- China

- /

- Renewable Energy

- /

- SHSE:600863

Inner Mongolia MengDian HuaNeng Thermal Power And 2 Other Reliable Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets respond to political developments and economic data, with U.S. stocks reaching record highs amid optimism surrounding trade policies and AI investments, investors are increasingly looking for stable options to bolster their portfolios. In this environment, dividend stocks can offer a reliable source of income and potential growth, making them an attractive choice for those seeking to enhance their investment strategy amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

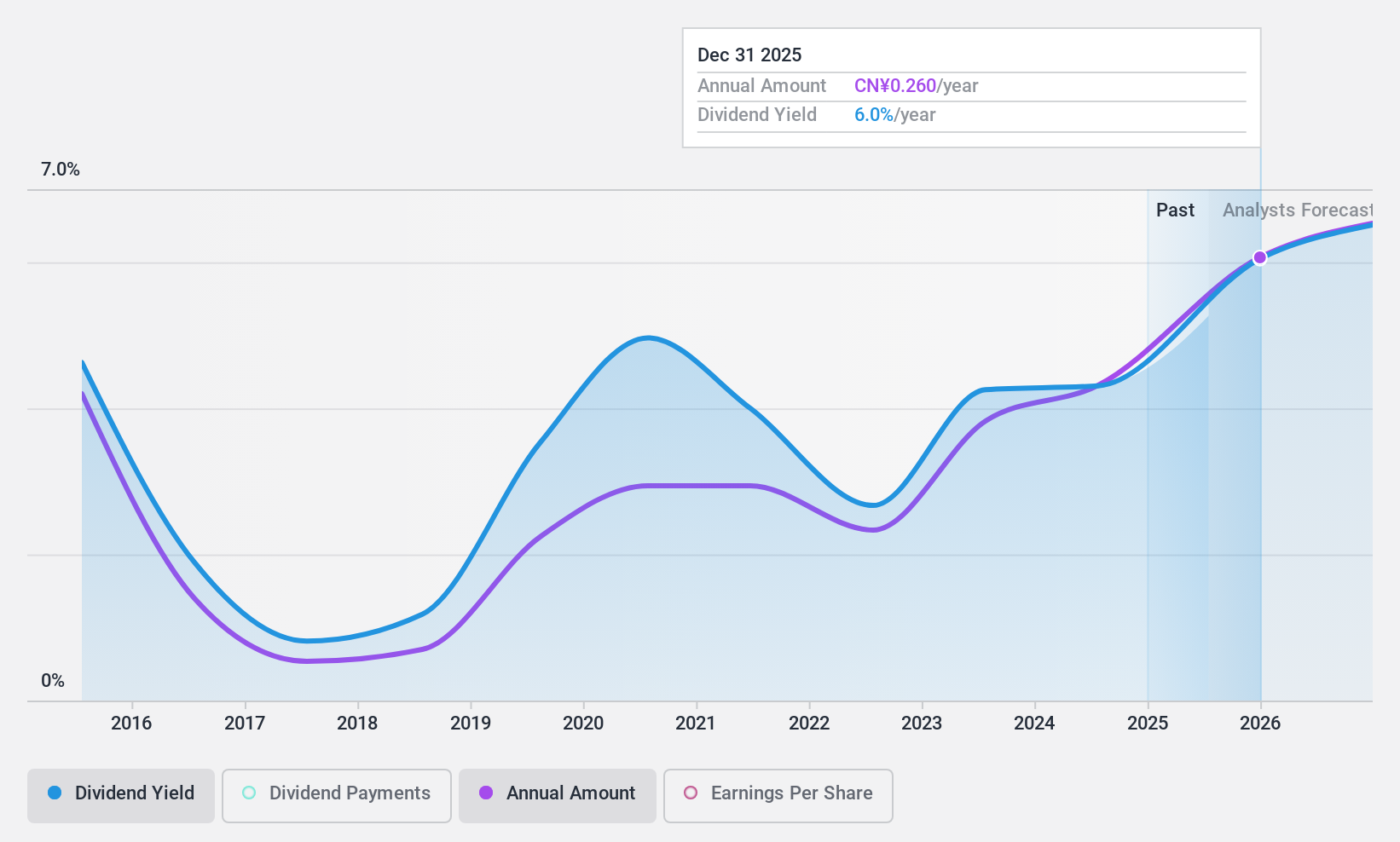

Inner Mongolia MengDian HuaNeng Thermal Power (SHSE:600863)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited operates in the thermal power generation sector with a market cap of CN¥27.35 billion.

Operations: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited generates its revenue primarily from thermal power generation.

Dividend Yield: 4.4%

Inner Mongolia MengDian HuaNeng Thermal Power offers a dividend yield of 4.42%, placing it among the top 25% of dividend payers in China. Despite its attractive yield, the company's dividends have been volatile and unreliable over the past decade, with significant fluctuations in payments. However, dividends are well-covered by earnings (payout ratio: 55.1%) and cash flows (cash payout ratio: 34.6%), indicating sustainability despite past instability in payouts. The stock trades at a significant discount to estimated fair value, enhancing its appeal for value-focused investors seeking income potential.

- Delve into the full analysis dividend report here for a deeper understanding of Inner Mongolia MengDian HuaNeng Thermal Power.

- The valuation report we've compiled suggests that Inner Mongolia MengDian HuaNeng Thermal Power's current price could be quite moderate.

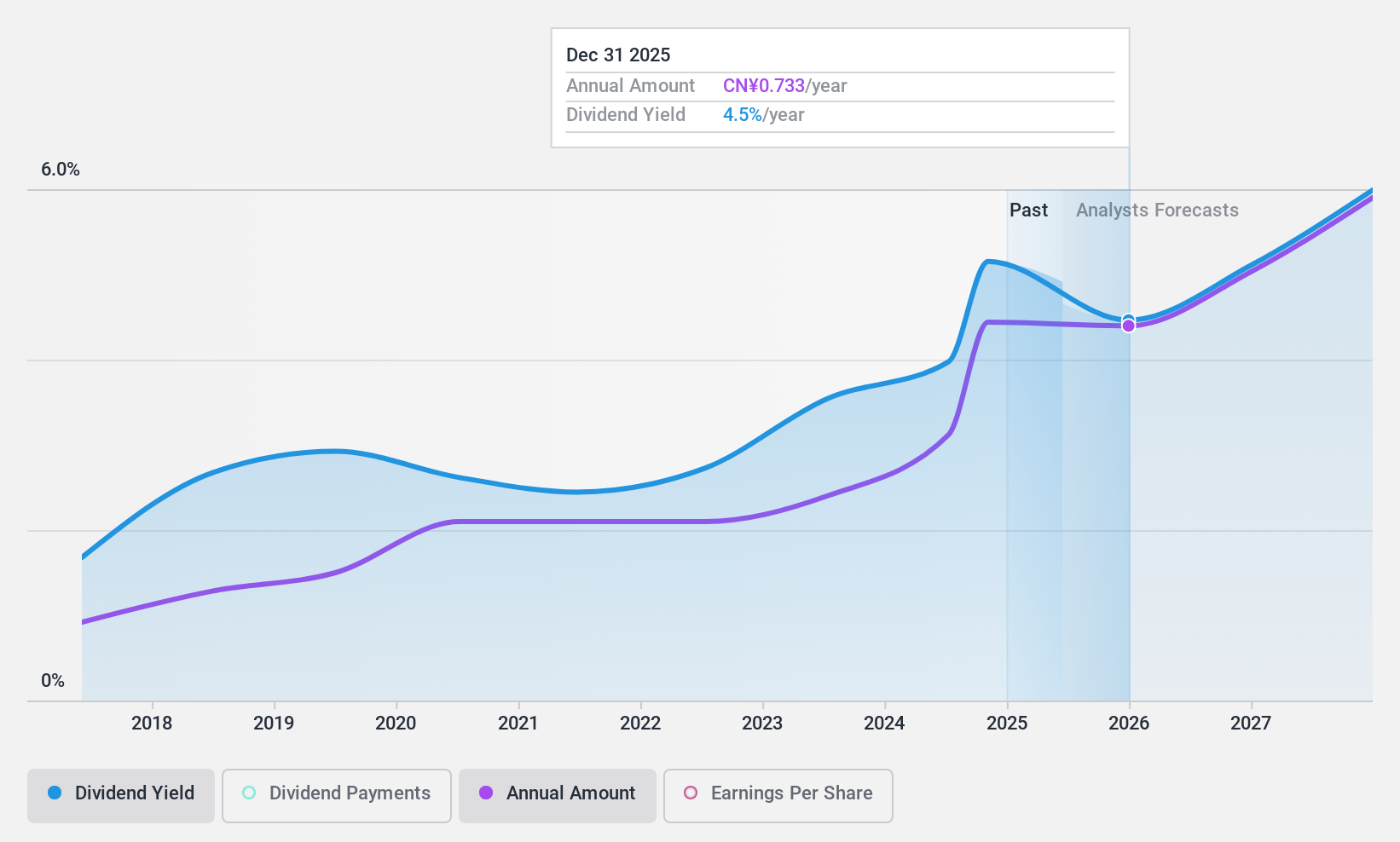

Bank of Hangzhou (SHSE:600926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Hangzhou Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small and micro businesses in China, with a market cap of CN¥89.29 billion.

Operations: The company's revenue segments include individual banking, corporate banking, and services for small and micro businesses in China.

Dividend Yield: 5%

Bank of Hangzhou's dividend yield of 5.01% ranks it in the top 25% among Chinese dividend payers, supported by a low payout ratio of 33.1%, indicating sustainability. Despite only eight years of payments, dividends have been stable and are expected to remain well-covered with a forecasted payout ratio of 23.8% in three years. The stock trades at a significant discount to its estimated fair value, offering potential value for income-focused investors. Recent inclusion in major indices may enhance visibility and investor interest.

- Navigate through the intricacies of Bank of Hangzhou with our comprehensive dividend report here.

- Our valuation report unveils the possibility Bank of Hangzhou's shares may be trading at a discount.

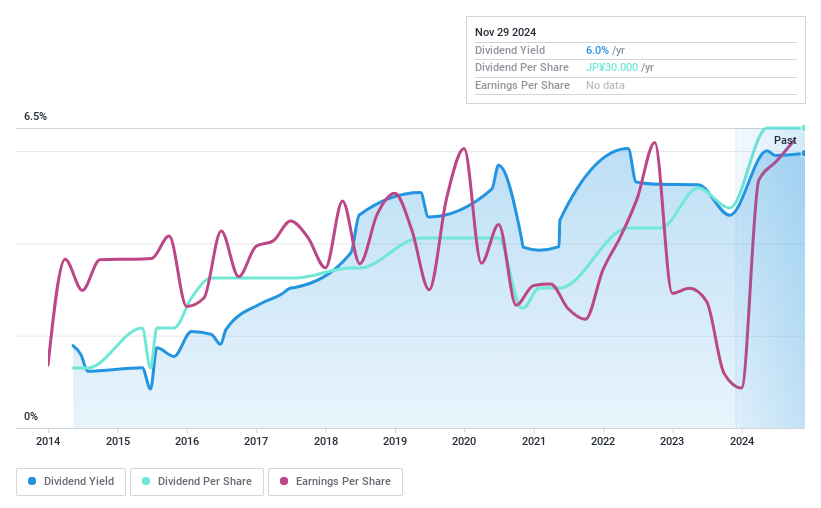

MIRARTH HOLDINGSInc (TSE:8897)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MIRARTH HOLDINGS, Inc. operates in the real estate sector in Japan and has a market capitalization of ¥71.07 billion.

Operations: MIRARTH HOLDINGS, Inc. generates revenue from its Real Estate Business at ¥189.09 billion, Energy Business at ¥13.73 billion, and Asset Management Business at ¥1.05 billion.

Dividend Yield: 5.7%

MIRARTH HOLDINGS, Inc. announced a dividend increase to JPY 7.00 per share for Q2 2024, reflecting growth from JPY 6.00 the previous year. Despite a high debt level and past shareholder dilution, its dividend yield of 5.73% ranks in the top quartile in Japan and is covered by earnings (29% payout ratio) and cash flow (20.6% cash payout ratio). However, dividends have been volatile over the last decade, indicating an unstable track record.

- Get an in-depth perspective on MIRARTH HOLDINGSInc's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that MIRARTH HOLDINGSInc is priced lower than what may be justified by its financials.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1948 more companies for you to explore.Click here to unveil our expertly curated list of 1951 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600863

Inner Mongolia MengDian HuaNeng Thermal Power

Engages in thermal power generation and heating businesses in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)