Benign Growth For China Master Logistics Co., Ltd. (SHSE:603967) Underpins Its Share Price

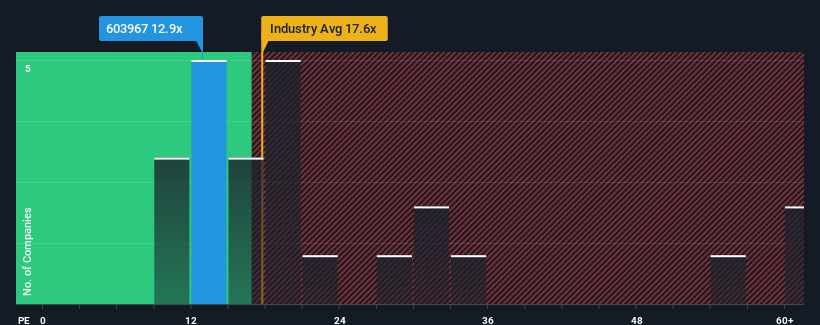

China Master Logistics Co., Ltd.'s (SHSE:603967) price-to-earnings (or "P/E") ratio of 12.9x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

China Master Logistics' negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for China Master Logistics

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, China Master Logistics would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 28% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 16% per annum over the next three years. That's shaping up to be materially lower than the 19% per year growth forecast for the broader market.

In light of this, it's understandable that China Master Logistics' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On China Master Logistics' P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Master Logistics maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China Master Logistics that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603967

China Master Logistics

Operates as an integrated logistics company in China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives