Exploring None And 2 Other High Growth Tech Stocks With Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances with major indexes like the S&P 500 and Nasdaq Composite reaching record highs, while small-cap stocks represented by the Russell 2000 Index saw declines. This divergence highlights a rally in growth stocks, particularly in sectors such as information technology and consumer discretionary, against a backdrop of rebounding job growth and expectations for potential interest rate cuts from the Federal Reserve. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and resilience amidst economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

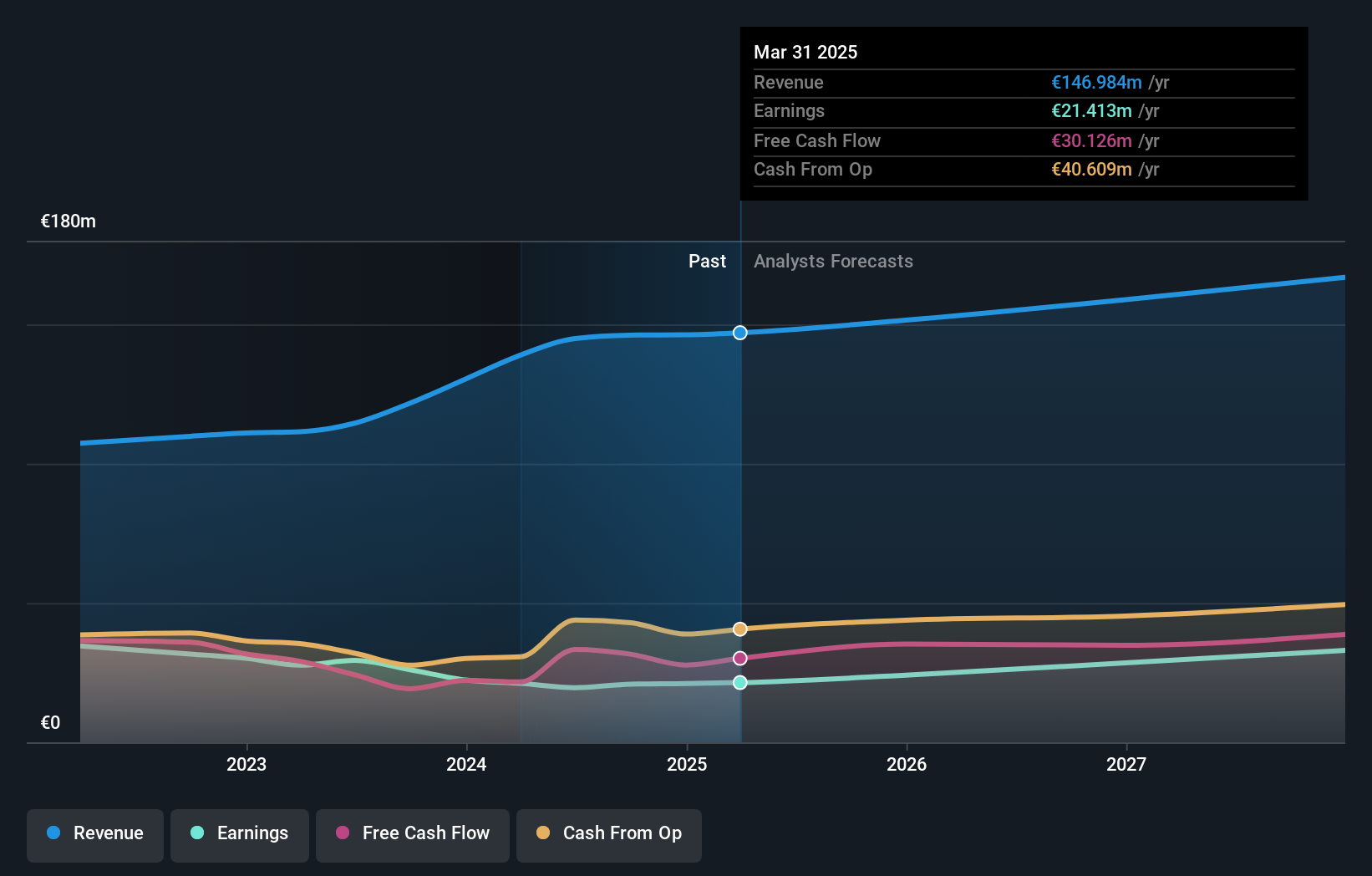

Overview: F-Secure Oyj is a cybersecurity company based in Finland that provides security solutions both domestically and internationally, with a market capitalization of €322.80 million.

Operations: F-Secure Oyj generates revenue primarily from its Consumer Security segment, which accounts for €146.13 million. The company focuses on providing cybersecurity solutions to both domestic and international markets.

F-Secure Oyj, navigating through a challenging tech landscape, reported a notable increase in sales to EUR 36.35 million in Q3 2024 from EUR 35.13 million the previous year, underscoring its resilience amidst market fluctuations. Despite a slight dip in net income over nine months, the company's strategic initiatives—highlighted during recent earnings calls and executive appointments—are poised to bolster its market position. With R&D expenses meticulously aligned with revenue growth forecasts of 3.6% annually, F-Secure is investing wisely to innovate and stay competitive in cybersecurity solutions. The firm's commitment is further evidenced by aggressive financial targets set for post-2025, aiming for an accelerated growth trajectory supported by robust product strategies and leadership enhancements.

- Dive into the specifics of F-Secure Oyj here with our thorough health report.

Understand F-Secure Oyj's track record by examining our Past report.

Wanma Technology (SZSE:300698)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wanma Technology Co., Ltd. specializes in the research and development, production, system integration, and sales of communication and medical information equipment with a market cap of CN¥5.20 billion.

Operations: Wanma Technology generates revenue primarily through its communication and medical information equipment sectors, focusing on research and development, production, system integration, and sales. The company operates with a market capitalization of CN¥5.20 billion.

Wanma Technology's recent performance showcases a mix of challenges and growth potential. While the company saw an increase in sales, rising from CNY 357.46 million to CNY 385.48 million year-over-year, net income dipped from CNY 40.39 million to CNY 31.22 million, reflecting some operational headwinds. Despite these challenges, Wanma is positioned for significant future growth with expected revenue and earnings forecasted to surge by 37.3% and 53.8% per year respectively, outpacing the broader Chinese market projections of 13.7% and 25.9%. This robust growth trajectory is supported by substantial R&D investment, aligning with industry demands for continuous innovation in technology sectors.

- Click here to discover the nuances of Wanma Technology with our detailed analytical health report.

Assess Wanma Technology's past performance with our detailed historical performance reports.

Brogent Technologies (TPEX:5263)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Brogent Technologies Inc. is a technology company that offers digital content creation services across Taiwan, Asia, Europe, the Americas, and internationally with a market capitalization of NT$11.29 billion.

Operations: The company generates revenue primarily from its entertainment software segment, amounting to NT$1.14 billion.

Brogent Technologies has demonstrated a remarkable turnaround, with its recent quarterly sales more than doubling to TWD 402.17 million from TWD 230.77 million the previous year, and net income soaring to TWD 28.99 million from just TWD 0.065 million. This surge is underpinned by an aggressive R&D strategy, crucial for sustaining its momentum in a competitive tech landscape where innovation is key. Looking ahead, Brogent's revenue is expected to grow at an impressive rate of 44.1% annually, significantly outpacing the broader Taiwanese market's growth of 12%. Moreover, earnings are projected to increase by a staggering 102.2% per year, positioning the company well for future profitability and making it a noteworthy entity in the tech sector despite current unprofitability and past shareholder dilution challenges.

Key Takeaways

- Click here to access our complete index of 1286 High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brogent Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5263

Brogent Technologies

A technology company, provides digital content creation services in Taiwan, Asia, Europe, the Americas, and internationally.

High growth potential with adequate balance sheet.