Logicom (CSE:LOG) Has Announced A Dividend Of €0.09

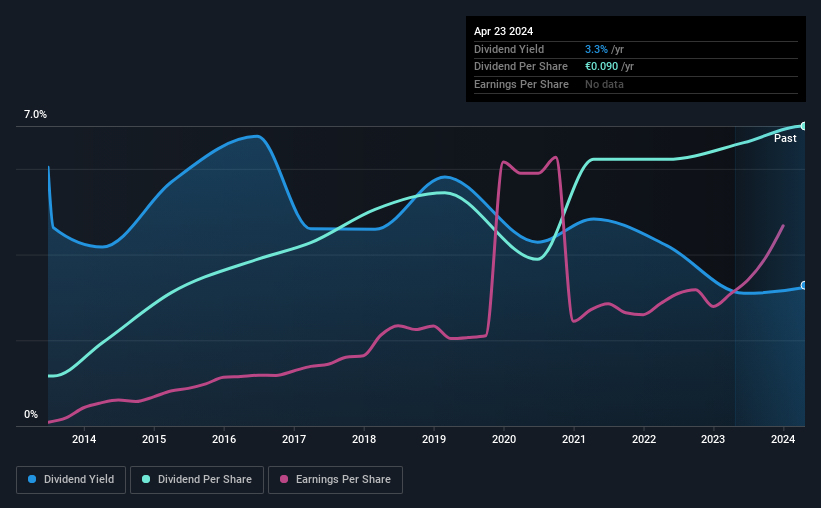

Logicom Public Limited (CSE:LOG) will pay a dividend of €0.09 on the 12th of July. The dividend yield will be 3.3% based on this payment which is still above the industry average.

Check out our latest analysis for Logicom

Logicom's Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, Logicom was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share could rise by 14.9% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 14%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the dividend has gone from €0.015 total annually to €0.09. This implies that the company grew its distributions at a yearly rate of about 20% over that duration. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Logicom has seen EPS rising for the last five years, at 15% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Logicom is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Logicom that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:LOG

Logicom

Engages in the distribution of technology products, solutions, and services in Cyprus, Greece, the United Arab Emirates, Saudi Arabia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)