- China

- /

- Auto Components

- /

- SHSE:603730

January 2025's Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing inflation fears and political uncertainty, investors are keenly observing how these conditions affect growth stocks. In this environment, companies with high insider ownership often stand out as they suggest confidence from those who know the business best, offering a potential edge in turbulent times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 25.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd focuses on the research, development, production, and sale of passenger car components for OEMs and automakers both in China and internationally, with a market cap of CN¥14.46 billion.

Operations: Shanghai Daimay Automotive Interior generates revenue from the sale of passenger car components to original equipment manufacturers and automakers in both domestic and international markets.

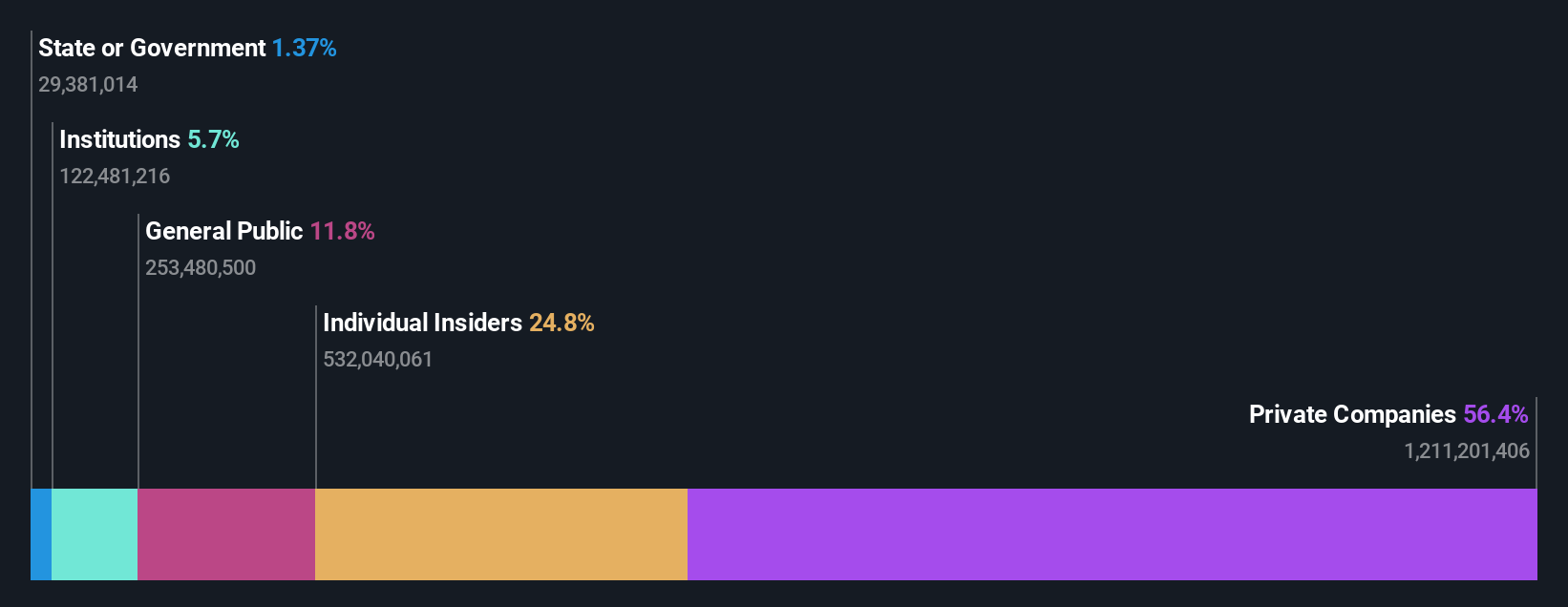

Insider Ownership: 24.2%

Shanghai Daimay Automotive Interior is trading at a significant discount to its estimated fair value, presenting potential growth opportunities. The company's earnings are forecast to grow 22.69% annually, with revenue expected to outpace the broader Chinese market at 20.4% per year. Recent financials show solid performance with sales reaching CNY 4.80 billion and net income improving to CNY 623.03 million for the first nine months of 2024, indicating robust operational momentum despite slower relative earnings growth compared to the market.

- Get an in-depth perspective on Shanghai Daimay Automotive Interior's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Daimay Automotive Interior shares in the market.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company involved in the research, development, manufacture, and commercialization of pharmaceutical products in China with a market cap of CN¥12.71 billion.

Operations: BrightGene's revenue is primarily derived from its activities in researching, developing, manufacturing, and commercializing pharmaceutical products within China.

Insider Ownership: 32.2%

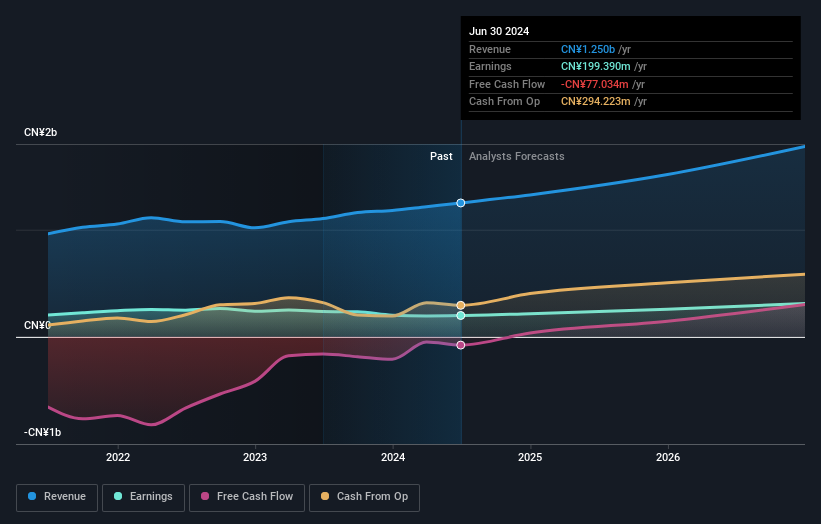

BrightGene Bio-Medical Technology is trading 71.3% below its estimated fair value, offering potential growth prospects. Despite a decline in net income to CNY 177.41 million for the first nine months of 2024, revenue increased to CNY 976.83 million from the previous year. The company's earnings and revenue are forecast to grow significantly at 37.6% and 29.8% annually, respectively, outpacing the broader Chinese market's growth rates in both areas.

- Click here to discover the nuances of BrightGene Bio-Medical Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report BrightGene Bio-Medical Technology implies its share price may be too high.

Shenzhen Yinghe Technology (SZSE:300457)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Yinghe Technology Co., Ltd specializes in the R&D, production, and sale of lithium-ion battery automation equipment in China, with a market cap of CN¥11.78 billion.

Operations: Shenzhen Yinghe Technology Co., Ltd's revenue primarily arises from its activities in the lithium-ion battery automation equipment sector within China.

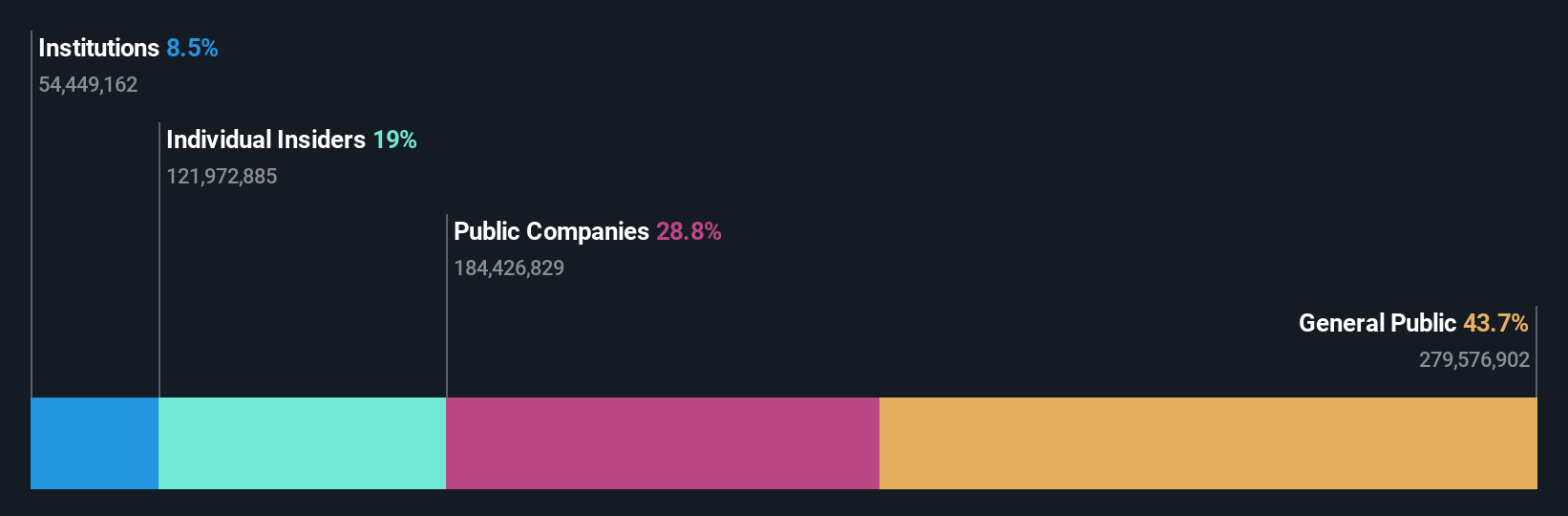

Insider Ownership: 19.3%

Shenzhen Yinghe Technology is trading at 51.2% below its estimated fair value, presenting potential for growth. Despite a decrease in revenue to CNY 6.48 billion for the first nine months of 2024, the company's earnings are forecast to grow significantly at 34.48% annually, surpassing the Chinese market's projected growth rate of 25.3%. Analysts expect a stock price increase of 37%, although its dividend yield of 0.96% is not well covered by free cash flows.

- Dive into the specifics of Shenzhen Yinghe Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Shenzhen Yinghe Technology implies its share price may be lower than expected.

Summing It All Up

- Embark on your investment journey to our 1455 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603730

Shanghai Daimay Automotive Interior

Researches, develops, produces, and sells passenger car components for OEMs and auto makers in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives