Jiumaojiu International Holdings Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have been experiencing volatility, with U.S. equities declining amid inflation concerns and political uncertainty, while European indices showed resilience due to expectations of interest rate cuts. Despite the choppy market conditions, identifying stocks with strong fundamentals remains a key strategy for investors looking to navigate these fluctuations. Although the term 'penny stock' might seem outdated, it still represents an area of investment where smaller or newer companies can offer significant potential when backed by solid financials. In this context, we explore three penny stocks that demonstrate financial strength and potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$39.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £5.00 | £481.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.68 | £420.17M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$142.2M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.54 | THB1.97B | ★★★★☆☆ |

Click here to see the full list of 5,710 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited operates and manages Chinese cuisine restaurant brands across the People’s Republic of China, Singapore, Canada, Malaysia, Thailand, and the United States with a market cap of HK$4.05 billion.

Operations: The company's revenue is primarily derived from its restaurant brands, with Tai Er contributing CN¥4.54 billion, Jiu Mao Jiu generating CN¥603.83 million, and Song Hot Pot bringing in CN¥885.66 million.

Market Cap: HK$4.05B

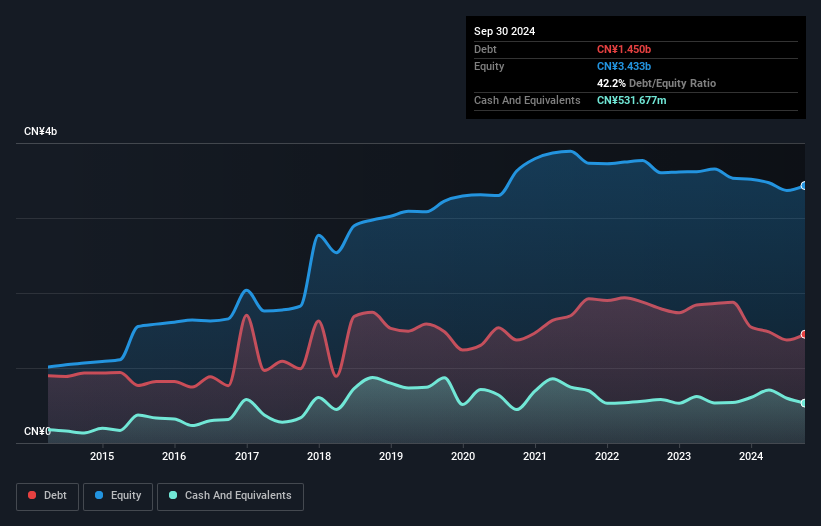

Jiumaojiu International Holdings, with a market cap of HK$4.05 billion, shows potential in the penny stock space due to its substantial revenue streams from restaurant brands like Tai Er and Jiu Mao Jiu. The company is trading significantly below its estimated fair value, which may attract value investors. It has reduced its debt-to-equity ratio over five years and maintains strong interest coverage with EBIT 13.5 times higher than interest payments. However, the management team is relatively inexperienced with an average tenure of 1.2 years, and the stock price has been highly volatile recently despite stable earnings growth forecasts at 16.86% annually.

- Unlock comprehensive insights into our analysis of Jiumaojiu International Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Jiumaojiu International Holdings' future.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd operates in the construction and management of water treatment and environmental protection projects, as well as energy-saving and clean energy transformation initiatives in China, with a market cap of CN¥5.18 billion.

Operations: Heilongjiang Interchina Water Treatment Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥5.18B

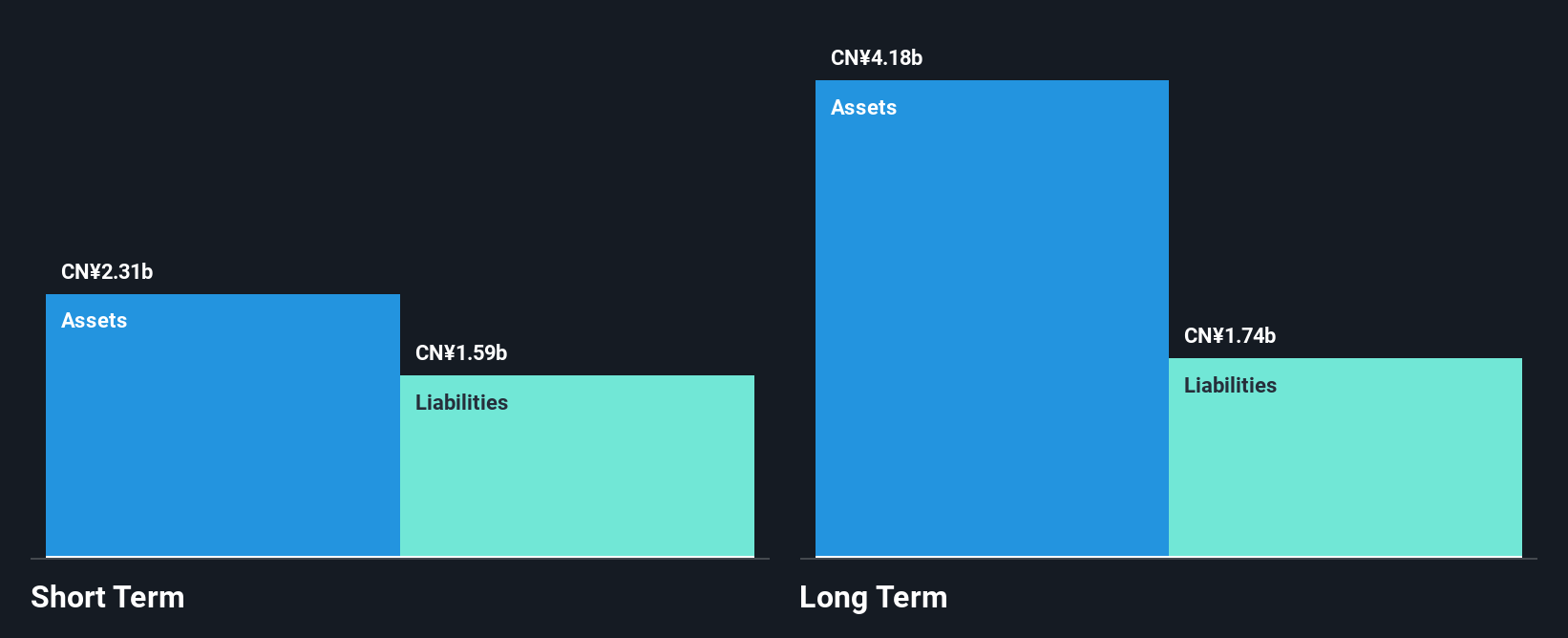

Heilongjiang Interchina Water Treatment Co., Ltd, with a market cap of CN¥5.18 billion, faces challenges in the penny stock arena due to declining financial performance. Recent earnings show a drop in sales to CN¥125.45 million from CN¥170.43 million year-over-year and net income falling significantly to CN¥9 million from CN¥67.31 million. Despite having more cash than total debt and short-term assets exceeding liabilities, the company is currently unprofitable with negative return on equity and operating cash flow issues, indicating financial strain. The management team's experience remains unclear; however, the board is seasoned with an average tenure of 7.4 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Heilongjiang Interchina Water TreatmentLtd.

- Review our historical performance report to gain insights into Heilongjiang Interchina Water TreatmentLtd's track record.

Xiamen Hexing Packaging Printing (SZSE:002228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xiamen Hexing Packaging Printing Co., Ltd. operates in the packaging and printing industry, with a market cap of CN¥3.38 billion.

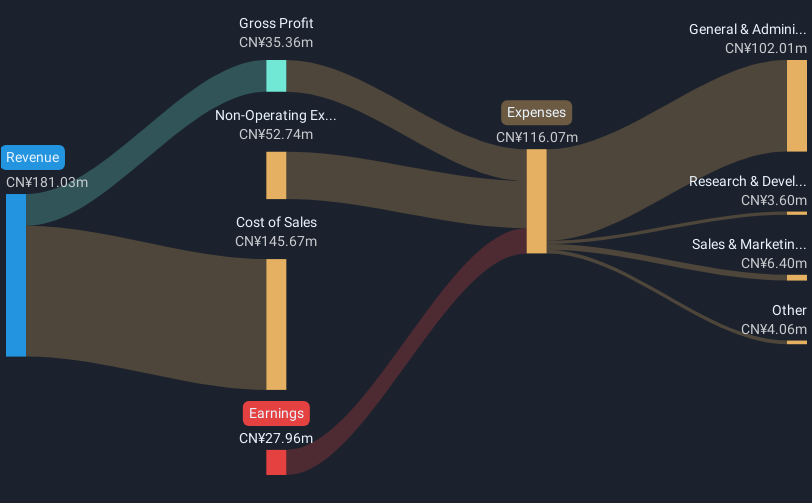

Operations: The company generates revenue of CN¥11.63 billion from its packaging manufacturing industry segment.

Market Cap: CN¥3.38B

Xiamen Hexing Packaging Printing Co., Ltd. demonstrates potential in the penny stock sector with a market cap of CN¥3.38 billion and revenue of CN¥11.63 billion from its packaging segment. The company has shown improved financial metrics, including a 20% earnings growth over the past year, surpassing industry averages, and an increase in net profit margins to 1.1%. Its debt is well-managed, with operating cash flow covering 43.7% of debt and interest payments covered by EBIT at 3.4 times. However, its return on equity remains low at 3.5%, and dividends are not well covered by earnings despite stable shareholder value without dilution recently.

- Get an in-depth perspective on Xiamen Hexing Packaging Printing's performance by reading our balance sheet health report here.

- Explore Xiamen Hexing Packaging Printing's analyst forecasts in our growth report.

Seize The Opportunity

- Reveal the 5,710 hidden gems among our Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002228

Xiamen Hexing Packaging Printing

Xiamen Hexing Packaging Printing Co., Ltd.

Flawless balance sheet established dividend payer.