRA:CON

Continental (XTRA:CON) Valuation in Focus After Strategic Spin-Off and Shift Toward Tires and ContiTech

Reviewed by Kshitija Bhandaru

If you own shares in Continental (XTRA:CON) or are simply watching from the sidelines, the recent Aumovio spin-off will likely catch your attention. By shedding non-core units and zeroing in on its Tires and ContiTech businesses, Continental is shifting its strategy. Now more than ever, the bulk of sales and earnings are tied to tires, a segment expected to benefit from growing demand in electric vehicles. Management is also aiming for an improved, less cyclical earnings profile, which could reshape how investors think about risk and potential rewards going forward.

With the spin-off now complete, Continental’s stock has experienced mixed momentum. While long-term returns are strong, up 31% over three years, the past year has delivered only modest 6% growth, and performance since the start of the year has lagged. The company’s topline shrank slightly, but profitability improved, and markets seem to be digesting whether the simplification and strategic focus will help drive sustainable growth in the years to come.

So, after this year’s uneven ride and Continental’s pivot toward tire-led earnings, is the market giving investors a compelling entry point, or is future growth already baked into the current price?

Most Popular Narrative: 24.2% Undervalued

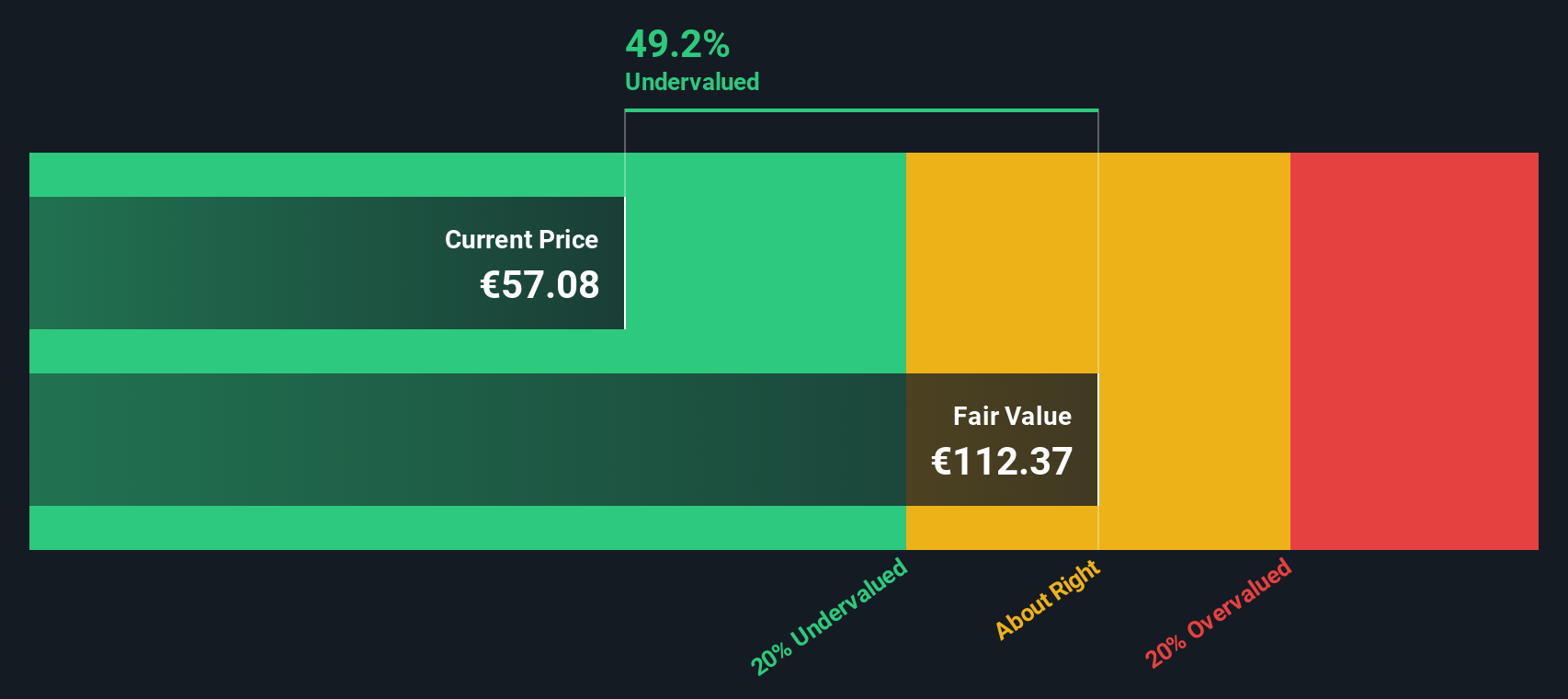

According to the most widely followed narrative, Continental is currently trading at a notable discount to its estimated fair value. This suggests meaningful upside potential if analyst forecasts are realized.

"Ongoing digitalization in the automotive sector is fueling expansion of Continental's software, over-the-air update, and integrated mobility platform offerings. This is unlocking higher-margin and recurring revenue streams that should steadily lift both topline growth and earnings stability."

Curious how Continental could leverage cutting-edge tech and platform innovation to outpace expectations? This narrative hinges on a set of bold growth assumptions that most investors haven’t yet factored into the price. Could these future earnings and margins redefine what the market is willing to pay? The full narrative reveals the ambitious profit roadmap and what needs to go right for this gap to close.

Result: Fair Value of €74.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent foreign exchange headwinds and ongoing restructuring costs could weigh on Continental's profitability and interrupt the case for upside in the near term.

Find out about the key risks to this Continental narrative.Another View: Discounted Cash Flow Perspective

Looking at Continental’s valuation through the lens of our DCF model, the picture also points to the shares being undervalued. However, does the DCF capture all the risks and growth challenges ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Continental Narrative

If you have different insights or want to dig deeper into the numbers, you can shape your own Continental story in just a few minutes: Do it your way.

A great starting point for your Continental research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not limit themselves to a single opportunity. The Simply Wall Street Screener helps you quickly discover fresh possibilities tailored to your interests, so you can stay informed about potential stock moves.

- Unlock the potential of major breakthroughs in medicine and patient care by using the tool for healthcare-powered AI innovations with healthcare AI stocks.

- Target market-beating returns by seeking out hidden gems trading below their true worth with undervalued stocks based on cash flows.

- Tap into the world of fast-growing digital assets and cutting-edge financial technology by starting with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CON

Continental

A technology company, provides solutions for vehicles, machines, traffic, and transportation worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives