- China

- /

- Communications

- /

- SZSE:300628

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and economic uncertainties, investors are closely monitoring the impact of tariff announcements and consumer spending concerns on major indices. Amidst this backdrop, dividend stocks can offer a source of steady income and potential stability, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

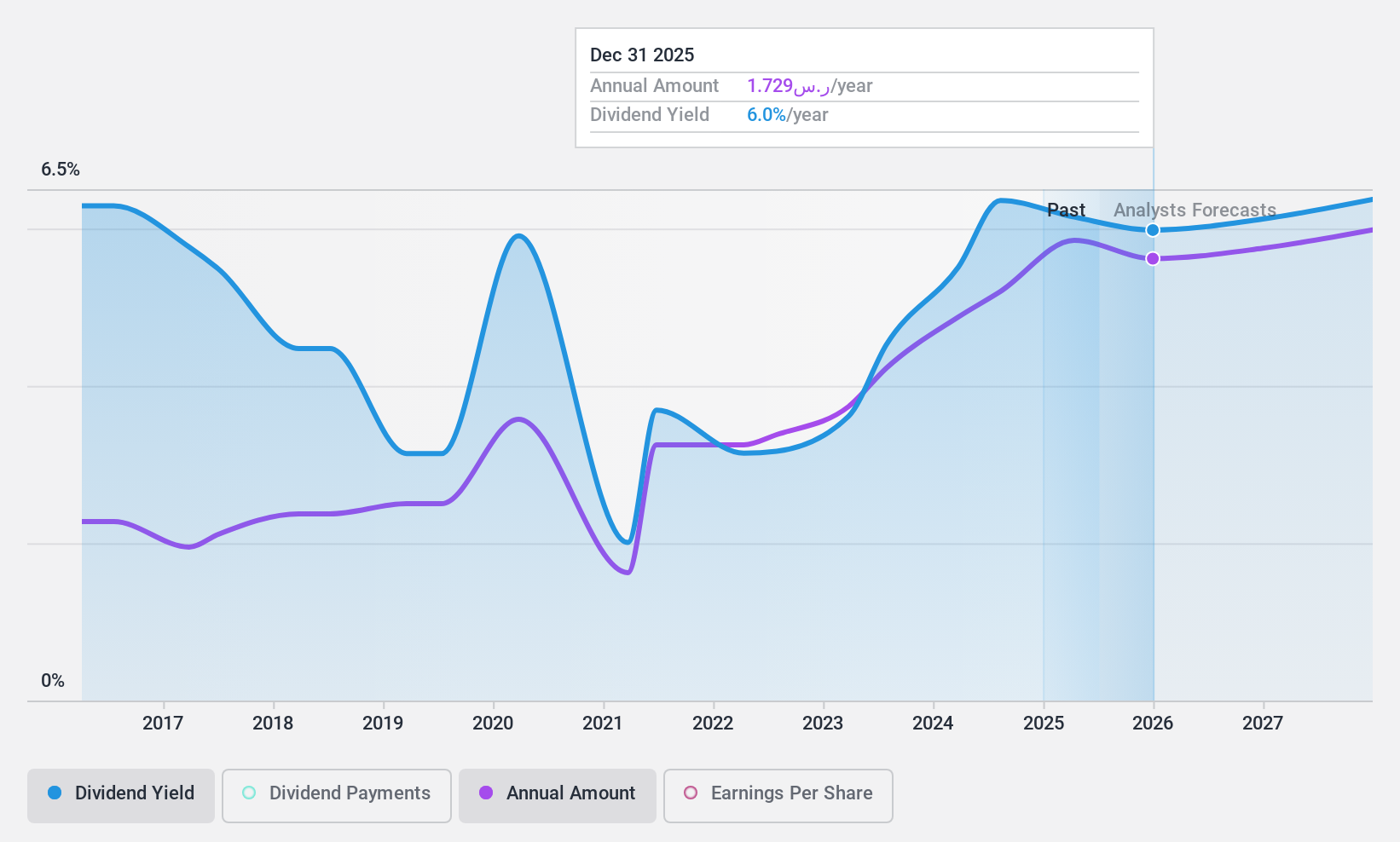

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia, with a market cap of SAR88.65 billion.

Operations: Riyad Bank's revenue is primarily derived from its Corporate Banking segment at SAR8.25 billion, followed by Retail Banking at SAR4.09 billion, Treasury and Investment at SAR2.33 billion, and Riyad Capital contributing SAR987.19 million.

Dividend Yield: 6.1%

Riyad Bank's dividend yield of 6.08% ranks in the top 25% of Saudi Arabia's market, though its dividend history has been volatile over the past decade. Despite this, dividends have increased over ten years and are currently covered by earnings with a payout ratio of 56.5%, forecasted to improve to 49.2%. Recent earnings growth supports sustainability, with net income rising to SAR 9.32 billion in 2024 from SAR 8.05 billion previously, indicating potential for future stability.

- Take a closer look at Riyad Bank's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Riyad Bank is priced higher than what may be justified by its financials.

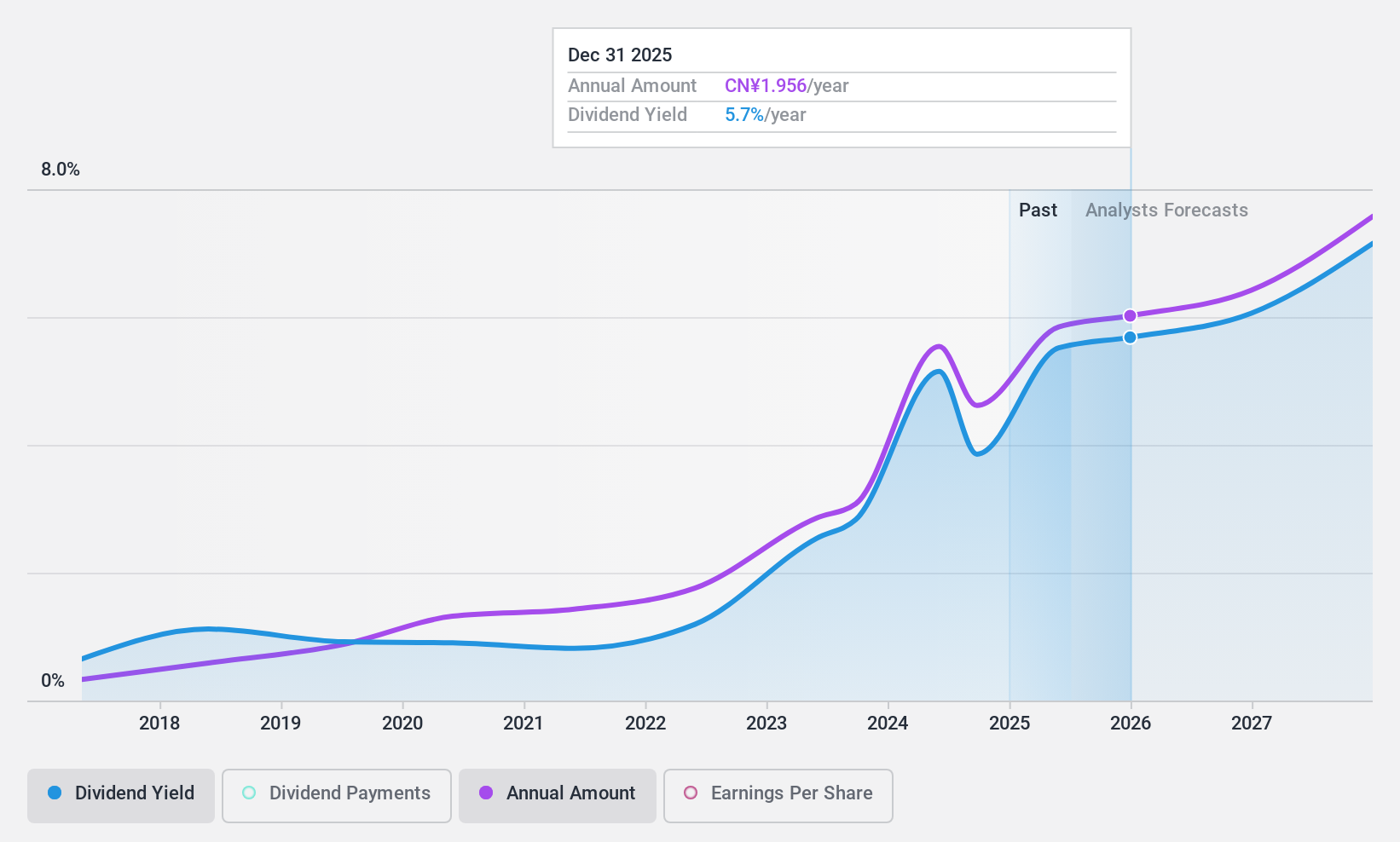

Yealink Network Technology (SZSE:300628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yealink Network Technology Co., Ltd. offers global voice conferencing, voice communications, and collaboration solutions with a market cap of CN¥52.46 billion.

Operations: Yealink Network Technology Co., Ltd. generates revenue primarily from its Internet Telephone segment, which amounts to CN¥5.23 billion.

Dividend Yield: 3.6%

Yealink Network Technology's dividend yield of 3.61% places it in the top 25% of China's market. However, its dividend history is less stable, having been paid for only eight years with notable volatility and unreliability. Despite this, current dividends are covered by both earnings and cash flows at a payout ratio of 77%. Trading at a significant discount to its estimated fair value, Yealink offers good relative value compared to peers and industry standards.

- Delve into the full analysis dividend report here for a deeper understanding of Yealink Network Technology.

- Our comprehensive valuation report raises the possibility that Yealink Network Technology is priced lower than what may be justified by its financials.

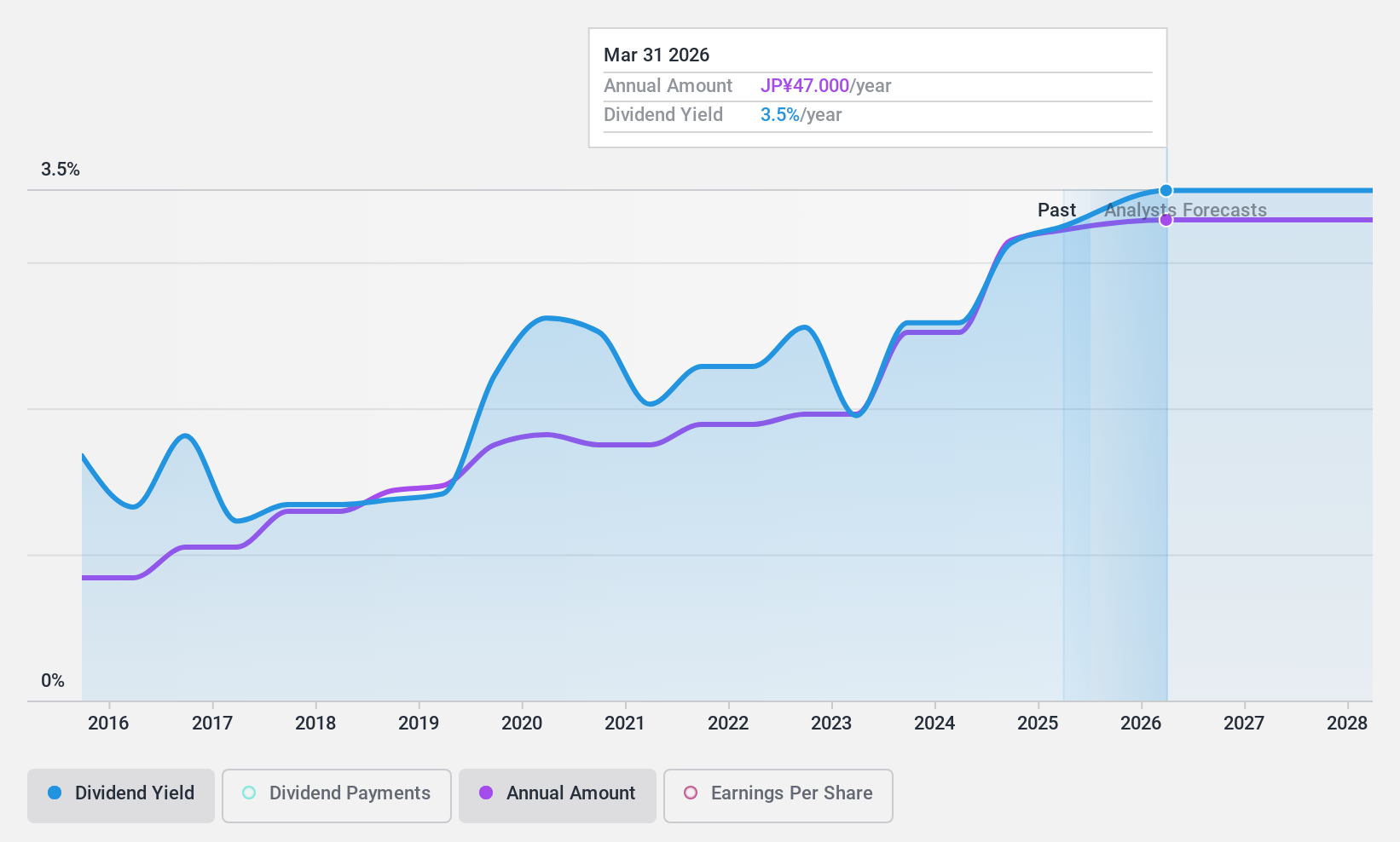

Hirakawa Hewtech (TSE:5821)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hirakawa Hewtech Corp. is engaged in the manufacturing and sale of cables, assemblies, electric and electronic equipment, as well as medical equipment and parts both in Japan and internationally, with a market cap of ¥20.61 billion.

Operations: Hirakawa Hewtech generates revenue primarily from Electric Wires/Processed Products at ¥25.75 billion and Electronic/Medical Parts at ¥4.69 billion.

Dividend Yield: 3.1%

Hirakawa Hewtech offers a stable dividend history over the past decade, with payments reliably covered by earnings and cash flows, reflected in its low payout ratios of 25.6% and 21.3%, respectively. Despite a modest yield of 3.14%, below the top tier in Japan, its dividends remain sustainable amid strong earnings growth of 38.8% last year. The stock trades at a significant discount to estimated fair value, potentially offering good value for investors seeking stability and growth potential.

- Dive into the specifics of Hirakawa Hewtech here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Hirakawa Hewtech is trading behind its estimated value.

Turning Ideas Into Actions

- Discover the full array of 2008 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300628

Yealink Network Technology

Provides video conferencing, voice communications, and collaboration solutions worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)