- China

- /

- Electronic Equipment and Components

- /

- SZSE:300130

Three Chinese Dividend Stocks Offering Up To 3.5% Yield

Reviewed by Simply Wall St

As global markets navigate through mixed economic signals, with some regions showing signs of recovery while others grapple with challenges, investors are closely monitoring opportunities for stable returns. In this context, dividend stocks in China present an interesting avenue for those seeking potential yield enhancements up to 3.5%, especially considering the recent tentative signs of recovery in the Chinese property sector and broader economic metrics. A good dividend stock typically offers not just a reliable return but also stability during turbulent times, which may be particularly appealing given the current global economic uncertainty.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.11% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.54% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.47% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.47% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.66% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.02% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.25% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.40% | ★★★★★★ |

Click here to see the full list of 214 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Inner Mongolia Xinhua Distribution GroupLtd (SHSE:603230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia Xinhua Distribution Group Ltd, operating under the ticker SHSE:603230, is a company based in China with a market capitalization of approximately CN¥4.44 billion, focusing on distribution and logistics services within the region.

Operations: Inner Mongolia Xinhua Distribution Group Ltd generates its revenue primarily from distribution and logistics services within Inner Mongolia.

Dividend Yield: 3.6%

Inner Mongolia Xinhua Distribution GroupLtd, despite a short dividend history of less than 10 years, has shown a commitment to shareholder returns with a stable dividend yield of 3.59%, ranking in the top 25% in the Chinese market. The dividends are well-supported by earnings and cash flows, with payout ratios at 52.9% and cash payout ratio at 49.1%, respectively. However, recent financials indicate slight volatility; Q1 2024 net income fell to CNY 128.02 million from CNY 141.93 million year-over-year, reflecting potential challenges ahead despite overall revenue growth.

- Take a closer look at Inner Mongolia Xinhua Distribution GroupLtd's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Inner Mongolia Xinhua Distribution GroupLtd is priced lower than what may be justified by its financials.

Zhejiang Langdi Group (SHSE:603726)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Langdi Group Co., Ltd. is a company based in China that specializes in manufacturing and selling wheels for household air conditioners, with a market capitalization of approximately CN¥2.42 billion.

Operations: Zhejiang Langdi Group Co., Ltd. generates CN¥1.69 billion in revenue from its electronic components and parts segment.

Dividend Yield: 3%

Zhejiang Langdi Group, with a dividend yield of 3.04%, stands in the top quartile of Chinese dividend payers. The company's dividends are well-backed by both earnings and cash flows, with payout ratios of 55.6% and 48.6% respectively, indicating sustainability. Despite a relatively short history of less than ten years in dividend payments, recent financial results show robust growth with net income rising to CNY 109.55 million from CNY 91.4 million year-over-year as reported on April 29, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Zhejiang Langdi Group.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Langdi Group shares in the market.

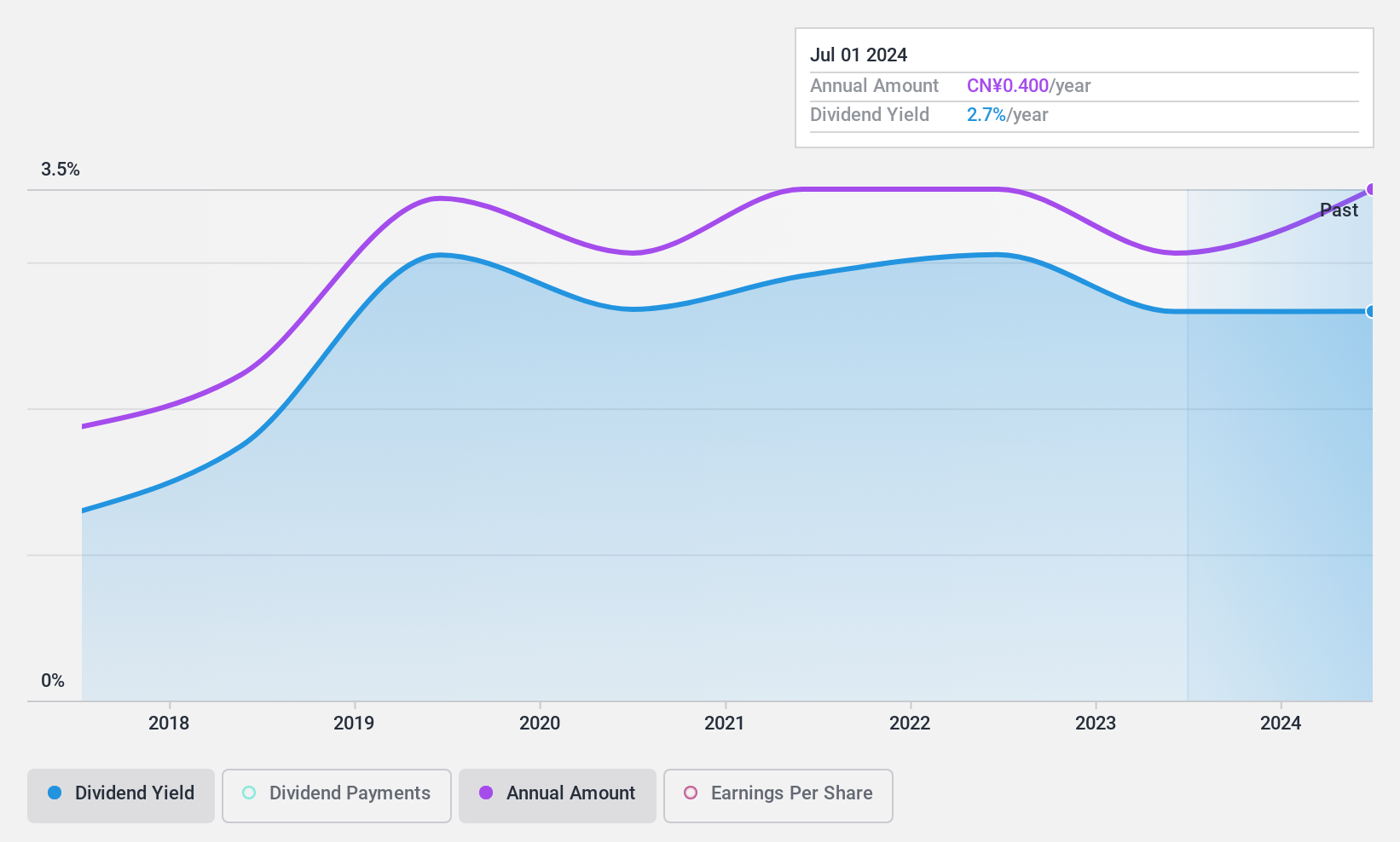

XGD (SZSE:300130)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: XGD Inc. operates in the technology sector, focusing on the research, development, manufacturing, sale, and servicing of payment terminals both in China and globally, with a market capitalization of approximately CN¥10.97 billion.

Operations: XGD Inc. generates its revenue primarily through the research, development, production, and sale of payment terminals across domestic and international markets.

Dividend Yield: 3.4%

XGD Inc. recently declared a dividend of CNY 6.70 per 10 shares, with a record date of June 14, 2024. Despite its volatile dividend history over the past decade, the company's dividends are currently well-supported by both earnings and cash flows, with payout ratios of 42.5% and 34.3% respectively. Additionally, XGD's Price-To-Earnings ratio at 13x is notably below the Chinese market average of 30.1x, suggesting potential value compared to peers despite recent earnings growth reported in Q1 2024 showing a substantial increase to CNY 220.77 million from CNY 132.67 million year-over-year.

- Click here to discover the nuances of XGD with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that XGD is trading behind its estimated value.

Next Steps

- Click here to access our complete index of 214 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300130

XGD

Researches, develops, manufactures, sells, and services payment terminals in China and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives