As global markets grapple with trade uncertainties and inflation concerns, Asia's economic landscape remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership can offer a unique advantage, as they often align management interests with shareholder value—a key consideration when navigating such volatile market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.8% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| WinWay Technology (TWSE:6515) | 22.6% | 32.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 64.3% |

| BIWIN Storage Technology (SHSE:688525) | 18.9% | 57.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here we highlight a subset of our preferred stocks from the screener.

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★★★

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both domestically in South Korea and internationally, with a market cap of ₩6.69 trillion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 11.6%

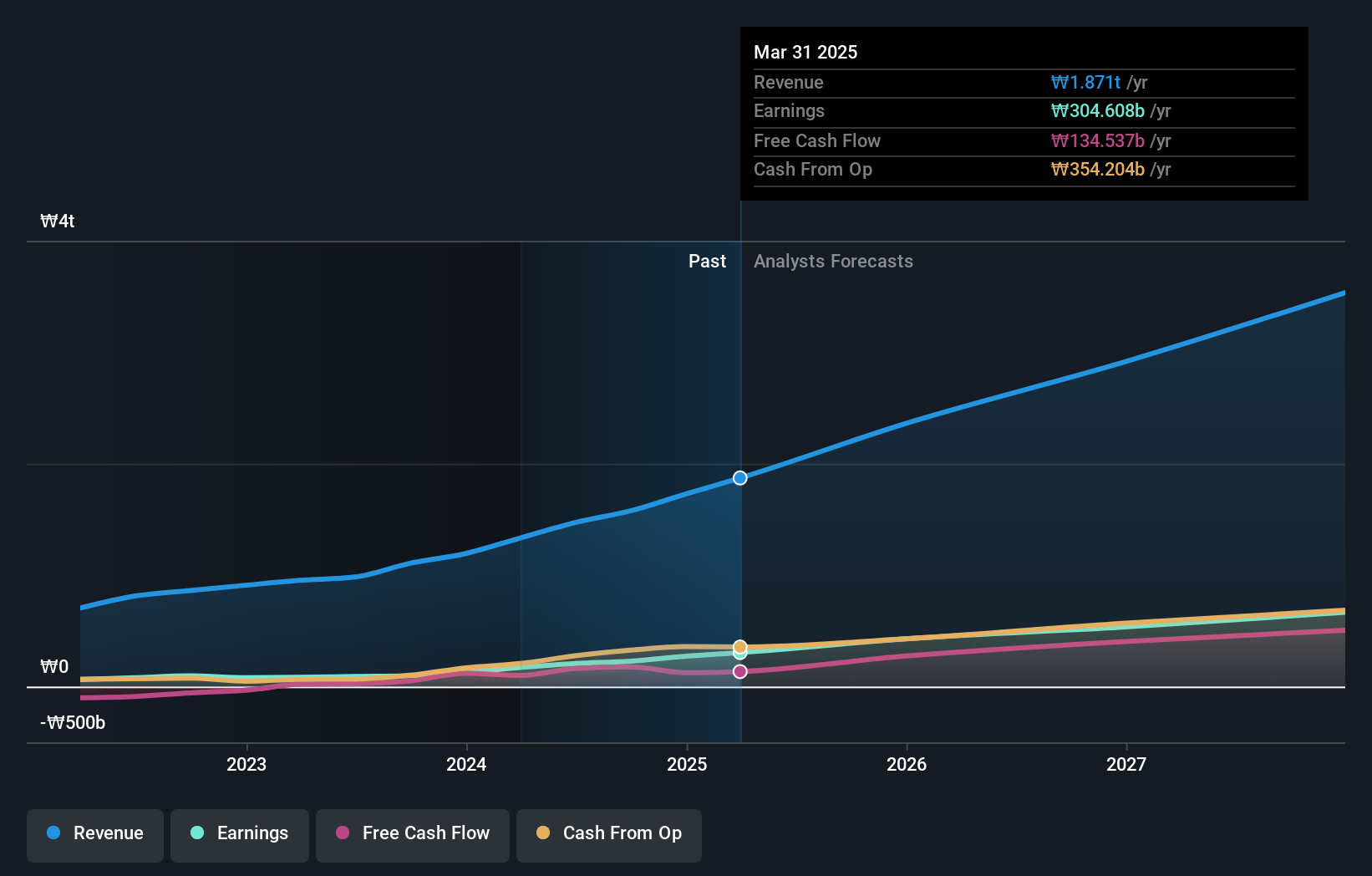

Samyang Foods exhibits strong growth potential with earnings projected to grow significantly over the next three years, surpassing the Korean market's average. The company's revenue is also expected to increase at a rate faster than 20% annually. Despite trading at nearly half its estimated fair value, Samyang Foods maintains high insider ownership, suggesting confidence in its future prospects. Recent events include a cash dividend announcement and an investor call discussing business status and outlook.

- Click here to discover the nuances of Samyang Foods with our detailed analytical future growth report.

- The analysis detailed in our Samyang Foods valuation report hints at an inflated share price compared to its estimated value.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector and has a market cap of CN¥16.88 billion.

Operations: The company's revenue segment includes Information Technology Service, generating CN¥910.10 million.

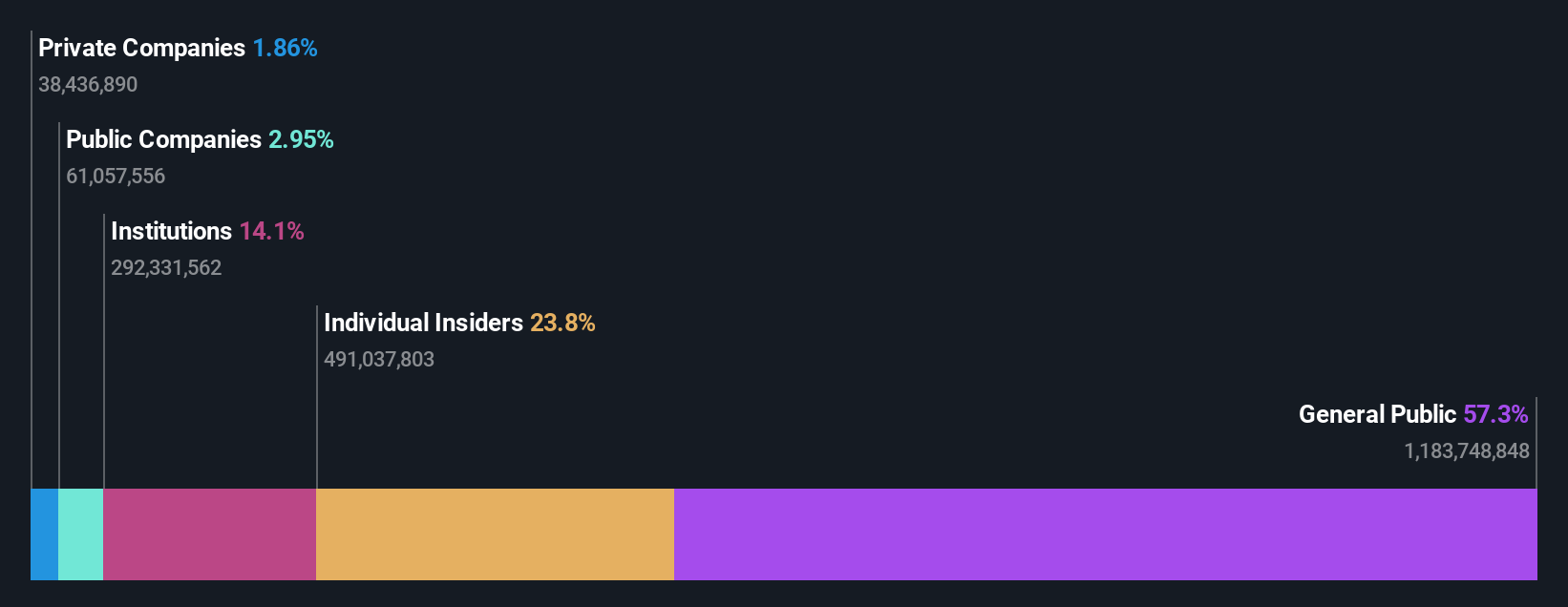

Insider Ownership: 24.1%

Doushen (Beijing) Education & Technology is poised for substantial growth, with revenue expected to rise at 38.4% annually, outpacing the broader Chinese market. Despite its high price-to-earnings ratio of 69.4x, it remains below the industry average of 110.2x, indicating potential value within the sector. The company became profitable this year and boasts significant insider ownership, reflecting strong internal confidence in its growth trajectory despite recent share price volatility.

- Navigate through the intricacies of Doushen (Beijing) Education & Technology with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Doushen (Beijing) Education & Technology's share price might be too optimistic.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Ampron Technology Co., Ltd. is involved in the research, development, manufacture, sale, and service of sensors in China with a market cap of CN¥10.74 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, totaling CN¥860.91 million.

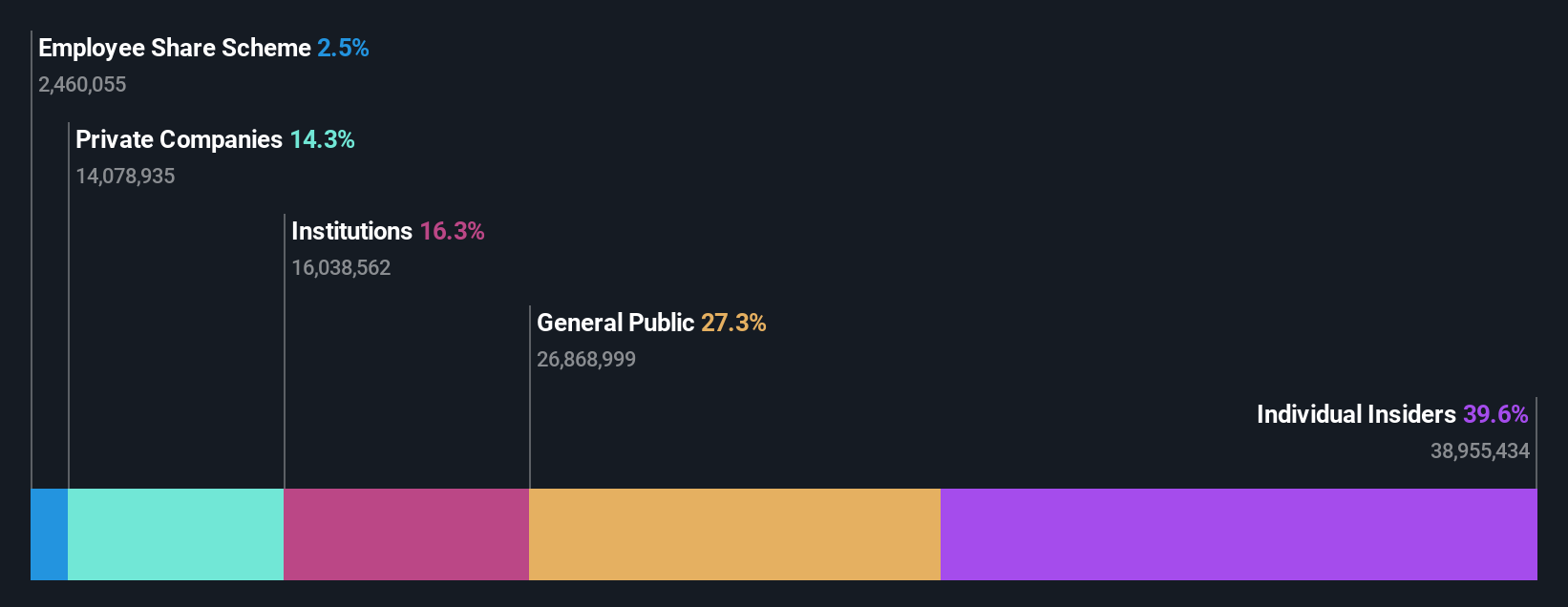

Insider Ownership: 39.6%

Shenzhen Ampron Technology is set for robust growth, with earnings projected to rise 35.63% annually, surpassing the broader Chinese market's expectations. Revenue growth at 24.1% per year also exceeds market averages. Despite recent share price volatility and a low future Return on Equity forecast of 11.9%, high insider ownership suggests confidence in its strategic direction, as highlighted by recent shareholder meetings focusing on cash management and financial strategies for 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Ampron Technology.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Ampron Technology shares in the market.

Where To Now?

- Discover the full array of 646 Fast Growing Asian Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives