- China

- /

- Electronic Equipment and Components

- /

- SZSE:301205

Linktel Technologies Co., Ltd. (SZSE:301205) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Those holding Linktel Technologies Co., Ltd. (SZSE:301205) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 135% in the last year.

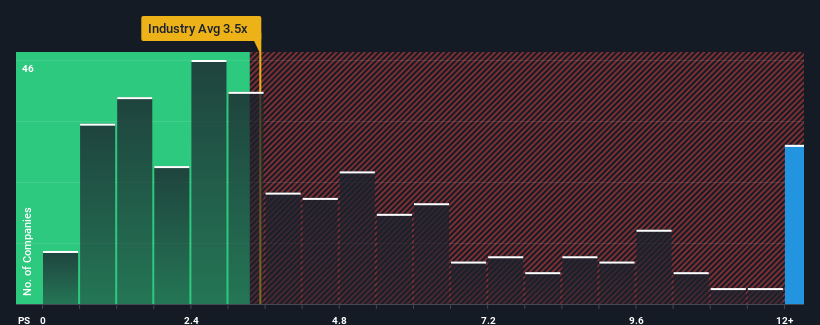

Since its price has surged higher, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.5x, you may consider Linktel Technologies as a stock not worth researching with its 18.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Linktel Technologies

How Has Linktel Technologies Performed Recently?

For example, consider that Linktel Technologies' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Linktel Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Linktel Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this in mind, we find it worrying that Linktel Technologies' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Shares in Linktel Technologies have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Linktel Technologies revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Linktel Technologies (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301205

Linktel Technologies

Focuses on the research and development, production, and sale of optical communication modules in China and internationally.

High growth potential with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)