- China

- /

- Metals and Mining

- /

- SZSE:002756

3 Dividend Stocks To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures, U.S. stocks have reached record highs, buoyed by optimism in technology and materials sectors. Amidst this backdrop of economic shifts and investor sentiment, dividend stocks can offer a stable income stream and potential growth opportunities for enhancing investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.73% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.45% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.92% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.44% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 2036 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

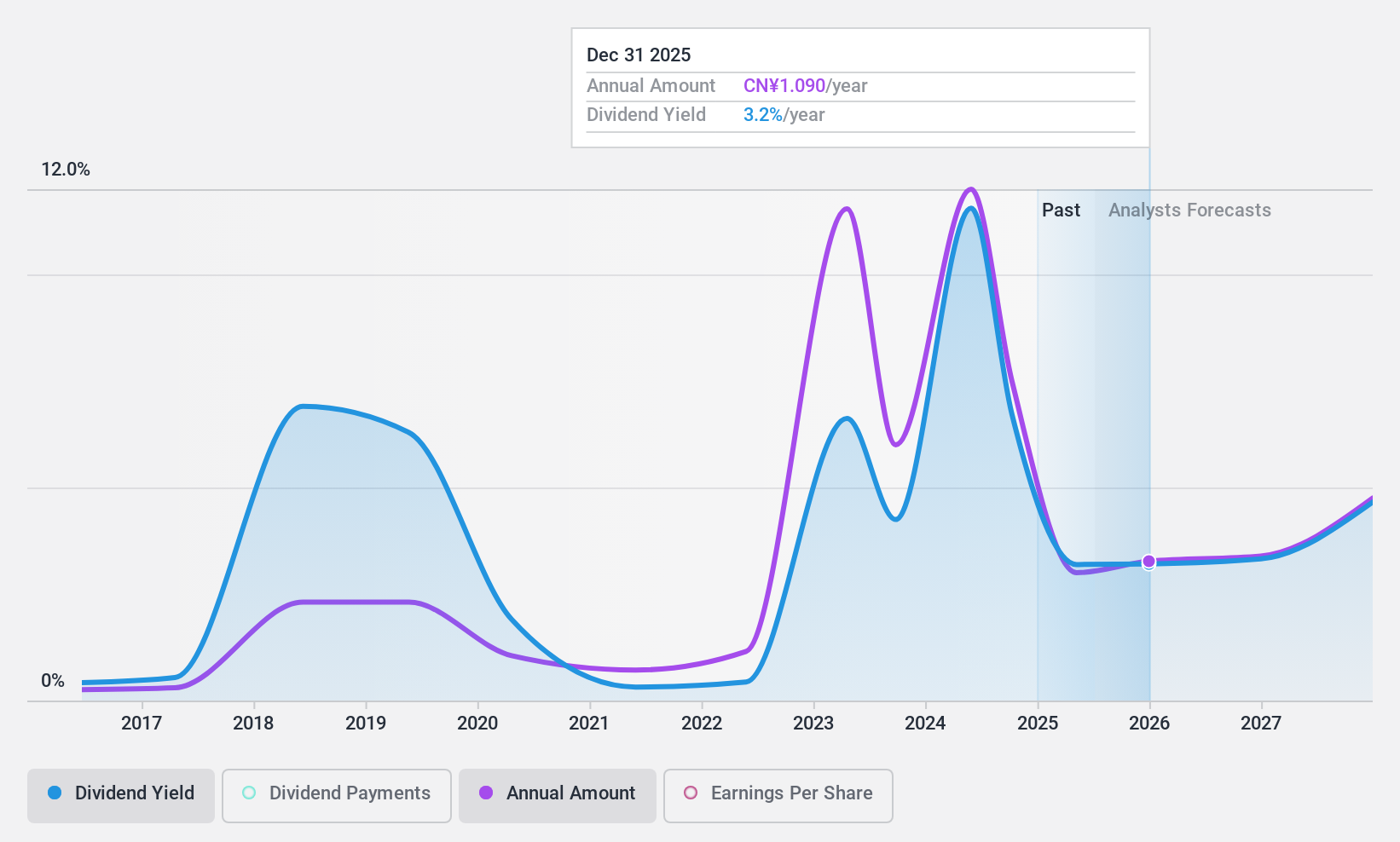

Yongxing Special Materials TechnologyLtd (SZSE:002756)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yongxing Special Materials Technology Co., Ltd is involved in the development, production, and sale of stainless steel rods and wires, special alloy materials, and lithium battery materials both in China and internationally, with a market cap of CN¥21.99 billion.

Operations: Yongxing Special Materials Technology Co., Ltd generates revenue from the New Energy Industry amounting to CN¥3.71 billion and the Stainless Steel Industry totaling CN¥6.32 billion.

Dividend Yield: 6%

Yongxing Special Materials Technology Ltd. offers a dividend yield of 6.01%, placing it in the top 25% of CN market payers, but its track record is unstable with volatile payments over eight years. The recent interim dividend decreased to CNY 5 per ten shares, highlighting this volatility. Despite a reasonable payout ratio (59.1%) and cash flow coverage (69.8%), declining earnings and profit margins raise concerns about future sustainability amidst share buybacks totaling CNY 499.85 million recently completed.

- Navigate through the intricacies of Yongxing Special Materials TechnologyLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Yongxing Special Materials TechnologyLtd shares in the market.

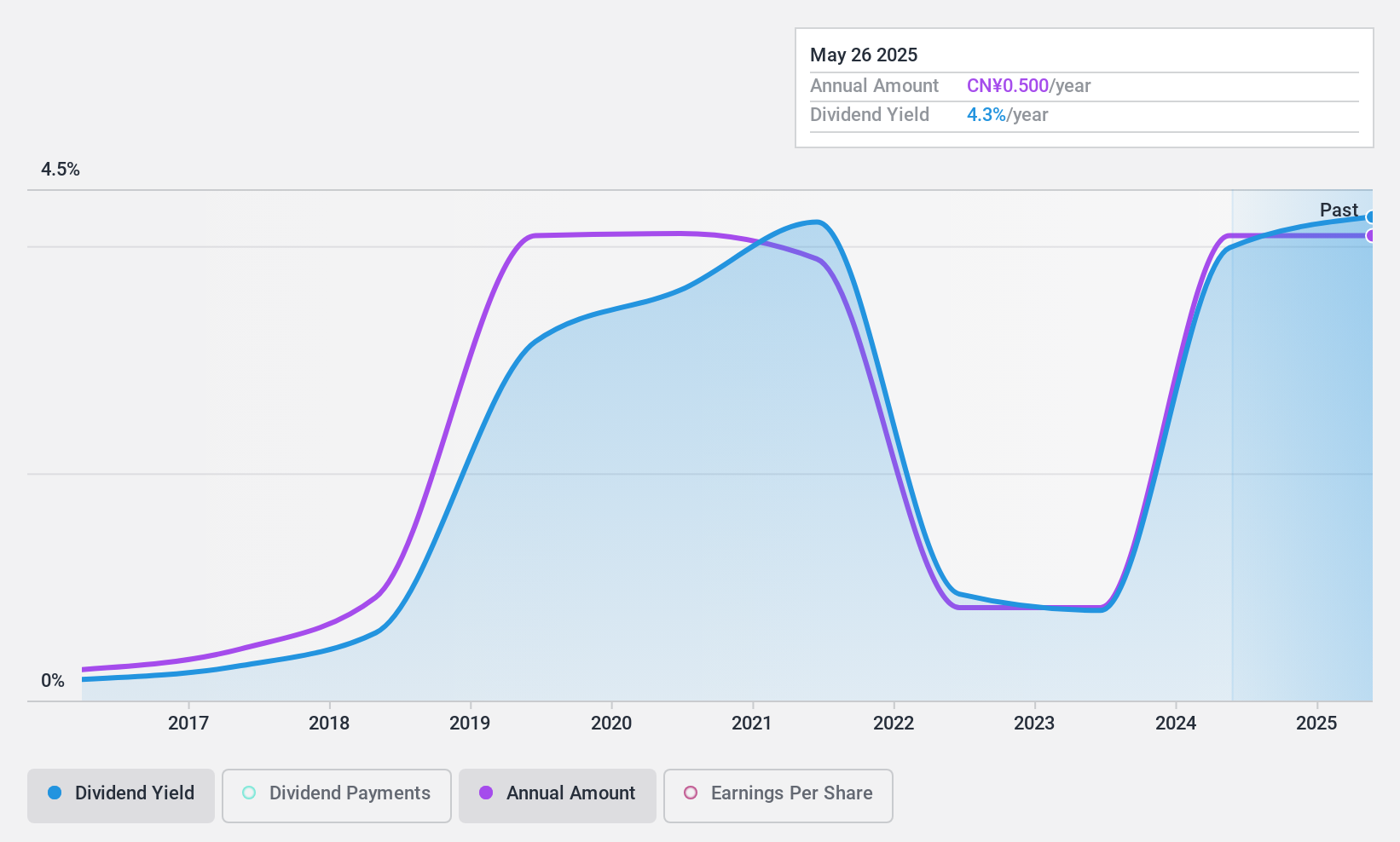

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥5.50 billion.

Operations: Goldcard Smart Group Co., Ltd. generates its revenue through providing digitalization solutions for smart gas, smart water, and hydrogen metering in China.

Dividend Yield: 3.7%

Goldcard Smart Group's dividend yield of 3.74% is among the top 25% in the CN market, though its payments have been volatile over the past decade. Despite a reasonable earnings payout ratio of 48.5%, high cash payout ratios indicate dividends aren't well covered by free cash flow, raising sustainability concerns. The company's recent inclusion in the S&P Global BMI Index and a net income increase to CNY 218.09 million highlight positive growth momentum despite these challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Goldcard Smart Group.

- Our valuation report here indicates Goldcard Smart Group may be undervalued.

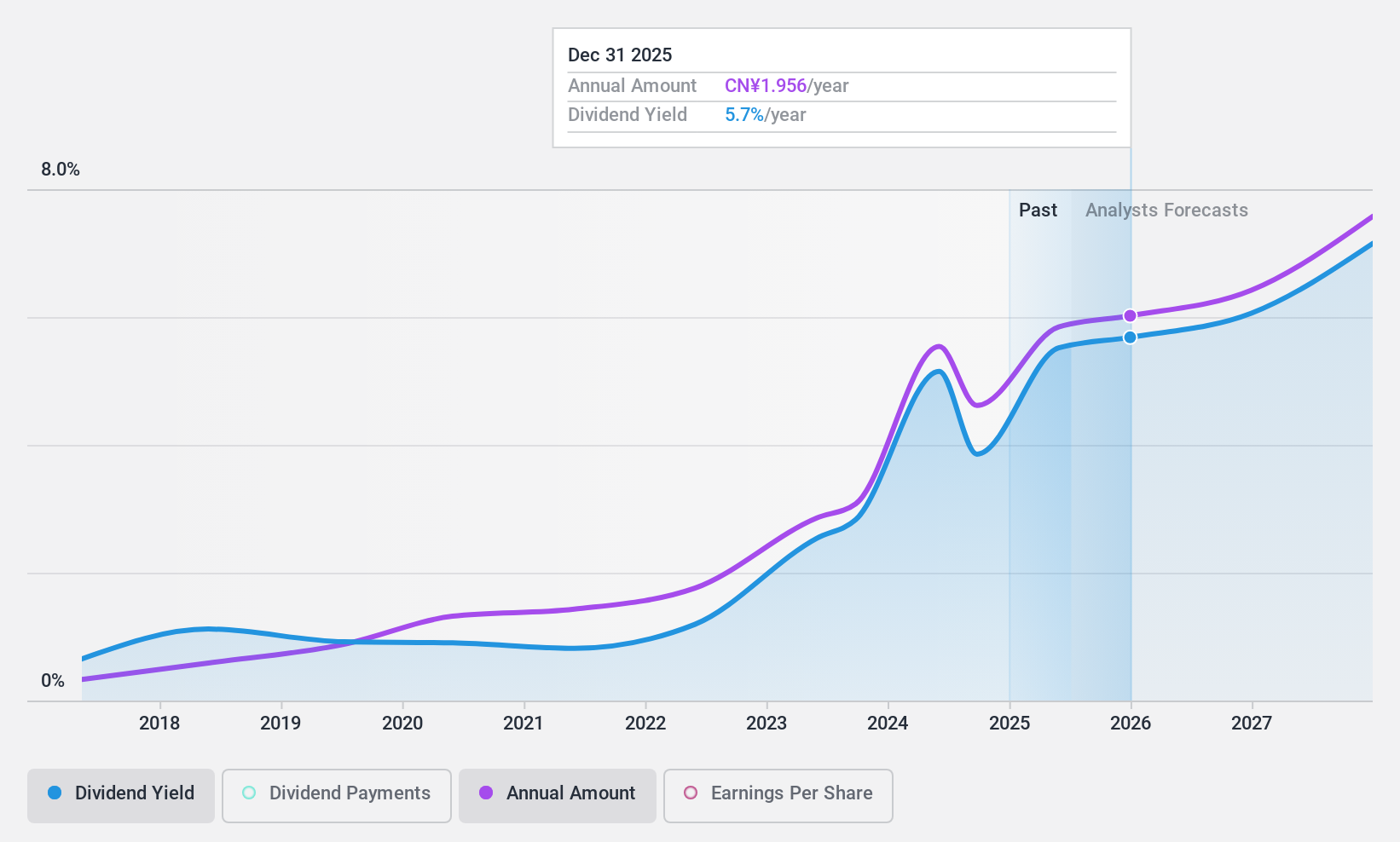

Yealink Network Technology (SZSE:300628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yealink Network Technology Co., Ltd. offers voice conferencing, voice communications, and collaboration solutions globally with a market cap of CN¥53.38 billion.

Operations: Yealink Network Technology Co., Ltd.'s revenue from Internet Telephone amounts to CN¥4.97 billion.

Dividend Yield: 3.5%

Yealink Network Technology's dividend yield of 3.55% ranks in the top 25% of CN market payers, but its payments have been volatile over seven years. The payout ratios—81% of earnings and 89.7% of cash flows—indicate coverage, yet sustainability concerns persist due to instability. Recent announcements confirm a CNY 6 per ten shares interim dividend for 2024, reflecting ongoing shareholder returns amidst strong earnings growth and strategic product advancements like the MeetingBar A40.

- Dive into the specifics of Yealink Network Technology here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Yealink Network Technology is priced lower than what may be justified by its financials.

Make It Happen

- Navigate through the entire inventory of 2036 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002756

Yongxing Special Materials TechnologyLtd

Engages in the development, production, and sale of stainless steel rods and wires, special alloy materials, and lithium battery materials in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)