- China

- /

- Electrical

- /

- SHSE:603855

Warom Technology And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, marked by inflation concerns and political uncertainties, investors are increasingly seeking stability amid the volatility. In such an environment, dividend stocks can offer a reliable source of income and potential resilience against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.37% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1995 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

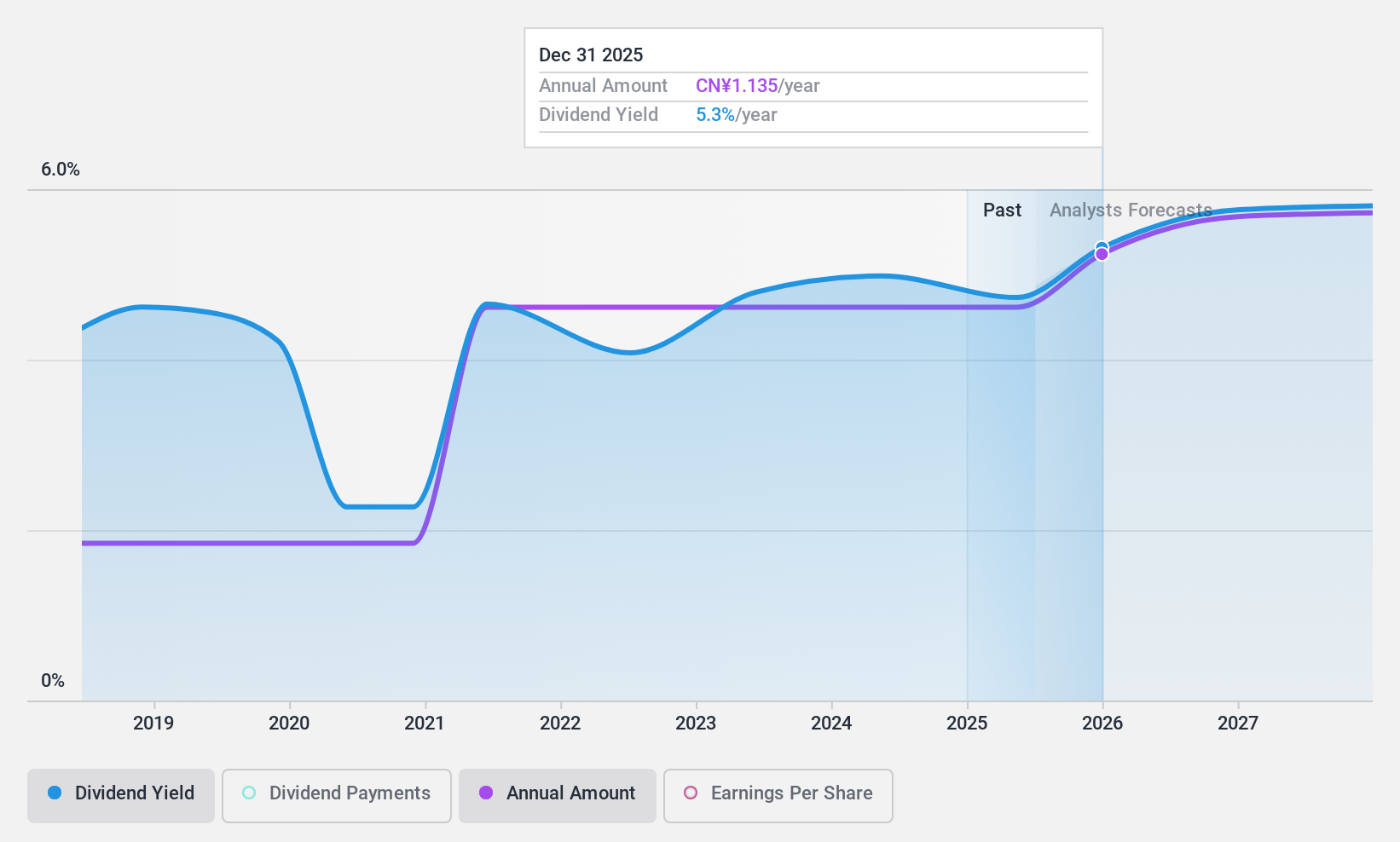

Warom Technology (SHSE:603855)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warom Technology Incorporated Company engages in the research, development, manufacturing, and supply of explosion-proof electric apparatus and professional lighting equipment both in China and internationally, with a market cap of CN¥6.38 billion.

Operations: Warom Technology's revenue segments consist of its operations in explosion-proof electric apparatus and professional lighting equipment across domestic and international markets.

Dividend Yield: 5.2%

Warom Technology's dividend yield of 5.19% is among the top 25% in China, supported by a reasonable payout ratio of 68.9%, indicating earnings cover dividends well. Recent earnings growth of 27.5% underscores financial health, with sales reaching CNY 2.45 billion for the first nine months of 2024, up from CNY 2.05 billion a year prior. However, dividends have been paid for only seven years, suggesting limited historical stability despite consistent payments and growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Warom Technology.

- In light of our recent valuation report, it seems possible that Warom Technology is trading behind its estimated value.

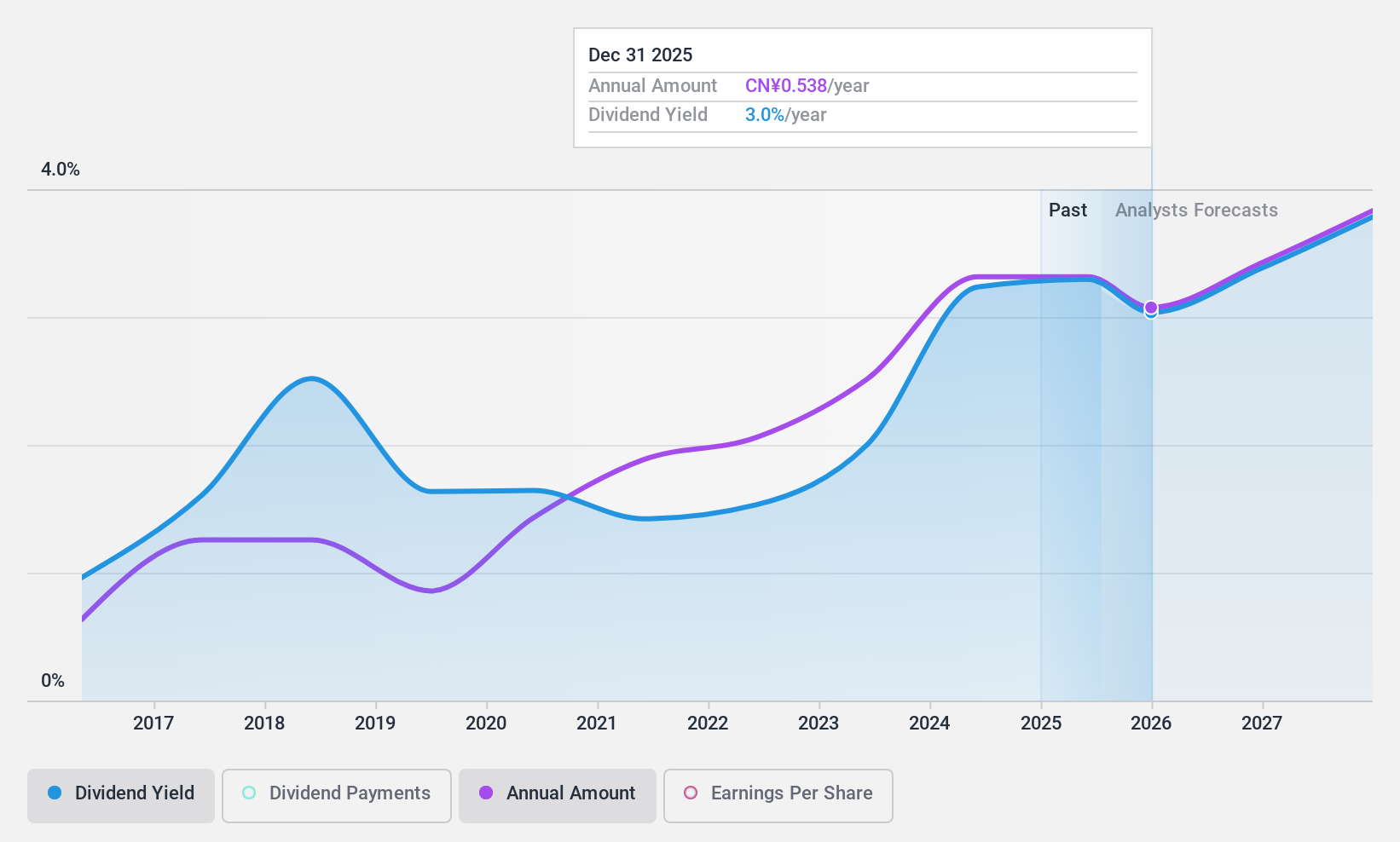

Shanghai Hanbell Precise Machinery (SZSE:002158)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Hanbell Precise Machinery Co., Ltd. operates in the machinery industry, focusing on the production and sale of compressors and related equipment, with a market cap of CN¥9.64 billion.

Operations: Shanghai Hanbell Precise Machinery Co., Ltd. generates its revenue primarily from the production and sale of compressors and related equipment.

Dividend Yield: 3.2%

Shanghai Hanbell Precise Machinery offers a dividend yield of 3.22%, placing it in the top quartile of CN market dividend payers, supported by a low payout ratio of 34.2%. Despite an unstable dividend history with volatility, payments are covered by earnings and cash flows. Recent earnings growth to CNY 721.4 million for the first nine months of 2024 reflects financial strength, though sales slightly declined from the previous year’s CNY 2,906.18 million.

- Navigate through the intricacies of Shanghai Hanbell Precise Machinery with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Shanghai Hanbell Precise Machinery's current price could be quite moderate.

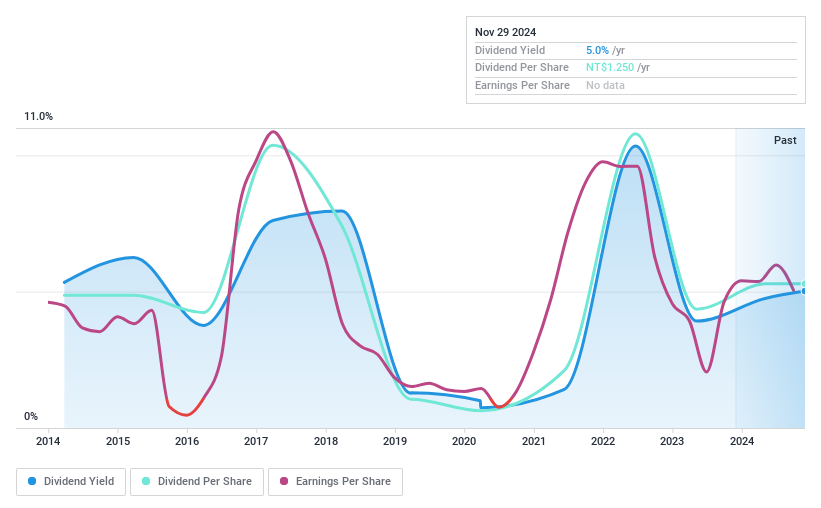

Sheng Yu Steel (TWSE:2029)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sheng Yu Steel Co., Ltd. is engaged in the manufacturing, processing, and selling of steel sheets across Taiwan and international markets including Asia, Europe, and the United States, with a market cap of NT$7.64 billion.

Operations: Sheng Yu Steel Co., Ltd. generates its revenue primarily from its core operations amounting to NT$12.86 billion.

Dividend Yield: 5.3%

Sheng Yu Steel's dividend yield of 5.25% ranks in the top 25% of TW market payers, with a payout ratio of 69.7%, indicating coverage by earnings and cash flows. Despite growth over the past decade, dividends have been volatile and unreliable. Recent financials show third-quarter sales rising to TWD 3.36 billion from TWD 3.12 billion year-on-year, though net income fell significantly to TWD 83.04 million from TWD 219.77 million, reflecting earnings pressure amidst revenue growth challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Sheng Yu Steel.

- Our comprehensive valuation report raises the possibility that Sheng Yu Steel is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 1995 Top Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warom Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603855

Warom Technology

Researches and develops, manufactures, and supplies explosion-proof electric apparatus and professional lighting equipment in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives